DeWALT battery-powered lawn mower recall: these are the model numbers affected

If you have an early 2024 DeWalt Battery Push or Self-Propelled walk-behind mower, stop using it straightaway

If you have an early 2024 DeWalt Battery Push or Self-Propelled walk-behind mower, stop using it straightaway

News Dyson's first dedicated wet floor cleaner, the Dyson WashG1, will tackle wet and dry debris in one go.

News The Dyson 360 Vis Nav uses 360 vision to intelligently deep clean your home, picking up more debris than others claim.

Hands-On We tried out Weber's smaller Traveler gas grill to see how it compared to the original model.

News There are three global first-time launches among the wave of new products from SharkNinja.

News The new Ninja Double Stack Air Fryer is one of the latest kitchen countertop innovations to be announced.

CES 2024 These are the CES 2024 trends to watch and get involved with this year.

CES 2024 The Yarbo S1 Snow Blower is a world-first for versatility in yard maintenance that'll take care of your grounds all year through.

CES 2024 The Eureka Dual Washing Bot is space-saving, time-saving, and saves on a load of effort, too.

CES 2024 We had the chance to see Whirlpool's new SlimTech insulation refrigerators up close at CES 2024, and they're impressively space-saving.

Hands-on The Revolution Cooking Touchscreen Toaster R180 is a good-looking, impressive toaster but should you buy it? We find out..

CES 2024 The Mammotion LUBA 2 AWD Series improves of it's predecessor. Here's how.

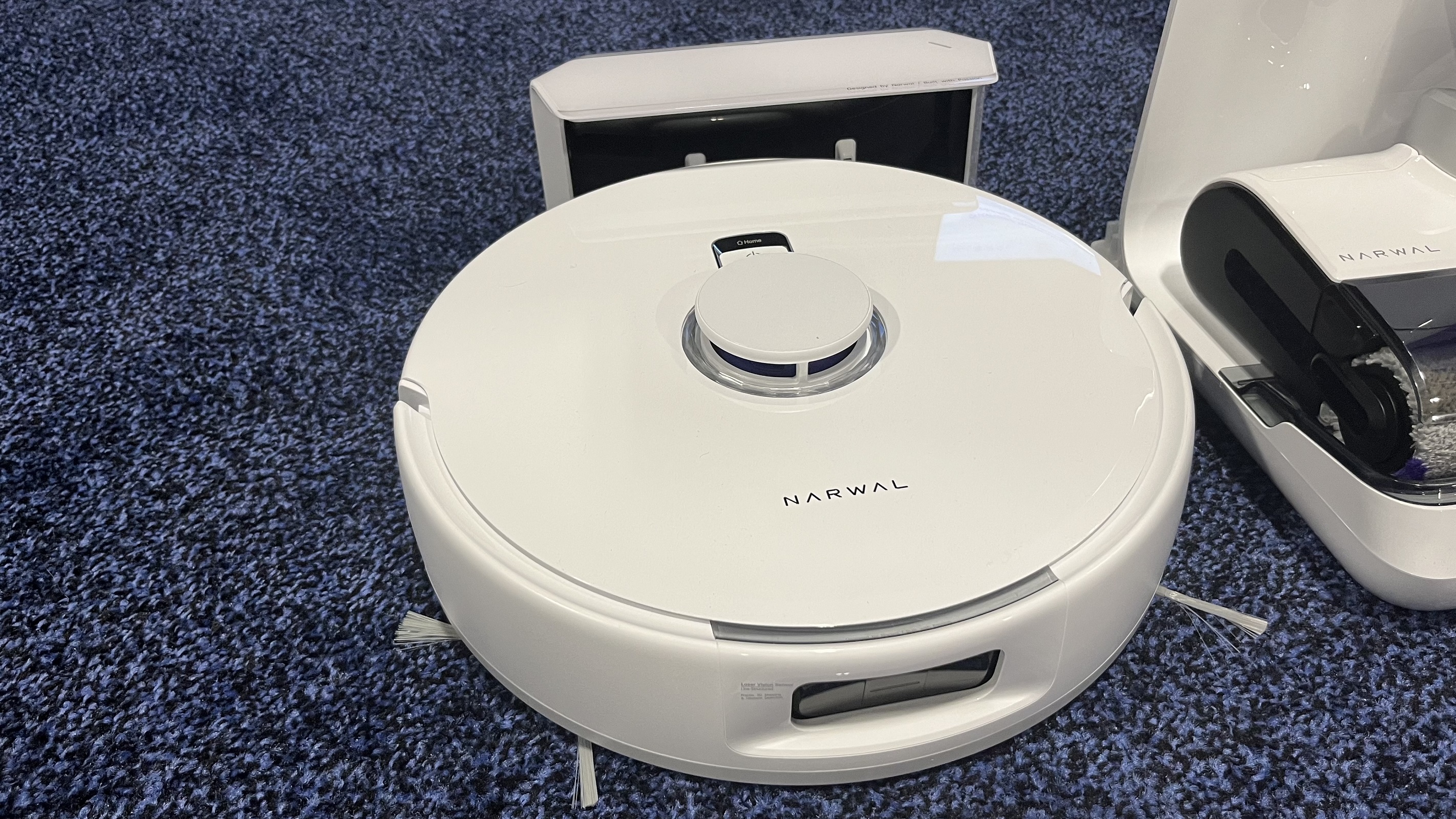

CES 2024 The Narwal Freo Series unveils a world-first for smart home cleaning tech across three advanced devices.

