Fidelity Investments helps over 32 million investors to achieve their market-related goals and deserves its status as one of the best online stock trading brokers as a result. Some 2.3 million trades are made via Fidelity each day, with $8.3 trillion entrusted to the investment giant in the form of customer assets.

It is a truly global operation too, with 40,000-plus associates covering eight other countries across North America, Europe, Asia, and Australia to serve customers worldwide. Besides stock trading, the overarching Fidelity name is well-known for its insurance solutions, and ranks among the best final expense insurance providers too.

Fidelity Investments review: The basics

Account minimum amount: None

Commission fee: None

Account fees: Some fees may apply

Investment products: Mutual Funds, Retirement & IRA, trading, stocks, fixed income, bonds & CDs, ETFs, options, sector investing, savings

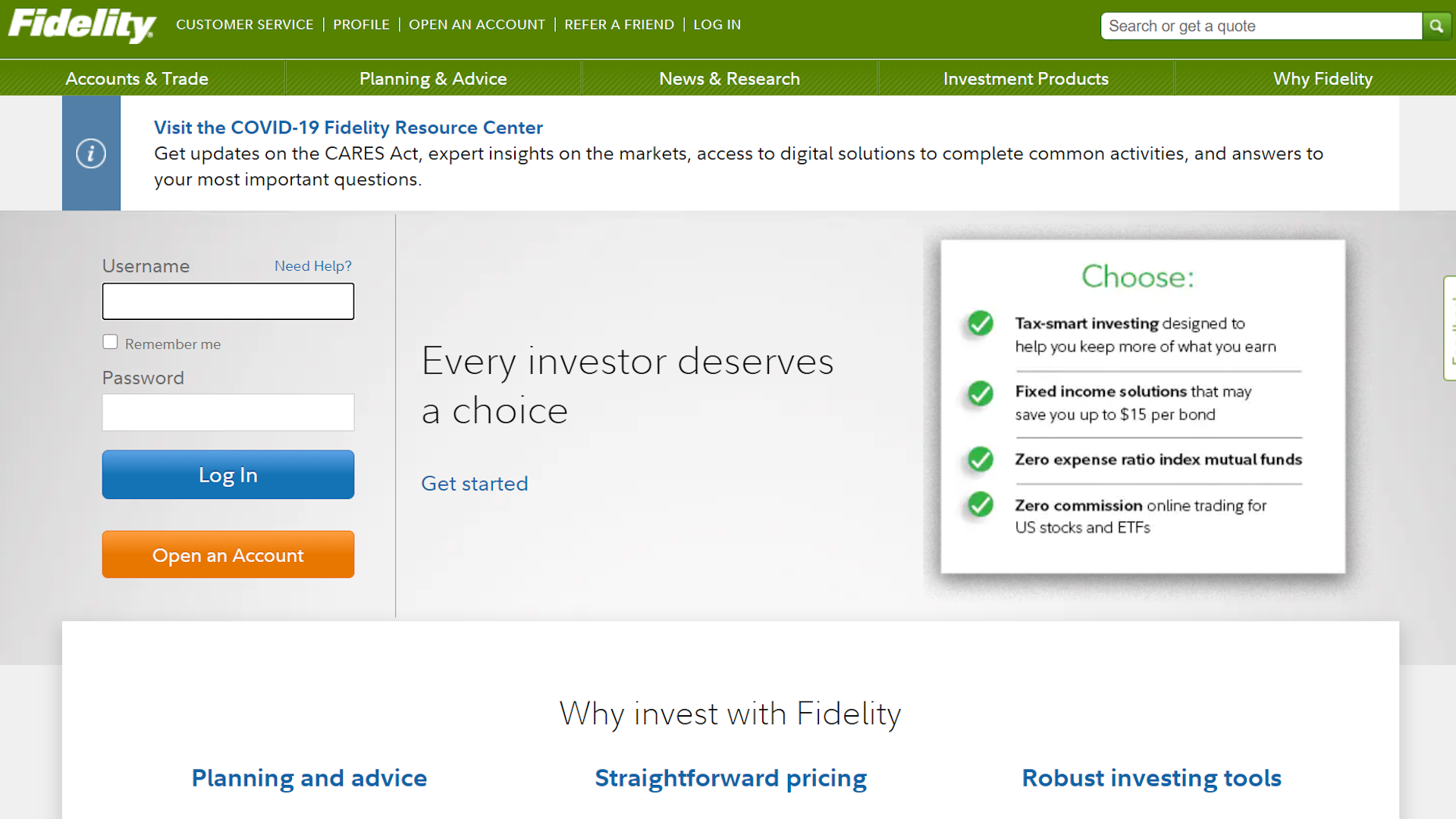

Fidelity Investments may not be the most aesthetically pleasing stock trading platform but look under the skin, and you'll find a plethora of services and investment options that will impress, regardless of your investment experience.

Beginners will appreciate the planning and advice section, which includes insights that they can use to start the process from an informed standpoint. Meanwhile, the expert investor will enjoy the News & Research section that also includes Watch Lists, Options and Market and Shares Data.

Fidelity Investments review: Tools and services

- Varied account choices

- Retirement tracking

Fidelity Investments has some great tools and services. You can see how your investments track against your retirement goals using the Fidelity Retirement Score, and you can manage your entry and exit trading strategies using the Trade Armor tool. There's also access to an online service called Fidelity Estate Planner that guides you through the estate planning process smoothly, including finding the right attorney.

The company has representatives available 24/7 so you can trade at any time of the day or night, while its national branch network means you can walk in off the street for a more personalized experience if you that's what you prefer. If you like making your own investment choices, expert insights and investing tools are available on the website, including calculators and well-researched Fidelity Viewpoints articles. The latter are made up of industry relevant analysis and commentary that will help you shape your investment decisions.

The Fidelity Investments trading platform - Active Trader Pro - comes with real-time alerts, insights, and a customizable Daily Dashboard. The latter is extremely useful for accessing news, announcements and economic events in real time. The platform lets you place trades, monitor accounts and generally fine-tune your trading. There are also mobile apps for iOS, Android and Google that work seamlessly with your accounts and allow you to trade anytime and any place you want.

Fidelity Investments review: Trading options and forex

- Wide range of investment options

- Access to popular mutual funds

It’s hard to find fault with Fidelity Investments given they have countless investment solutions to suit the widest range of investment styles. Some of the stand-out offerings include access to the Fidelity Zero Total Market Index Fund and the range of zero expense ratio index funds. Their offerings are extremely cost effective and tailored to help get the best out of your portfolio, although forex trading is not an option.

In this regard, on the Fidelity Investments planning page, you’ll find features such as Fidelity Go – a robotic digital investment advisor – and a personalized planning and advice service that offers you advisor-led support. You can also use the tools to plan for specific life events, such as having children, various levels of health, and arranging your legacy.

Fidelity Investments: Service and support

- Impressive education platform

- Good customer reviews

Fidelity Investments might have the best research tools available on the market today, beating even TD Ameritrade for variety and depth. You gain access to decision making technology for your trading investments, and use the News & Research section to view different charts, sectors, and performance levels. These features are also built into the Fidelity mobile apps and the trading platform, which means you should always have the information you need at hand.

When it comes to customer service, Consumer Affairs elicits a disappointing one out of five stars. More positively, some of the most recent reviews are from happier customers who appreciate the hands-on service and 24/7 customer support. At the same time, consumer feedback has seen Fidelity gain positive recognition from Stockbrokers.com and Investopedia. The service also ranked highly in the Investor’s Business Daily 2019 investor survey, garnering a spot in the top ten for yet another year.

Should you use Fidelity Investments?

Fidelity Investments is reliable, customer friendly, and packed full of different investment options and choices. The website may not be the best looking around, but the company more than makes up for it in terms of digital offerings, research, tools, services and support.

It has calculators and apps designed to help users through very specific investment decisions, and it provides both beginner and novice with the right level of choice. With the platform well-regarded by customers and the market alike, it’s a solid place to start if you’re wanting to develop a financial future without adding on too much risk.