- Personal setup service

- Merchant account

- Online portal and virtual terminal

- Real-Time payment processing

- Sales tracking and reporting

- Shopping cart setup

- Hardware and POS software

- Fraud prevention

- Merchant console

- PCI/DSS compliance

- 24/7 customer support

- Heavily discounted rates

- Special Amex rate

- High volume rates

- Fundraising and loan services

- Free iPhone/iPad app

- Customer database

- Web payment links

- Plenty of third-party integrations

- Non-commissioned sales people

- Ethical business model

- Environmentally friendly

- Best for larger volume businesses

A traditional merchant services provider, Dharma Merchant Services offers excellent pricing, incredible transparency with a non-commissioned sales team and highly rated customer care. Even though it's not one of the more well know vendors, Dharma Merchant Services is one of the best credit card processing companies we've reviewed.

With no setup or termination fees and a low monthly subscription, the Dharma proposition is enticing. However, although there is no monthly minimum stipulated by Dharma, the model works best for businesses processing over $10,000 per month. If you are expecting to process less, then Square or PayPal Business might be better options.

This service is only available to US merchants trading in the US only, and high-risk businesses such as gambling sites are not accepted.

Although the main offering is credit card payment processing, Dharma offers a range of add-on services including storefronts, special rates for restaurants and cafes, hardware sales and reporting tools.

The B2B interchange-plus pricing is the lowest in the industry, and the exclusive rates are the result of relationship building and a high level of client confidence. Dharma offers better rates for those processing more than $6,500 a month, and high-volume discounts for large businesses with a volume of more than $100,000 a month.

Dharma Merchant Services review: Features

- Exclusive interchange-plus pricing

- Certified green business with ethical practices

- Personalized pre- and post-sales support

Dharma Merchant Services offers the most incredible interchange plus rates on the market. The standard pricing is just 0.15%+0.7c above interchange for storefront payment processing. The monthly fee is around $20 for most merchants.

If you’re an eCommerce merchant, you will be charged an extra $10 a month for your gateway and an extra $0.05 for payments processed through that gateway.

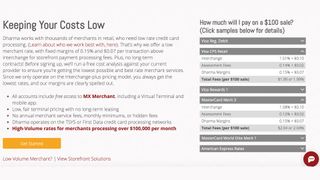

If you’re used to flat rates or interchange inclusive pricing, it can take a moment to get your head around what is actually on offer, but Dharma Merchant Services likes to be upfront so offers pricing examples to help you. For example, Visa CPS Retail has an interchange fee of 1.51%+10c.

The assessment fee is 0.14%+0.02c and Dharma’s markup is 0.15%+0.7c – which makes the total payable fee on a $100 ticket just 1.99%. MasterCard comes in at 2.04% on a $100 ticket, and Amex processing via Dharma’s OptBlue service is charged at a flat rate of 0.25%, reducing your processing fees by up to 62% on this type of card.

Dharma Merchant Services also offers exclusive deals for specific types of merchant or those with higher volumes. More on this below.

If you run an environmentally sustainable business or a not-for-profit or operate a highly ethical business model, and want the companies you deal with to be cut from the same cloth, then Dharma could well be the service provider for you.

Dharma Merchant Services, based in Washington state, is a Certified Benefit Corporation. This means it meets the highest possible standard for social and environmental performance, public transparency and legal accountability.

Its commitment to green business practices is particularly compelling, and meets co-founder Jeff Marcous’s belief in holistic stewardship. Dharma banks with socially conscious Beneficial State Bank, its employee transportation is 100% foot, bus and bike power for the commute, and the company uses hybrid City Car Share vehicles for business purposes.

It is a carbon-neutral business, provides full health coverage to all employees, and all its on-site snacks and beverages are locally sourced, Fair Trade and/or organic. When choosing suppliers to work with, it has a preference for local, minority-owned businesses.

The solid socially and environmentally conscious foundations trickle upward into the way the company does business. It employs a non-commission paid sales team, a dedicated in-house customer care team who seem to rate highly in internet reviews of the service, and offers a variety of ways to get in touch. It also has an extensive FAQs section online which is really easy to use, and will no doubt provide answers to most of your questions.

There is nothing cryptic about Dharma’s offering. The website gives you all the information you need about pricing structure, add-ons, software and hardware and specialist services.

The company is exceptionally transparent and makes it clear it’s not just here to make money – it genuinely wants to see its clients flourish. It even offers a line of credit up to $150,000 via Kabbage Merchant Financing, and has partnered with 4aGoodCause to offer not-for-profit clients fundraising options.

Dharma donates a percentage of its own profits each year to good causes. In 2017 it donated over $100,000 to not-for-profit organizations including Out of the Darkness – a suicide prevention organization, Beyond Limits therapeutic riding, Calypso Farm and Ecology Center, Muttville dog rescue and Veteran’s Path returned servicemen’s support. Each employee can also pick an organization to receive a $5,000 donation.

Dharma Merchant Services review: Usability

- Personalized approach to set up

- Intuitive online portal

Once you’ve been approved, Dharma Merchant Services will provide you with access to MX Merchant, its dedicated online portal that gives you access to a virtual terminal with a host of features.

Intuitive and easy to use with simple graphics to signpost you around, MX Merchant also boasts a high level of functionality including good reporting tools, online payment links, a customer database, customizable receipts, and a smart notifications tool that will alert you by email or text message about things that are happening in your account, such as chargebacks, refunds and statement availability. There’s also a bunch of MX add-ons and third party integrations you can choose from too.

Like Flagship Merchant Services, Dharma Merchant Services is a traditional merchant services provider, and offers a personalized approach to setup rather than an online portal.

