Best Medicare Part D plans 2022: Find the right prescription drugs plan for you

Buying Guide The best Medicare Part D plans and providers, from AARP to WellCare Medicare prescription drug plans.

Find reviews and recommendations for money services.

Buying Guide The best Medicare Part D plans and providers, from AARP to WellCare Medicare prescription drug plans.

Buying Guide The best online fax services offer firms a reliable and secure method of communication. Here's the most trusted services of 2022.

Buying guide The best small business phone systems can bring sophistication and efficiency to your business.

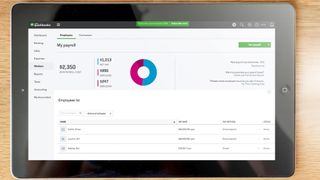

Buying Guide Simply the best payroll software for your business.

Buying guide Want to find the best POS system for your restaurant, website or store? Look no further.

Buying Guide Use the best pest control companies to get rid of unwanted bugs, rodents and reptiles, both inside and outside your home or business.

Buying Guide Choose from the best accounting software and make life for small businesses and medium-sized businesses that much easier.

REVIEW Intelius is a good site for people searching and background checking, with no customer funnel. While it lacks some features, Intelius's data organization makes the service stand out.

Review National Debt Relief offers a reputable debt consolidation service that most customers are quick to praise.

Review An Avant personal loan is perfect for low credit score borrowers who want to pay off debt and enhance rating.

Review Lending Club is the peer-to-peer lending pioneer that offers a hardship plan and directly pays off lenders, ideal for debt consolidation.

Review LightStream's personal loans are a strong credit borrower's delight with no fees, lows rates and co-sign options.

Review Marcus by Goldman Sachs is one of the best-rated online personal loans available with great rates, no fees and flexible terms.

Review Upstart has a loan for everyone, even those with less credit history and poor FICO scores.