Intuit QuickBooks Online is one of the best full-featured accounting packages around, and QuickBooks Self-Employed is its smaller, leaner sibling. As the name suggests, QuickBooks Self-Employed is aimed very much at the freelancer, contractor and sole proprietor end of the SME market, where it competes with the likes of FreshBooks, GoDaddy Bookkeeping and Wave. After a recent overhaul, the software’s user experience is cleaner and friendlier than ever, and its other big selling point is a focus on tax. QuickBooks Self-Employed handles tax issues as well as or better than anything else in its market. Besides that, it’s a decent basic bookkeeping solution for the smallest businesses but could be better in one or two areas.

Intuit QuickBooks Self-Employed review: Features

- Good transaction tools

- Powerful tax tools

- Basic bookkeeping

Deployment: Cloud

Apps: Android and iOS

Training: Documentation, webinars

Support: Contact form, live chat, help center

In other respects, QuickBooks Self-Employed is quite basic. There is only one invoice format and it is not customizable. There is no real contact management, and no sales tax support or estimates. There are limited reports and no full chart of accounts, and the software lacks project management and time tracking features.

QuickBooks Self-Employed is not a full-featured accounting package and those looking for one should go elsewhere (its big brother - QuickBooks Online - isn’t a bad place to start). It is really a tool for the self-employed to track income and expenses and separate business from personal spending, calculate quarterly taxes and send invoices. It doesn’t offer double-entry accounting, and advanced features are thin on the ground.

QuickBooks Self-Employed is heavily focused on its target market, at the expense of all others. If you’re a self-employed online seller or service provider and always will be, it could be for you. If you just happen to be the first employee of a business you hope to grow, it probably isn’t. Whichever of the two QuickBooks Self-Employed price plans ($10 or $17 a month) you opt for you get one user and that’s it. Nor can you move all your data from QuickBooks Self-Employed to more sophisticated accounting solutions if you outgrow the more basic package.

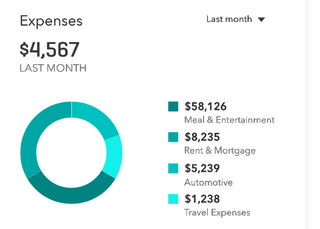

Nevertheless, if you’re a very small business or have a sideline in online selling, QuickBooks Self-Employed comes into its own with its handling of transactions, and their categorization for tax purposes. You can import transactions from your bank account or PayPal, and quickly separate spending into business or personal expenses. Simply download a transaction, mark it business, personal or split (if it’s a little of both), and QuickBooks Self-Employed will automatically categorize appropriately. That can mean apps and software, meals and entertainment or anything else. This automation is not 100% accurate but works pretty well.

You can set expense rules to make categorization even easier, and add receipts. The software uses technology to extract data from smartphone receipt photos and autofill relevant categories, potentially saving freelancers a lot of valuable time.

When you’ve got the hang of entering and tracking expenses, the software’s powerful tax tools really start to work in your favor. Calculating tax is a thankless task for any freelancer, but QuickBooks Self-Employed does a good job of doing it for you.

After asking you some basic questions on your tax filing status, QuickBooks Self-Employed takes all the information from your income and expenses to estimate your quarterly tax bill and annual tax projection. You can dig down into a quarter to see taxable income, deductions and projected profit. It also supports Schedule Cs. QuickBooks Self-Employed lets you file and pay taxes online with TurboTax but only if you invest in the higher priced package.

Deductions are excellently handled. You can track mileage, vehicle costs, office supplies and even healthcare expenses.

Intuit QuickBooks Self-Employed review: Interface and usability

- Very easy to use

- Jargon free

Intuit QuickBooks Self-Employed is easy to set up, asking you for some basic company information and then offering you the opportunity to add your bank account, download the mobile app and forward receipts from your email inbox. After that, you’re all set.

QuickBooks Self-Employed is quite a simple package and even beginners won’t take long to get to grips with it. It’s an easy learning curve from set up, to sending your first invoice, to linking your bank account and starting to categorize expenses. This is how it should be with a basic tax and bookkeeping tool. Freelancers and sole proprietors are unlikely to have either the time or inclination to spend hours learning arcane accounting rules.

