Intuit QuickBooks Online started out as a desktop package - then simply titled 'Intuit QuickBooks' - and has since migrated to the cloud. The software has been around since 2002, which means parent company Intuit has had a long time to perfect its product. In many ways it has. Intuit QuickBooks Online is packed with powerful features that, together with a huge library of potential integrations, make it the only accountancy package most small businesses will ever need. But its depth and flexibility come at a price, with its top of the line package now coming in at around a cool $700 a year when not discounted.

Intuit QuickBooks Online: Features

- QuickBooks claims to be a full-featured accountancy package - it is

- Accountancy and reporting options are powerful and comprehensive

- Layout and design are good but not world-beating

Deployment: Cloud, SaaS

Apps: Android and iOS

Training: Documentation, webinars, live online

Support: Phone, FAQs

All in all, there are no obvious gaps in QuickBooks’ feature list, and small businesses will be reassured to know that the software has a very good reputation among accountants, who especially like the reports, chart of accounts, and bank reconciliation features.

Even larger SMEs will find it difficult to find important bookkeeping and accountancy tasks that they can’t complete with QuickBooks. Like most of its rivals, a QuickBooks’ journey starts with a simple dashboard displaying a clear overview of your organization’s financial health. A menu to the left takes you to the most useful and commonly used features, and various other buttons allow you change settings and dig deeper into the software. It’s a fairly standard design, and one that works perfectly well. Despite the complexity of QuickBooks, you’re unlikely to get lost for long as you navigate around its various sections.

As you do, you’ll quickly glean some understanding of just how comprehensive a package QuickBooks is. This isn’t an invoicing and time management app for one man bands (though invoicing and time management are both ably supported). It’s a serious accounting tool for businesses that need, well, a serious accounting tool.

As such, it boasts all the features you’d expect, and one or two that you wouldn’t. The menu leads to separate sections for banking, sales, expenses, reports, taxes, accounting and more. At bottom left, an apps button takes you into the QuickBooks universe of potentially helpful financial applications.

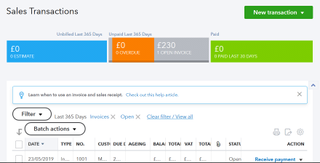

So how does it all work? Let’s take sales as an example. Click on the link and you are taken to a page with a multicolored bar along the top displaying basic information about your accounts receivable. You can immediately see what you’ve billed, what you’ve been paid and what’s outstanding. It tells you about the state of your estimates, unbilled activity and invoicing. In each case you can view everything together or filter by type, status, date or customer. It’s potentially a lot of information, but presented in a smart and digestible way. We found it easy to use and straightforward to tailor to a range of requirements.

But that’s not all. From the sales page you can select a customer or a set of customers and complete batch actions, from printing delivery notes to sending reminders.

A similar system exists within the expenses section, and by connecting a bank or card to QuickBooks you can automate the entire income and expense tracking process, potentially saving numerous hours of manual reconciliation.

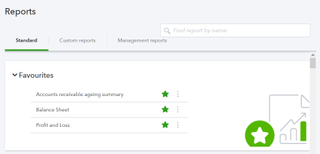

One of the standout features of QuickBooks is the number of reports it can run. There are over 80, ranging from the standard - balance sheet, profit and loss - to the more specialist. For small businesses, it’s a comprehensive list, and the reports are highly customizable. Competitors like Xero and Zoho do reports quite well too, but they either don’t offer as many or you can’t tailor them so precisely to your business requirements.

More predictably, QuickBooks lets you reconcile your books to your bank record, so you can find gaps quickly and easily. Features like inventory tracking, purchase orders and budgeting are available in the higher priced plans.

Intuit QuickBooks Online: Interface and usability

- A clean, uncluttered design

- Starting out is made easier by intelligent setup wizards

- Good readymade templates that some SMEs won’t look beyond

It would be fair to say that QuickBooks is not as intuitive to use as a package like FreshBooks, but then that is not really comparing like with like. FreshBooks is aimed at freelancers and sole proprietors and does a very good job of making people who are perhaps not familiar with accountancy software feel instantly at home.

By contrast, QuickBooks takes longer to really get to grips with. You can be sending invoices in a few minutes, but to get the most from the package you really need to spend a few weeks or even months delving into its more sophisticated features. That’s not a criticism. QuickBooks takes longer to learn because it does a lot more. You get out what you put in.

