For most companies, expenditure is the second biggest cost of doing business, after salaries. Staff spending is a large part of that. Getting it right is essential, for both the bottom line of your business and for avoiding endless back and forth emails with your accountant, bookkeeper or finance department. Abacus will help you get it right, and features a good range of tools for administrators and accountants. Employees, too, will appreciate its simple and well-designed mobile app and swift reimbursement process via automated clearing house (ACH) payments. Abacus is not as comprehensive as one or two high end competitors like Expensify and Rydoo, but it is a very capable solution, and a reasonably priced one, for smaller businesses.

Features

- Clean, contemporary look and feel

- Excellent and comprehensive admin controls

- Mobile app a little light on features

Free trial: 30 days (but you have to contact the company)

Software type: SaaS

Mobile: iOS, Android

Support: Knowledge base, email (live chat and phone at higher price points)

Like many rivals, Abacus offers three price points, starting at $9 per active user per month for its Starter package. The Professional plan comes in at $12 per user, adding a couple of extra features like programmable approval routing, alongside a more personal service from Abacus. There is also an Enterprise option for larger businesses, which includes Salesforce CRM integration and API access on top. You have to contact the company for a quote if you’re interested in the Enterprise option.

USER FEATURES

The first thing most users will notice about Abacus is that it looks great and is wonderfully intuitive to use. The company formed in the mobile era and has produced very clean desktop and mobile interfaces that feel bang up to date.

Looking good is one thing. Working well is another. Luckily Abacus does both. Good expense management software starts with the mobile app, and the Abacus app is simple but capable. Users take a photo of a receipt and leave much of the rest of the submission process to Abacus. Abacus creates the expense, auto-categorizes it (based on previous categories you’ve used), and matches it to a linked credit card transaction. When it has completed those tasks, it will tell you the expense is ready to submit. Of course, you can manually enter receipt information too, and receipts can be emailed to the software.

Submitting expenses with Abacus is certainly quick and largely painless. For users, the nice thing is that you can simply submit the receipt, without having to attach it to an expense report. Let’s face it, what users want most of all is quick and easy reimbursement for money spent on company business. Creating expense reports just gets in the way.

For users, then, Abacus is a very solid solution. For those travelling abroad for business, Abacus supports multi-currency, and will automatically convert any foreign expense into U.S. dollars, using the conversion rate on the day of the transaction.

Nevertheless, the user experience is not quite as comprehensive as that of rivals like Certify. Abacus can track mileage, for example, but you have to input miles driven manually, rather than having the mobile app calculate them for you using Google Maps and GPS. And the Android mobile app, though very easy and intuitive to use, is in effect little more than a way to capture and submit receipts. For most users, this will be quite enough, but some solutions offer wider functionality in their mobile incarnations.

ADMIN FEATURES

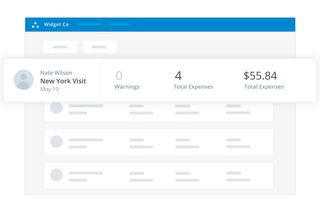

Administrators, managers and other approvers get everything they need with Abacus. Expenses land in an approver’s inbox, but Abacus will flag any that violate company policies.

Those policies are created during initial setup, though admins can change them at any time. Rules can be created around receipts, daily spending limits, category spending and so on. Warnings can be set that alert users when a rule is close to being violated. We found the blocking rules to be especially useful, because they stop users submitting an expense that violates policy or is short on essential detail. That saves time for both users and approvers, stopping the back and forth of explanatory emails.

Abacus lets you establish different approval workflows for different circumstances. Expenses can be routed along different paths according to custom rules based on, for example, amount, user, category or client. That’s useful, because again it stops time being wasted chasing approvals.

Abacus has really been built for speed. Rules and workflows are designed to push expenses through the process in the shortest possible time. For the same reason, approvers can green light reimbursement as soon as they’ve signed off a compliant expense. In theory, users can speed from receipt capture to reimbursement in just 48 hours.

Although users send in receipts rather than expense reports, Abacus helps out the finance department by organizing submitted expenses by category, client, project or another criteria. From that information, reports can be produced on spending by employee, department, vendor and so on, helping companies keep a firm grip on the what, where and who of expense spending.

Abacus lets admins and users sync personal and company credit cards and automatically downloads transactions. It also links to thousands of financial institutions, and admins can manage multiple corporate card accounts from a single dashboard.

Taken together, Abacus is an excellent tool for admins who want to keep tight control of company spending. For an extra level of oversight, an accountant can be linked to the software for free.

Interface and usability

- Pleasing modern layout and design

- Gentle learning curve

Usability is one of the key selling points of Abacus, making it a very good fit for small or very small businesses with little prior experience of expense tracking software. From setup onwards, Abacus is a joy to use.

Admins can quickly set up Abacus on their own, and then invite users to sign up. Setting rules and policies is easy, and though the software will guide beginners through key processes, users will quickly get to grips with receipt capture and submitting expenses. Abacus does a very good job of making you feel quickly at home.

As mentioned above, Abacus looks and feels great, in both its desktop and mobile incarnations. It has been designed with mobile users in mind, and nothing is more than a quick click or tap away. Navigation is straightforward. The desktop dashboard contains Expense List, Chart View and Receipt View dropdown menus, and admins and managers then get a series of links to main screens, including Inbox, Pending, Approved, Inbox with Warnings and Inbox without Warnings. You can also change and tweak policies and settings from here.

It’s all clear and usable, with an easy learning curve and plenty of supporting material.

Performance

- Good range of integrations

- Live chat and phone options only available at Professional level

Abacus performs well, making life easier for users, approvers and administrators. It’s quite a simple solution for users, and lacks some of the features more intense business travellers might appreciate, but its admin automations are capable and comprehensive.

Abacus also integrates with third-party accounting and ERP applications like QuickBooks Desktop, QuickBooks Online, Sage, Oracle, Microsoft Dynamics, Xero and NetSuite.

It links with a range of other useful apps, too. By linking with connectivity solution Zapier, Abacus can connect to a huge range of other finance, expense, tax and productivity apps. In addition, it links to Lever, Slack, Salesforce and Zenefits.

If you get stuck, Abacus offers a good searchable knowledge base, a range of articles covering popular topics and email support for Starter plan users. Customers taking higher price point options also get phone and live chat options and Enterprise customers get a dedicated account manager.

Verdict

Abacus is an excellent package that works well. Users will love the 48 hour reimbursement process, while admins will appreciate a range of powerful controls and reports. Everyone will like the software’s clean, contemporary design.

We would argue that Abacus is a little better suited to smaller businesses with more straightforward requirements, if only because the software lacks some of the travel-related integrations and automations that some rivals offer. These are useful, but Abacus’ excellent user experience may suit small businesses better.

The software’s receipt capture is not the most powerful or accurate, but will still come as a revelation to users who are used to typing information from paper receipts into an Excel spreadsheet. In every other respect, Abacus is a match for any of its competitors, deftly taking the drudgery out of expense management for everyone concerned.