The best online travel sites are wonderful not only plan your next trip for peace of mind, they're also a fun way to get excited ahead of your next adventure. You can simply go to one site and plan most of your trip's main parts from flights and hotels to rental cars and excursions. If what you're after is just hotel bookings, check out our list of the best hotel booking sites.

While what many of these sites offer is similar, it's the way in which they do it which is important. The last thing you need is a stress-inducing website when planning to go away to relax and unwind. So we've reviewed the best sites based on their price, of course, but also on the way they work, with the ease of use and clarity as important features. We also checked to make sure you won't suffer any extra charges added on top at the last minute. Plus, we took rewards schemes into account, which could help you save money upfront or in the longer term if you use some sites more than once.

With all that in mind, these are the very best online travel sites out there right now.

The best online travel sites

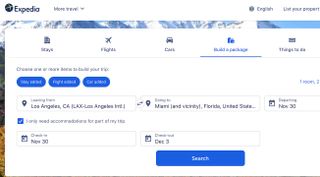

1. Expedia.com: Best online travel site overall

Why you can trust Top Ten Reviews

Expedia is a big name in online travel sites and hotel booking services and owns many popular sites like Hotels.com and Hotwire.com. We're fans of the original, though, thanks to its clean and straightforward to use interface. Hit the packages section of the site, and you can add up to five connecting flights, choose to add accommodation for all of or only part of your trip, and tag on car rentals too.

It's all suitably well laid out, and it only takes a few seconds to start putting together your itinerary. However, we do wish there were a few more options for filtering out accessibility issues. Still, for most people, Expedia.com has everything they'll need, and there's even the option of a cruise too if you fancy it. It's as aspirational to look at as it is useful to, well, use and there are extra discounts for booking multiple parts of your vacation with the site. A Things To Do section rounds off the site's bid to help you plan your entire trip in one place.

2. Booking.com: Best for ease of use

Booking.com is a giant in the world of holiday bookings and not only offers over half a million properties in more than 207 countries but also offers flights and car rental services too. As such you can do it all from this one spot which makes it a very easy-to-use option. That said, there is a lot going on, and the user interface can be a little overwhelming at times.

But with a superb rewards program, it is a great option that encourages you to keep coming back, making it easier to use as you become accustomed. You can even sort your taxi hire from this site meaning there is very little to think about when you get traveling as it's all been planned ahead of time. You also don't have to pay a booking fee on lots of hotels, allowing you to remain flexible – ideal if you're traveling about a lot on your journey.

3. CheapTickets.com: Best for finding things to do

CheapTickets is another site acquired by Expedia, but it does things a little differently. You can easily add on flight, hotel, and car or any combination of the three for package deals, although multiple flights are under a different option. So far, so Expedia (if less intuitive), but you can also clearly purchase event tickets from the site, which is far more useful if you want a one-stop-shop place to buy your trip. It's something other sites provide, but CheapTickets is that bit keener to entice you into the process, even if the site itself is a little cheesier looking than others.

There's also the site's Vacation Value Finder, which lets you tweak how much you're willing to spend and what you're looking for from a vacation before making some fun suggestions. It's perfect for finding a last-minute deal if you don't have your heart set on one place. Students will also appreciate a section dedicated to them with extra discounts once you verify you're a student. All in all, it's a great varied site for numerous different needs.

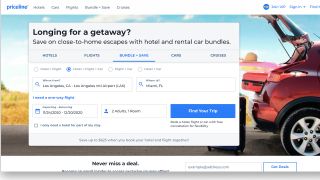

4. Priceline.com: Best for user reviews

Priceline is a big deal in the online travel site world for a good reason. It's effortless to use with options available for flights, cars, hotels, or any combination of the three. It's mildly annoying that Priceline's super cheap Pricebreaker deals don't extend to bundles, so you won't get an incredible bargain like you would if you booked separately. However, combining the set is still a worthwhile deal with discounts offered for the more you bundle together.

One thing we really appreciated is that every hotel we looked at had dozens of reviews, and they're all from verified customers. It takes seconds to gain a reasonably accurate picture of what to expect from wherever you're considering booking. That's the perfect peace of mind when you're booking online, and you can't be sure of what you're getting without user reviews backing hotel statements up. Clearly laid out, you can focus on enjoying rather than worrying. Finally, Priceline is keen to make its VIP scheme easily accessible with straightforward discounts offered to you over time -- something that not all sites so clearly highlight.