And in that context, we found QuickBooks easy to use. You can import data from another accountancy package or from Excel, or just jump straight to the setup wizards. These are useful and smart, asking just enough basic questions for QuickBooks to make some easy assumptions about what features your business might need and set them up for you. You can easily turn features on and off later on, but for now the set up that happens automatically in the background can save you both time and the monotony of filling in lots of boring forms.

So QuickBooks is easy to plug-in and play, with no technical or specialist knowledge needed at the outset. The readymade templates will be good enough for many businesses, and there are plenty of opportunities to customize forms, charts and reports if you need a more tailored experience.

Navigating is generally easy, though we had to hunt around for one or two things - including user management - that were eventually found after clicking the gear icon at the top of the page. In fact, quite a lot of useful information and links are squirrelled away under the gear icon, some of which might have been better located elsewhere.

That’s a small point though, and generally we found QuickBooks straightforward to use and easy to navigate. Getting to grips with it fully might take weeks, but that’s testament to its comprehensive feature list rather to any limitation in design. Competitors that offer a comparable user experience include Sage Business Cloud Accounting, but QuickBooks is certainly among the best.

Intuit QuickBooks Online: Performance

- Some outputs - like reports - are second to none

- Excellent third party app support

- Customer support has been criticized in the past

Perhaps the most common complaint about QuickBooks’ performance is not really about the software at all. Intuit’s customer service has a mixed reputation. It might be getting better, because the company is spending time and money to reduce call waiting times and train agents, but it is a reputation that may take time to shake off.

QuickBooks does what you need it to do, and does it well. Once you’ve completed initial setup, raising an invoice - for example - takes minutes to complete. As every good accountancy package should, it does a good job of automating boring tasks and saving you time.

Of course, you expect much more than that from a full-featured accountancy package like QuickBooks, and we think it delivers. We were particularly impressed with the reporting function, which offers a huge list of customizable reports. These were clear, easy to create and, for a small business that wants to measure its success and keep on top of its finances, extremely useful.

Standard functions too are well presented, flexible and functional. If there is a flipside here it is that more than one customer has reported that QuickBooks can occasionally be a bit buggy in places. We assume that Intuit are busy ironing out any faults that come to its attention. We didn’t come across any when we tested the software.

QuickBooks’ performance is also enhanced by its position at the heart of a huge network of complementary apps. At time of writing there are around 600 possible integrations with QuickBooks, from receipt management tool Receipt Bank to budgeting solution LivePlan. Apps integrate seamlessly with the software, conveniently putting an ecosystem of small business financial planning and management tools in one place. To take one example, there are now around 25 different payment processing options alone, which goes to show just how well populated the QuickBooks universe is.

And as you might expect, QuickBooks’ own mobile apps - for Android and iOS - are slick and powerful.

One thing worth noting is that some useful features are only available at the higher price points. For example, multi-currency support and employee time tracking are not available in the most basic small business price plan and inventory tracking is only available at the most expensive Plus and Advanced levels. In other words, check that your preferred price plan comes with all the features you need before committing.

Intuit QuickBooks Online: Should you buy?

QuickBooks has been around since 2002 and its longevity is easy to explain. Here is a full-featured accountancy package for small business that is easy to use and brings obvious business benefits.

As well as solid accountancy, tax, invoicing and expenses tools, QuickBooks boasts the best reports in its class and countless useful integrations. Taken together, it all makes QuickBooks an excellent choice for small businesses that have moved beyond the micro-business stage and face more complex bookkeeping and accounting challenges. QuickBooks has a price plan that caters for freelancers and sole proprietors, but there are better options out there for these users. Wave is one.

But if you need a complete accountancy package, you won’t go far wrong with QuickBooks. Just make sure you pick the price plan that reflects your needs, and be aware that you might need to pay a little more than you bargained for to get everything you want.

What other accounting software is available?

Intuit QuickBooks Online is one of the best accounting software packages you can buy in 2020. Depending on your company's needs, however, there are plenty of others you might want to consider. These are the pick of best accounting software packages and what we think each is best for; click through to read each review:

FreshBooks is the best for freelancers and micro-businesses; Zoho Books is the best for smaller small businesses; QuickBooks Self-Employed is the best for tax; and Wave Accounting is the best free accounting software around right now.

To see this accounting software compared head-to-head, read our buying guide: Best accounting software 2020.

Editor's note: Looking for a Payroll System for your business? If you're looking for information to help you choose the one that's right for you, use the questionnaire below to provide you with information from a variety of vendors for free: