Cloud-deployed payroll solutions are now the industry standard, and on the surface they offer many of the same features. However, look closer and there are many differences, some which will suit specific industries and needs more than others. Here’s a rundown of the ten best payroll solutions with their strengths and weaknesses all laid bare.

Looking for pricing information on payroll systems? Answer the questions below, and our vendor partners will contact you with a free quote:

1. Gusto Payroll Solutions: Best all-rounder

Why you can trust Top Ten Reviews

Gusto Payroll Solutions is a relatively new player in the payroll solutions industry (previously known as ZenPayroll), having been around since 2011. The product range is very focused on the small business owner and their needs, and the company has a youthful, dynamic vibe that translates into the slick, clean design of their software. There are three levels of plan, all hosted in the cloud and easily accessed from any web browser.

Gusto Core is the entry-level plan that comprises the essential payroll features that any small business needs. The base charge is $39 per month, with an additional $6 per month per person. Gusto Complete is the next tier up and includes hiring and onboarding tools, time-off requests, employee directory and surveys as extras. The base charge is also $39 per month but the additional charge per person per month is $12. Gusto Concierge is the top-level plan offered by Gusto Payroll Solutions and it includes access to certified HR pros, and an HR resource center with dedicated support. The base charge for this plan is $149 per month, plus $12 per person per month.

The aesthetics and the intuitive nature of the interface are pleasing, and payroll processing can be done easily in a few minutes once the set up of employee data has been done – this can be outsourced to the individual employees themselves as Gusto Payroll Solutions supports self on-boarding. The pricing structure is very competitive but payroll processing is limited to four times per month and the customer service lines are not available at weekends.

2. ADP Payroll Solutions: Best for scalability

ADP is an industry-leading name and has been a major player in the world of payroll for decades. It has a wide range of payroll solution packages, tailored to every size of business and appealing to every kind of industry. To make the choices easier, the company offers four levels of plans, each having various tiers within them to create a bespoke package for each business.

The entry-level package. ADP Run is deigned for small businesses with 1-49 employees. Within ADP Run there are four plans, each offering a different range of features, starting with essential payroll features and gradually working in more HR-related offerings.

ADP Workforce Now is aimed at companies with 50-1,000 employees. As such, it is a versatile and varied plan that ADP representatives will help the business create.

ADP Vantage is designed for large companies with over 1,000 employees and ADP Streamline is designed for global businesses.

Every ADP Payroll Solutions package is hosted in the cloud, sidestepping installation challenges. The interface is intuitive and easy to use even for non-payroll professionals. Employee data entry is simple and the automated features mean that all relevant payroll and tax processes are done on time and in full. It also allows good employee access, and this frees up the time of small business owners and payroll professionals as many queries can be attended to by the employees themselves. The pricing structure is designed individually for each company and ADP charge for each payroll run rather than a flat fee. ADP is slightly more expensive than comparable plans but has a solid customer service team.

3. MyPayRollHR: Best for HR services

MyPayRollHR has been in the industry since 2006, and primarily targets its payroll solutions applications to small businesses that are growing quickly, mainly through the addition of its comprehensive HR functionality. In contrast to other solutions, MyPayRollHR doesn’t offer tiered pricing packages, but instead deliver a bespoke variation on a set package, with pricing structured around the number of employees. A typical entry-level quote would likely be $100 for the initial set-up, around $100 per month subscription and a further $11.50 per employee.

MyPayRollHR has a more utilitarian, functional interface that some users will no doubt prefer, and the set up, payroll processing and report production features are all fairly intuitive. The selection of report templates is particularly good compared to its close competitors. It’s cloud-hosted for ease of access from any internet browser and employee access is possible so that interdepartmental queries can be kept to a minimum.

4. TriNet: Best full-service payroll

TriNet has been around since the mid-1980s and the company offers a fully-bundled, industry-specific HR and payroll solution to growing businesses. This means that no matter what the size or industry sector of the business, the fact that HR and payroll services are being bundled brings a definite financial consideration. For some businesses, this will represent good value and serve as their HR department. For businesses that can take care of their HR in-house, it may seem like unnecessary expense.

Pricing information is bespoke and not made public, though online examples suggest something within the region of $125 per employee per month for companies with up to 49 employees. However, the full-service solution works efficiently and the payroll process is intuitive and quick to run once data entry has been taken care of, with all relevant tax information duly dealt with. The choice of reports is underwhelming at just twenty, though those that are no offer are customizable. One for growing companies with immediate HR needs.