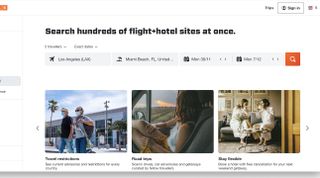

5. Kayak.com: Best for aggregated results

If you're short on time, Kayak is pretty useful. That's because you simply enter where you want to go, and it aggregates results from multiple different sources. While it means you never book directly with Kayak, it does mean you get results quickly and without having to search around yourself, even if you will feel a bit overwhelmed with adverts while you search.

The site itself looks a little basic, but under the hood is a surprising number of different filters (although no accessibility ones to speak of) and all the critical information you could require, although obviously you'll be sent to another site for the full details. The site also has a deals section, which has some great bargains for things you can do once you reach your destination, along with cheap car rental deals. It might not be pretty, but if you simply don't want to do the groundwork yourself, Kayak has you covered. It can be a real time-saver, and we reckon it's particularly useful if you're mostly researching possible trips in the future and want rough price estimates. Just watch out for the fact you can’t bundle in car rental deals.

6. Hotwire.com: Best for renting properties

Hotwire keeps things straightforward. All you need to do is enter what you're looking for, and a somewhat dated interface tells you what's available. It's not as pretty as some sites, but we really liked the extensive property type filters available. Want to stay on a houseboat or in a chalet at your destination? Hit the relevant filter, and you can find out if that's an option in the locale. That might not matter if your heart is set on a hotel, but it's a nice bonus even amongst the awkward site layout.

Elsewhere, it's mostly business as usual, but that's no bad thing. Well laid out discounts are available to compare reasonably quickly, and most locations have plenty of reviews. If you feel like tracking down specific deals, you can do that too, with the site keen to offer up discounts to central locations if you're not quite sure where you'd like to visit next. It feels like the site needs updating when you compare it to its rivals, but it works well and speedily enough.

7. Agoda: Best for private home rental in Asia

Agoda is a great option if you want to look for accommodation that isn't a hotel as this specializes in offering apartments and private rentals. In fact, there are dedicated market managers that work on finding properties, especially in Asia. As such you can find unique destination rentals at decent rates and should you change your mind there is a helpful 24-hour free cancellation policy in place.

Everything is very easy to use and if you want to make more than one booking you can make great savings. Customer support is also a plus, as there is a 24-hour multilingual customer support service available when booking. With millions of reviews, Agoda makes finding a property very easy with a feeling of trust that can offer great peace of mind.

What to look for in an online travel site

Booking Travel Packages

Travel packages can let you combine flights, hotel reservations and car rentals together for a better deal than booking separately. Some companies, like Priceline, pick hotels and flights for you, to get you to your destination for the lowest price. Other companies let you mix and match flights, hotels and car rentals to fit your schedule.

Booking Airfare

One of the biggest reasons for searching on a travel site is to find cheap airfare. While there are dozens of airfare-specific websites, travel sites also give you the option to add hotel stays and car rentals. The best travel sites combine flight information from over nine different airlines and let you sort flights by price, number of stops, duration and flight class.

Booking International Travel

Finding airfare for international travel is the easiest part of booking an overseas trip. AirGorilla helps you find accommodations and rent GPS units with your rental car, so you can find your way around. Often, sites will recommend hotels that are far from your actual destination or event. Searching for reservations on a site that gives accommodation recommendations will help you schedule an international trip with less stress.

How we tested the best online travel sites

We looked at how easy each site is to use during our testing, such as how quickly the site loaded and how easy it was to find what we were looking for. We considered whether the site felt cluttered with adverts or seemed like a dated interface. We also looked at how easy it was to find Contact Us pages, price guarantee information, and any kind of special deals section.

We also considered how easily bundle deals could be arranged and how extensive they were and any potential discounts tied to them. We checked filter options to see how flexible and easy it was to look up different needs along the way.

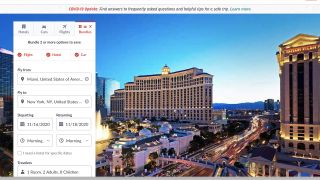

We looked at trips between Los Angeles and Miami, Paris to Lisbon, and New York City to Los Angeles during testing. We also looked at lesser-known routes to see if they were also catered for appropriately.