The pages are generally simple and clear, ideal for time poor freelancers wanting basic information at a glance. They follow a familiar format of a left hand vertical panel containing navigation links and a large central area for information and data entry. There’s nothing surprising here, but it’s very nicely done, and a match for the likes of Wave, which is also very well designed.

You get very few templates with QuickBooks Self-Employed but what there are are clean and professional. The whole package is free of jargon and complexity, and gratifyingly light on clutter and extraneous information. Completing tasks is straightforward, but if you do get stuck the Help button can take you to a small library of useful articles. All in all, we found it easy to use.

Intuit QuickBooks Self-Employed review: Performance

- Great mobile app

- Decent customer support

- Limited integrations

Intuit QuickBooks Online has been criticized for rather sluggish customer support, but Intuit has obviously realized that freelancers tend to need more of a helping hand than employees of larger businesses. QuickBooks Self-Employed actually has better customer service options than its grander sibling, with a decent live chat option and a contact form that is answered quite quickly. There is also a help center and QuickBooks forum, though the latter is for all QuickBooks products and not just QuickBooks Self-Employed.

QuickBooks Self-Employed doesn’t do a vast amount, but it handles its limited brief well. It’s best to think of it as tax software with some basic bookkeeping thrown in as opposed to accounting software, and with expectations thus set you are unlikely to be disappointed.

At least, not if you’re a freelancer or sole proprietor business. For this niche QuickBooks Self-Employed performs well. It will certainly help anyone get organised around expenses and tax, which is exactly what many very small businesses need.

This is especially true when you connect QuickBooks Self-Employed to its mobile app, which we liked a lot. The app is pretty much a mirror of the browser version, letting you manage expenses and invoice clients on the go. Better still, the browser’s mileage calculator really comes into its own when linked to the mobile app.

The app, available for Android and iOS, automatically tracks the mileage of any trip, detecting start and end points and allowing you to label journeys as personal or business. At tax time you can export a digital mileage log and use it to satisfy IRS requirements. It’s a great way of speeding up and simplifying a rather painful and time consuming process.

Third party integrations are limited but potentially useful, especially when you take into account the software’s user base. QuickBooks Self-Employed syncs with Etsy, PayPal and digital currency exchange Coinbase. It also integrates with QuickBooks Payments which allows you to accept online invoice payments. It’s fair to say that integrations are not a strong point, however. FreshBooks, for example, offers a lot more, including links to Trello, Gusto and G Suite.

Intuit QuickBooks Self-Employed review: Should you buy it?

It’s worth reiterating that Intuit QuickBooks Self-Employed is a financial organization tool for the smallest of small businesses, and doesn’t claim to be anything like a full accounting solution. That’s just as well, given that big brother QuickBooks Online is one of the market leaders in that particular field. We don’t want any sibling rivalry.

As such, freelancers will appreciate its excellent transaction handling and expense categorization features, and its ability to use that information to estimate quarterly tax and assign business transactions to Schedule C. Contractors and others who drive for work will love another of the software’s standout features – the automatic mileage tracker. Mileage tracking is much better if you download the mobile app, which you really should do. It’s a very useful addition to the complete package, and better than many rivals’ mobile efforts.

On the flipside, QuickBooks Self-Employed is only a very basic bookkeeping tool. Invoicing is limited, and project management, estimates, contact management and time tracking nonexistent. It offers a very limited range of reports.

If you want more bookkeeping features, you will be better off with Freshbooks, Wave or perhaps GoDaddy Bookkeeping. Having said that, for freelancers who want tax software with some basic bookkeeping thrown in, QuickBooks Self-Employed is worth considering. If you don’t know whether that’s you or not, the software’s 30-day free trial is the obvious place to start.

What other accounting software is available?

Intuit QuickBooks Self-Employed is one of the best accounting software packages you can buy in 2020. There are, of course, plenty of others you might want to consider. These are our picks for best accounting software packages available and the use-case we think each is best for; click through to read each review:

Zoho Books is the best for the smaller small businesses; FreshBooks is our pick for freelancers and micro-businesses; we recommend Wave Accounting as the best free accounting software; and Intuit QuickBooks Online probably represents the best overall solution for small businesses but is relatively expensive.

To see all this accounting software compared head-to-head, read our buying guide: Best accounting software 2020.