BD Nationwide Mortgage offers a wide range of mortgage and refinancing products to an equally wide range of applicants, even those with less-than-perfect credit ratings. It’s a direct lender so there’s no searching for the best mortgage or refinance lenders that suit a particular need or situation - everything happens right through BD Nationwide Mortgage. We recommend you use the Lending Tree mortgage service to check multiple lenders at the same time online.

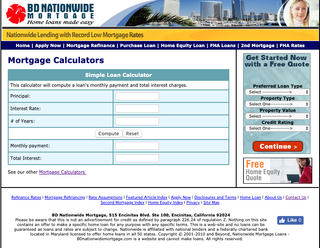

BD Nationwide: Mortgage Calculator

Beyond the types of loans offered by BD Nationwide which include; FHA Refinancing, 125 Home Equity Loan, Refinance Second Mortgage, Home Equity Line of Credit and Jumbo Loan Refinancing, it’s very difficult to tell what types of features each loan entails. Customers can apply and enroll online, but it’s difficult to determine details beyond that. The site does feature mortgage calculators online so payments can be determined to an extent, but without starting the enrollment process and talking to an operative via telephone it's hard to find more details.

BD Nationwide Mortgage: Limited Information

Finding out the cost of the loan is impossible to do online. However, one can assume that the cost will be lower for those with higher credit scores. When we did this we did find it to accommodate mortgages and home equity loans for those with lower-than-average credit.

It’s important to do whatever you can to improve your credit rating before attempting to get a refinancing loan. Nevertheless, BD Nationwide Mortgage should provide some information about cost so that applicants can have an idea of what to expect. The only way to get in touch with BD Nationwide is via phone and email. There are no frequently asked questions or online chat, and although there is a Facebook page it hasn’t seen an update since 2012.

BD Nationwide: Verdict

BD Nationwide Mortgage offers a variety of refinancing types. It’s difficult find rates, features or services and support because there is no information regarding these things. It’s obvious that it is limited when it comes to contact methods and applicants are likely to move on to the next company when they can’t get an idea of how much they’re going to pay for the service.