CES 2024 CES 2024 is a global tech event showing world-leading innovations in consumer electronics. But what does this all mean for you? Let me tell you...

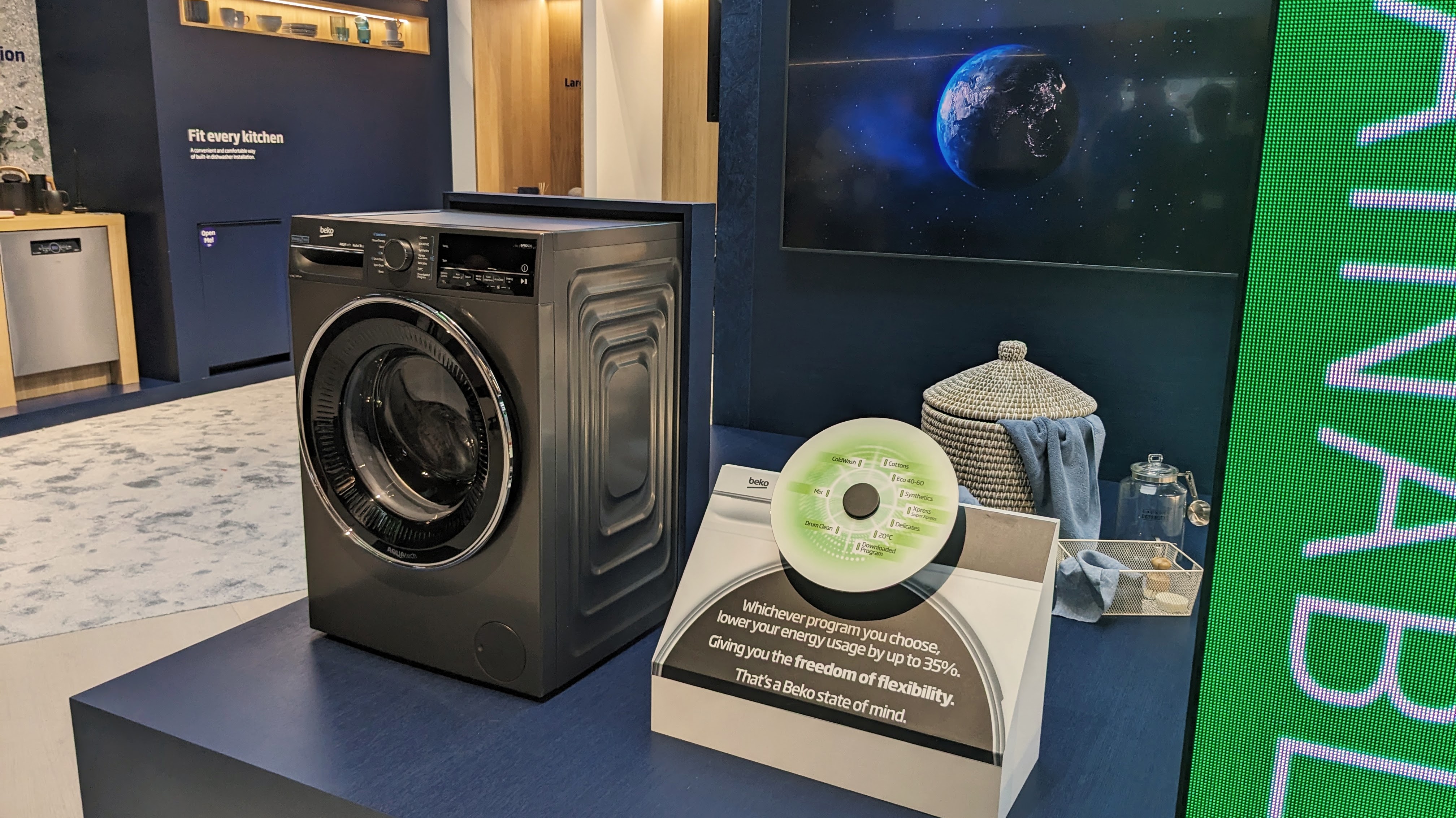

IFA 2023 Whether you like it or not, Beko's newest washers and dryers are going to be more eco-conscious.

IFA 2023 We're off to IFA Berlin 2023, and we're excited to see what appliances, smart home tech, and more might be in store...

News Samsung’s new Pet Care washer and dryer remove six times the amount of pet hair from clothes and bedding