5. Paychex Flex: Best for customer support

Paychex Flex bring decades of experience to the market, having been around since the early 1970s. Paychex Flex offers four tiers of payroll plans, the higher ones including more and more Human Resource features and functionality. Pricing information is subject to bespoke quotations and not made public, but indications are that Paychex Flex is at the more expensive end of the market. However, companies can buy a stripped-down payroll-only application and they are not obligated to spend unnecessary funds on elements they do not require.

The most attractive features of the Paychex Flex plans are the 24-hours a day, seven days a week customer support, and the plans above the entry-level option come with a dedicated payroll specialist on call. Good functionality, an impressive number of report templates and the scalability of the product are also plus points.

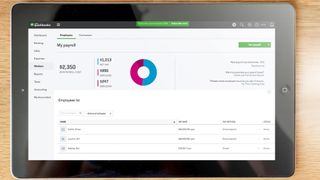

6. Intuit QuickBooks Payroll: Best for tax processing

QuickBooks is an instantly-recognizable name in the commercial world, and the payroll solution that it launched in 2018 – Intuit QuickBooks Payroll - replaces the former product Intuit Enhanced Payroll. This new product offers two tiers of solutions: Intuit QuickBooks Payroll Self Service is the entry-level, stripped-down version that offers smaller companies a chance to buy just the essentials. It starts at $35 per month with an additional charge of $4 per employee per month and although it requires some manual upkeep, it’s a good value package. The higher tier is Intuit QuickBooks Payroll Full Service and it offers an expanded payroll solution with more automated functionality plus a guarantee to pay any fines incurred by incorrect tax submissions.

Both employ the same cloud-deployed interface, which is clean and easy to use. Limitations include a small range of report templates and lack of depth of HR information but usability is good, especially for new payroll users, and there are excellent opportunities to integrate the application with other QuickBooks products.

7. Square Payroll: Best for beginners

Square is more famous for its Point of Sale and payment processing software and applications, but it made a foray into the payroll market in 2015. The company offers two plans, one that is for Contractors Only, and this comes at just $5 per month per contractor. The slightly more expensive Employees and Contractors plan costs 429 per month plus $5 per paid person per paid month. Both represent excellent value.

The application is cloud-based and easy to use, especially for first time payroll administrators. It features most of the functionality found with its competitors, including unlimited payroll runs, employee access, a free mobile app and phone support, but it has limited HR and employee information, and larger companies may need a more sophisticated solution. For small businesses, though, especially ones that only employ contractors, Square offers an attractive package.

8. OnPay: Best one-size-fits-all payroll

OnPay is a relatively new company but has made quick strides and from small beginnings, now compete with global names in the payroll solutions market. OnPay offers a one-size-fit-all payroll solution and while many solutions of this type can seem niche or limited, this has managed to combine an impressive list of features with an attractive price point.

Onpay has a flat fee of $36 per month, plus $4 per employee per month, and unlike some competitors’ additional charges, OnPay includes almost everything in that fee. The plan is budget-friendly enough to appeal to small businesses and has enough functionality to be a draw for medium and even some larger businesses. There’s no dedicated mobile app and support is limited to work hours, but it has a good number of report templates and an easy-to-use interface for the most part. A great all-rounder.

9. Workful: Best for employee directories

Workful launched in 2017 but is backed up by the decades of experience in the B2B financial services market of its parent company, TaxSlayer. It’s a full-service, cloud-deployed payroll solution with excellent Human Resource and Point of Sale integrations. Where it really stands out, though, is in a couple of areas.

Firstly, it has an employee time clock, which can be set to clock in employees when they walk in the building or when they log onto the company WiFi. Secondly, it has an expanded and sophisticated Employee Information section that rivals any product on the market. There isn’t a base subscription rate – the charge is $10 per employee per month – and tax forms are not automatically submitted (though they are calculated). Still, it’s a good all-round solution with that particularly good feature for employee information.

10. SurePayroll: Best for specific industries

SurePayroll was previously a fairly expensive option when it came to payroll solutions. However, not only has the company revamped the product, with new design and functionality, but it’s also dropped the price to make it much more attractive. Unlike almost all other solutions, there are special in-built features designed for specific industries, whether it’s restaurants, healthcare, non-profits, and more.

The new look is cleaner and navigation is among the easiest and most intuitive on the market. There are some limitations with parts of the employee information that would normally be featured, and SurePayroll charge extra for processing W-2 and 1099 forms. That said, $29.99 per month plus $4 per employee per month is a competitive price, especially for this much-improved solution.