The best POS systems provide a business with a well-rounded view into operations, employees, finances, and more. It allows for the business owner to keep track of the multitude of threads that run through every company, and to manage them more effectively.

Today, POS systems have evolved beautifully thanks to the growing powers of technology. They are more mobile, often integrating with tablets and mobile phones so users can access systems and manage sales from anywhere, and they are increasingly data rich, providing insights and analytics that can help the business make more informed choices.

In this guide, we have rounded up some of the best POS systems on the market today, each one offering something a little different and each one boasting some excellent features and capabilities.

We have made life easier for you by adding in which industry they are best suited for, what pricing structure they fit into, and their overall pros and cons. You can also read a more in-depth review of the product and its features by hitting the links.

If you don't need a full POS system, and just need to be able to take payments, then read our list of the best credit card processing companies.

1. Shopify: Best POS system for eCommerce

Why you can trust Top Ten Reviews

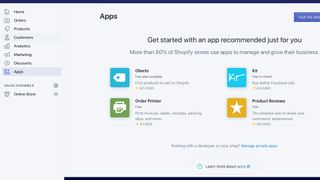

is a fully integrated, web-based POS system that is ideally suited for retail environments of all sizes. It will fit as neatly into the smaller one-man-band shop as it will into a larger retail outlet, and it comes with an intuitive user interface and plenty of extra features.

Shopify is a popular POS solution because the company has put time and effort into creating a platform that’s not just full of features, but easy to use and digest. The support center is available 24/7 and there are tons of customization options that allow you to really embed the system into your business.

Shopify provides you with an excellent, customizable dashboard, a free trial that gives you the time you need to see if this is the solution for you, and a stack of third-party app integrations to add extra value to the experience.

Read our full Shopify POS review.

2. Square: Best POS system for startups

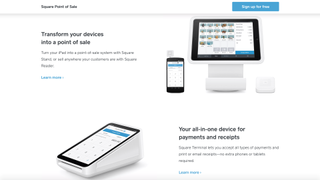

Square POS is a customizable and simple solution that’s so easy to use it is the perfect fit for the startup or the smaller business. The low barrier to entry makes it quick to set-up and understand, and the well-designed dashboard and feature set allow for the right levels of customization and control.

Users will appreciate the ability to fine-tune the system to suit their needs and the rather fun analytics tools that provide detail-rich reports. You can access these reports from anywhere in the world – even on holiday – so you can always keep your finger on the pulse of your business.

Square POS allows for you to easily make payments across multiple systems and devices, making it quite a neat solution for the mobile business. The system includes employee management, payroll control, and inventory management features.

Read our full Square POS system review.

3. Lightspeed: Best all-round POS solution

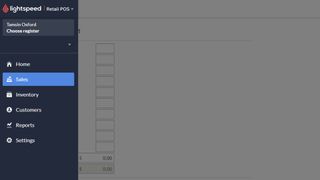

offers you three different types of platform and each one is designed to suit different business needs. You will need to ensure that you select the right POS solution for your business because the food and beverage POS won’t work perfectly in the retail environment.

Lightspeed is not a good fit for people who are averse to getting their hands dirty with technology. The technophobe may not enjoy the experience as the level of detail is high. However, this is what makes Lightspeed stand out – it is complex because it is full of features and opportunities to make it your own.

This POS platform can be used on an iPad as well as on a web-based interface and is easy to use and set-up. A comprehensive resource center provides you with walkthroughs and expert guidance so you shouldn’t get stuck, but the learning curve on this platform is steep.

Be prepared to spend some time getting to grips with the inventory management, the features and the POS system. Once you do, however, Lightspeed delivers a rich and tasty solution straight into your business hands.

Read our full Lightspeed review.

4. Intuit QuickBooks POS: Best for retail

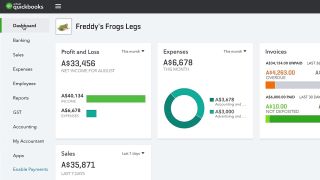

Not to be confused with the QuickBooks Online accounting software, this POS system is as beautifully designed and versatile. The fact that the two integrate seamlessly doesn’t harm the solution either – it’s a very handy blend of two worlds that make sense if you own one or the other. That said, QuickBooks POS is a heavy download with lots of customization requirements which means you will have to commit plenty of time to getting the system set up before you can get going.

It’s not often that you use the term ‘fun’ when describing a POS, but this is something that QuickBooks manages to inject into its interface and experience. So many options and so much variety within such a neat interface make it a joy to use and customize.

What makes QuickBooks rather special is that it can be used by organizations of all sizes. You can step into the system as a tiny little retail outlet and emerge as a large enterprise on the other end, and the software will keep up with your demands.

Read our full Quickbooks POS review.

5. ShopKeep POS: Best for interoperability

ShopKeep is a firm favorite in the POS market because it is so darn easy to use and so ubiquitous. It can be used across multiple operating systems and devices, it fits into most business sizes and capacities, and the pricing set is adaptable to suit most budgets.

ShopKeep has real-time data analytics capabilities, which is great, but it does ask you to pay for value-added extras, many of which come standard with competing products.

The front and back office interfaces and systems are beautifully integrated so you can move effortlessly between the various parts of the platform without getting confused or needing to learn a new interface. It is also easy to customize across inventory, table management and menus.

