PrivacyGuard Total Protection is one of the best identity theft protection services you can get. Not only does it cover you for a whopping $1 million and offer telephone assistance but it also comes with Norton antivirus software thrown in.

PrivacyGuard comes with lots more, including tools to help you protect and monitor your digital identity easily. Yet even an identity theft protection service, can't stop your data escaping, but it can help, should that happen. So if a big company leaks your personal information, despite your best efforts to stay safe, then having PrivacyGuard onside can help.

This means you'll be alerted to the problem as easily as possible and have a team at the ready to help tackle the issues to make sure your assets are secure and your identity is safe once more.

All our reviews of identity theft protection apps and services examine features, pricing, alternative options, and what you actually get with each product. We do not go hands-on with these services for our reviews because it is almost impossible to accurately simulate and test these services. In order to properly test ID Theft apps we would need to purposefully hack accounts to assess the level of protection, provide personally identifiable information that would compromise our reviewer, and we would need to perform multiple credit checks - all over the course of several months.

PrivacyGuard Total Protection: Plans and pricing

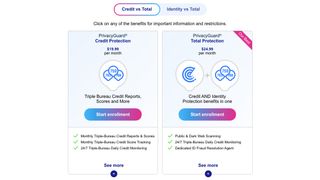

PrivacyGuard breaks down into three pricing tiers of Identity, Credit and Total. PrivacyGuard Identity is the most basic, starting at $9.99 per month which covers web monitoring, wallet protection and a dedicated fraud ID resolution agent. You also get bank account monitoring, driver's license checks, credit card monitoring and more.

PrivacyGuard Credit is charged at $19.99 per month and gets you credit reports and scores with 24/7 monitoring. You get email and text alerts, a PrivacyGuard app, a dedicated ID fraud resolution agent, a secure browser and keyboard, a credit score simulator, a credit information hotline and a financial calculator suite.

Upgrade to the PrivacyGuard Total, at $24.99 per month, which this review covers, and you get all that plus more for the incremental jump in price. Public and dark web scanning are major extras, as is monitoring for social security number, driver's license and passport, bank account, debit and credit cards, USPS address changes, email, DOB, phone and name, ID applications, public records and children's security numbers. You also get $1 million theft insurance, lost and stolen wallet protection, neighbourhood reports, medical records reimbursements and more.

PrivacyGuard Total Protection: How easy is it to use?

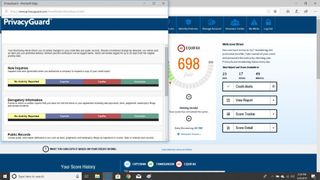

PrivacyGuard Total is one of the most easy to setup services out there. To go from nothing to up and running it takes as little as four minutes. Once you've taken a red herring credit history test, you'll get your login ID and VantageScore 3.0 credit scores.

You can use the apps on both iOS and Android which come with a secure keyboard and secure browser to help keep you better protected. Should you run into any issues there is tech support available on the phone, just not 24/7.

The site itself is a little sluggish to use, with lots of information crammed into the space. The three agency credit scores are shown front and central clearly though, which is a nice touch.

Rather uniquely, PrivacyGuard offers a 24/7 identity monitoring station which scans online and shows, using color coded icons, what you've provided and what you still need to fill in.

The credit score monitoring is really excellent with a merged credit report sent monthly. Unlike most services which offer quarterly or annual reports. This even has a countdown clock showing when the next report will become available. The catch? You're limited to ten credit cards and ten bank accounts. So not that much of a catch then.

PrivacyGuard Total Protection: Features

PrivacyGuard is always working, scanning the web and dark web for activity that might denote your information has been stolen and is for sale. It also checks court and real-estate records and includes details of your appearing, or not, in your monthly reports.

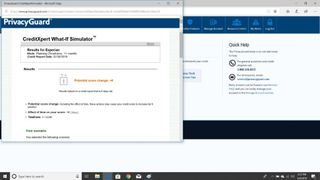

A really helpful addition is a selection of credit and financial calculators and simulators that allow you to maximize money management efficiency. We particularly liked the scenario simulator that works with the three credit bureaus, ideal if you're thinking of a big expense like buying a car.

It's worth mentioning that there is no two-factor authentication, at time of publishing, to keep your account secure. This seems like a bit of a shame but isn't a deal breaker. There is also a lack of family focus and makes us appreciate features like Childwatch protection offered by IdentityForce.

The dedicated case worker is a big plus with help claiming for up to $1 million with lawyers, court filings, getting new documents and carrying out investigations, should the worst happen and your identity is stolen and used. The company itself promises to reimburse lost funds up to $1,500 per week for up to five weeks for wages, travel expense and the like.

Alerts are helpful and come in via the app, text and email. From public record mentions and credit changes to address variations, this checks lots and alerts you. Ideally you'll just receive an All Clear notification over email each month.

Another useful features is that if a registered sex offender moves in nearby you'll be alerted with a map of their address.

You can also be helped to carry out a credit freeze by the staff, but it's not one click like on services such as Norton LifeLock.

Should you choose PrivacyGuard Total Protection?

PrivacyGuard is a very comprehensive service that offers personal assistance which can prove invaluable should your identity be stolen. But with the wide selection of credit monitoring alerts and financial simulators this goes beyond what many services offer.

It's not the cheapest, like ID Watchdog, nor is it the best like IdentityForce UltraSecure+Credit. But with some very unique and powerful tools this is a super compelling option.