Once you’ve filled out the online form you can wait for the dedicated in-house sales team to call you, or you can fill in a ‘pre-application’ online. In order to get past this hurdle in the setup process you need to have all your business registration information to hand, including your taxpayer ID, the date the business formed and full legal business name and address.

Once you have filled in the pre-application and been accepted for a full application, your Dharma sales team representative will ask you for some documentation. You will need to send in a fully completed application form signed by the business owner or not-for-profit authorized rep, and identities will need to be verified, as well as a credit check run for the business owner of a private enterprise.

You will need a letter from your bank or a voided check to verify your bank account, and proof of your entity, such as a business letter or a 501c3 letter from the IRS. If you already accept credit cards, then it’s helpful for the underwriters to see your previous processing statements to help them get your account structure and fees right.

It’s a lot of paperwork to get together, and even once you’ve sent all that in, Dharma may still request additional documentation as part of the due diligence process. However, if things go smoothly and you provide your paperwork quickly, they can have your account operation within one to two days.

If you need an instant payment processing solution then Dharma won’t be for you – try Square, whose almost instant setup allows you to accept payments immediately via its virtual terminal. However, if you are looking to partner with an ethical, affordable, traditional payment processing service provider, a couple of days isn’t really that long to wait for this industry leader.

Dharma Merchant Services review: Performance

- Exclusive B2B rates and volume discounts

- Exclusive rates for other types of merchant

- Socially and environmentally conscious business with excellent customer care

Most businesses offering impressively low charges do so by cutting corners, but Dharma Merchant Services is the opposite. A green, clean, socially woke organization, it has been able to negotiate low rates because other businesses trust them.

Dharma treats its clients very well, and a quick online search shows there are almost no complaints levied against them by its clients. It has an extensive online support page that answers pretty much every general question you could ever need to ask, coupled with a chat bot, an online ticket submission service and a publicly advertised customer services phone number.

Dharma prides itself on sorting out issues quickly and efficiently and chances are, if there is a problem with your account, Dharma will contact you to resolve it before you’ve even noticed.

For an additional fee of $20 per month, Dharma Merchant Services can offer you discounted B2B rates via its MX B2B app. The app captures level 2/3 data, a set of additional line item details, which unlocks exclusive lower rates with Visa and MasterCard.

This additional level of monitoring will also be useful to help monitor and moderate your business spend but it does require you inputting a lot of detail on each transaction. Interchange rates could be a full 1% lower than standard, so if you are a high volume, B2B merchant then it’s worth considering. The Dharma portal and app makes it easy to comply with the demands of level 2/3 processing.

If you’re not a B2B-heavy merchant, don’t worry. Dharma offers a variety of other exclusive rates that different types of merchant can take advantage of. Merchants with properly attributed MCCs (Merchant Classified Codes) can also take advantage of discounted interchange rates.

Not-for-profits, healthcare providers and rental merchants will all benefit from lower rates if their MCC code is correct and verified – something Dharma will take care of for you.

Merchants who process over $6,500 a month or those who process particularly large individual tickets could see their interchange rates discounted by over 40%. In addition, the MX Merchant ACH integration will save you money as ACH (Automated Clearing House) payments are cheaper than credit cards.

There’s a $25 monthly fee, and the underwriting process can take up to ten days, but if you run payroll, offer a subscription-based service or send a monthly bill to your clients, you could save money by accepting ACH. Again, Dharma will walk you through the setup process.

Very high volume merchants with more than $100,000 per month in processing can benefit from some incredibly low rates. For a monthly fee of $15 Dharma Merchant Services offers these customers interchange + pricing at 0.10%+10c on most cards, with Amex at 0.20%+10c. Even if your business can only take advantage of Dharma’s standard rate, at 0.15%+7c for a $17.95 monthly fee it is exceptionally low.

Dharma Merchant Services review: Should you buy?

Ultimately, the deal-maker for us is Dharma’s incredibly positive attitude to business. It is perhaps one of the most woke companies out there and is trying to improve the world with its environmental practices and socially conscious activities and donations. It’s a great model for showing how good ethical businesses can be.

It’s not often that good business meets good people, but Dharma Merchant Services has struck the balance just right. Its mix of highly competitive market rates for processing and an ethical approach to its clients and the wider community makes it a standout choice in the traditional merchant service provider field.

In keeping with its business approach, Dharma is very upfront about the type of businesses it works with best. It does not support high-risk merchants, and recommends PayPal Business or Square payment processing to low-volume merchants. If you are processing around $10,000 a month in volume, or above, then Dharma’s offering will no doubt serve you well.

The application and setup process is a little bit tedious, but no different to other providers in this space. By forfeiting the convenience of an online portal, you are getting the full merchant service with dedicated customer care, your own merchant account and an intuitive portal with plenty of functionality and integrations.

The FAQs section online will probably answer most of your questions and it is well ordered and searchable. If you still find the need to talk to a human, they are easy to contact via a bot, ticket or publicly advertised telephone number.

Even Dharma’s monthly fee for the service is low compared to other providers in this space, like Fattmerchant which is also very ethical and transparent. Dharma has made its excellent processing rates easy to understand, and the discounts for specific types of businesses, large ticket merchants and those with a large volume are very enticing.

What other credit card processing services should you consider?

Dharma Merchant Services is a good credit card processing service, but it may not be the right one for your size of business. Of course, there are plenty of other services for you to choose from. Here are the ones we think are worth consideration and what purpose they are most suitable for; click through for the full review.

Helcim is a great all-round option; Stripe Payments offers great customisation options; Flagship Merchant Services is best option for personal service; Fattmerchant is good for large volume; Square is best for SMBs; PayPal Business is best for micro-businesses; and iPayTotal is the best for high risk merchants.

To see all these compared in once place, read our Best credit card processing service buying guide.