ShopKeep works well across eCommerce and retail sectors, providing a selection of add-ons that allow you to customize it in the right direction. These do have to be paid for, but some of them are really well-designed and relevant.

Read our full ShopKeep review.

6. TouchBistro: Best POS system for restaurants

TouchBistro is the restaurant owner’s best friend with a truly rich buffet of features that can be customized and branded according to your business. The platform has been designed by restauranteurs so it understands what you need and why you need it, it also puts features together in a very intuitive way that makes a lot of sense when you’re working hard and fast.

Payment processing with TouchBistro has been designed to make life easier. You get to add in a variety of different payment types, which is great for your customers, but you will have to invest into card processing hardware, which isn’t that great for your set-up budget.

TouchBistro is very easy to set up but it doesn’t work on Android devices so you’ll need to fork out a few dollars on hardware as well as on the software when you start out. While this may be an annoyance for some, the touch and go interface makes it all worthwhile. The screens are easy to navigate and the ability to jump across different aspects of the platform on demand cannot be understated.

Read our full TouchBistro review.

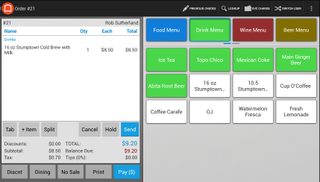

7. Toast: Best for bars and coffee shops

If the name doesn’t make you hungry, then the rather brilliant and robust feature set of definitely will. Hungry for success. This platform comes with some really excellent features such as automated alerts and a smart payment system. It brings together some really well-designed features but in an interface that doesn’t make you weep with joy.

That part is a bit bland and sometimes performance is a bit slow. That said, this is such a slick solution that you’d be hard pressed to find further fault with it. Every part of Toast has been developed carefully and with precision so you will enjoy working with it and enjoy the experience of working with it. Like TouchBistro it is a very good fit for the food and beverage industry.

Toast is relatively easy to navigate with only one or two odd location choices that may leave you scratching your head. Overall, you can’t go far wrong if you want a smart and steady solution for your food and beverage POS.

Read our full Toast review.

8. Vend: Best for retail outlets of all sizes

Vend is one of the market’s most popular POS solutions because it works really well. The features are solid, relevant and well designed, the interface is intuitive and nice to work with, the pricing is on par with the rest of the market, and the system is accessible and easy to use.

Vend has variable payment plans that can be cancelled whenever you want which is a great value add for the smaller business still trying to find its feet. It also has a variety of different types of pricing so you can pick the solution that best suits your budget.

Vend, like TouchBistro, isn’t usable on Android devices so expect to invest in Apple gizmos if you want to eke out the most value from your investment. It includes offline features so you can confidently operate while you are offline, and it has a rich roster of features to pick from overall. Like QuickBooks POS it grows with businesses of different sizes so you can start out small and work your way towards big.

Read our full Vend POS review.

What is a POS system?

You may think a point-of-sale system is just a cash register, but the best ones do much more than facilitate sales with your customers. The best POS systems can function as a hub for your entire business.

Typical POS systems have hardware that lets you ring up orders, including a barcode scanner, credit card reader, cash register and receipt printer. Modern POS systems include much more, though. For example, they include tools for inventory tracking, sales tracking, employee management and customer management. You can purchase each of these tools individually, but you save money by bundling them into a POS system.

What kind of POS system do I need?

Choosing a POS system for your business is a serious decision. The best kind for you depends on what type of business you have, how busy you are, and whether you need it to track inventory, sales and other data. For example, restaurants need systems to assign tables and track orders, while businesses that work trade shows or farmers markets need portable systems.

Cloud POS systems are becoming the norm. To use cloud POS software, you pay a monthly fee, which tends to be cheaper in the long run than buying a costly software license and paying to have a server onsite. There are also no annual upgrade costs associated with cloud systems.

What to look for in a POS system

A POS system can be as complex or as simple as you choose – you can ring up customers on a tablet or have an elaborate checkout kiosk with lots of advanced features. A lot depends on the type of business you have and what you need to keep it running smoothly. As such, before you even start shopping around, take stock of your business. Ask yourself if there are any tools you could use to improve your business, and consult with your employees to see if there’s anything that could help them. This will give you some direction as you navigate all the complexities of buying a POS system.

You should also take stock of what equipment you have. If you’re upgrading to new POS software, check to see if your existing equipment is compatible with what you’re looking for. Itemize all the equipment you already own and see if you have enough.

Another part of choosing a POS system is finding a payment processor. Some POS systems come bundled with their own processing, which can save you the headache of finding your own. However, if you run a larger business with a lot of sales, you may be better off finding a separate processor. Read our reviews of credit card processors to find out which is best for your business.

What Are the Costs?

As a business owner, your biggest concerns are likely the upfront and ongoing costs. You can get all the equipment you need for anywhere between $500 and $2,000. The software may cost extra, depending on whether it's bundled with the equipment or not. You can pay another $1,000 or so for a software license or $50 a month to use cloud software. The advantage of a cloud program is you don’t have to pay annual upgrade fees.

The price also goes up as you add features. Often, POS systems are sold at different service levels, and the features you want may bump you up to a higher pricing tier.

One of the biggest ongoing costs is payment processing. Many POS companies offer payment processing, but not all do. And even if you find one that does, you may get a better price on the service elsewhere. Often, it's better to look at payment processing as a completely separate cost, especially if you run a large business.