Gusto Payroll Solutions has not been around as long as some of the main competitors, having started in 2011 as ZenPayroll, but it’s already growing rapidly, opening new offices around the United States. In a crowded marketplace, it established an identity and selling point as being small-business focused, and providing specific, commonly-used payroll tools especially designed with his market in mind. They are generally considered to offer an elevated user experience, one that is clean, intuitive and easy to navigate, even for non-payroll professionals. The company has shown itself to be open to improvements and it continues to evolve impressively.

The set up process has been simplified pleasingly, and Gusto Payroll Solutions guides users through the various stages with appropriate prompts and a good database of help files and demonstrations if needed. Data entry can be done by one person, or the software can send employees an easy-to-follow email and they can enter the relevant details themselves.

If the company is switching from a different pre-existing payroll method (a sometimes overwhelming prospect for small business owners) then Gusto Payroll Solutions is an especially good choice as its interface is designed with this in mind and Gusto Payroll Solutions offers free assistance with this process. Gusto Payroll Solutions is cloud-hosted, which means no problems with software installation and excellent accessibility.

- Best Payroll Software

- Best Expense Management Software

- Best Personal Finance Software

- Best Accounting Software

Features

- Full service payroll with employee self service plus tax

- Integration with most of the main accounting software brands

- Each plan has a base price rate

Support – 6am - 5pm Pacific Time, Monday-Friday

Payroll processing: payrolls can be processed online, with everything stored in the cloud

Payroll reports: Filterable payroll reports (filter by employee(s), location, department)

Payment options: choose from various ways to pay employees, from direct deposits to paper checks

Payroll tax: the software handles all payroll tax necessities, including completion and filing of essential forms.

Accounts: Flexible Spending Accounts, Health Savings Accounts, and Commuter Benefits.

Operating Systems – iOS, Windows and Android

Hardware – not applicable as deployment is through the cloud

Free Trial – Offered to new customers, typically one month

Payment Options – Detailed above, specific plans have different base rates and there are a number of add-on options

These are the plans available:

Gusto Core

Gusto Core is the entry-level plan that comprises the essential payroll features that any small business needs. The base charge is $39 per month, with an additional $6 per month per person. Gusto Core includes all payroll features, employee accounts and profiles, as well as expert support from the Gusto customer service team.

Gusto Complete

Gusto Complete is the next tier up. As well as the payroll features, employee accounts and profiles and expert support, it includes hiring and onboarding tools, time-off requests, employee directory and surveys. The base charge is also $39 per month but the additional charge per person per month is $12.

Gusto Concierge

Gusto Concierge is the top-level plan offered by Gusto Payroll Solutions. As well as the features detailed in the above plans, it includes access to certified HR pros, and an HR resource center with dedicated support. The base charge for this plan is $149 per month, plus $12 per person per month.

It’s possible to add a range of features to any Gusto Payroll Solutions plan. The fee structures for these differ depending on specific requirements and numbers of participants and the like. These include Health Benefits, integrated 401(k) retirement plans, workers’ comp insurance and 529 college savings plans. An annual payment of $200 can also deliver tax-advantaged spending accounts, including HSA, FSA and commuter benefits.

The focus for Gusto is very much on small business owners. All of their plans fully automate the payroll process and have the added benefit of doing the same for the calculation, payment and submission of any relevant payroll taxes at state and federal levels. Gusto Payroll Solutions also offers the option for businesses to pay their employees through a bank deposit or a physical check and the software will automatically handle calculations and year-end forms in a way that avoids the chance of critical errors. These features also free up business owners and company staff from these tasks, and also the employee accessibility means that many queries can be handled by the employees themselves.

Design and usability

- Quick and easy access to information from any web browser

- Cloud-hosted system, no special software to install or maintain

- Employee access and information uploading

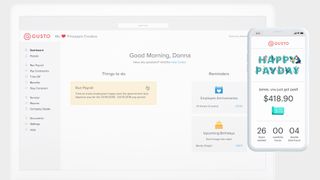

The set up and interface of Gusto Payroll Solutions is very user-friendly, as you might expect from such a young, dynamic company. As accurate information is essential for running a problem-free payroll process, Gusto Payroll Solutions is designed to really walk the user through these crucial early stages. There are helpful prompts that will reassure even users who are using this kind of software for the first time, and if any queries arise, there is a wealth of help files and even demonstrations that should sidestep the need to spend time on the phone to customer support.

The data entry process is easy, and there’s even an option to send individual employees an email so that they can input the necessary information themselves, which obviously saves a lot time for the administrator or business owner. The payroll process then links up to your company bank account and prompts you to choose a payroll schedule – one limitation of Gusto Payroll Solutions is that it does limit you to four of these payroll runs per month; broken down further into two salaried and two hourly runs.

Once unpaid tax liabilities, benefits, deductions and garnishments information has been collated, as well as allowed expenses such as travel or gas, the payroll is ready to be run. All of these data input elements are common to most payroll solutions, but Gusto Payroll Solutions executes them incredibly well.

One particular feature worth mentioning is that if a company is just starting out offering healthcare benefits to its employees, Gusto Payroll Solution is exceptionally useful as it uses algorithms that can recommend health plans based on all kinds of budgetary information that it already has about the company. The set up screens are intuitive and the design is clean, and when intuition fails, there’s always those prompts and help files.

Performance

- Payroll processing can be completed in minutes after the initial set up

- Seamless integration to accounting software

- Automated reminders flag up looming deadlines

Once we log into Gusto Payroll Solutions, the dashboard immediately flags up any items needing attention with a handy To Do list. There’s a section for reminders, too, which is a reassuring heads-up about any imminent payroll deadlines. Running the payroll process really only takes a few minutes.

Employees are listed clearly, with either their annual salary or hourly rate marked. There’s an option to enter any additional information here that might change each month (or whatever the frequency of the payroll process), such as bonuses, tips, expenses, overtime, etc. It’s a simple toggle to choose the payment delivery preference of each person, between checks and direct deposits. One slight limitation with Gusto Payroll Solutions is that any time off has to be entered on a separate screen, a feature which many other programs include on this same screen, so that’s a minor inconvenience at this point. After all of this is saved, the payroll run is calculated and presents us with a helpful preview so that we can double check what we’re about to approve, and exactly how much money is about to be moved from the company bank account.

In terms of taxes, Gusto Payroll Solutions has the ability to handle both W-2 forms and 1099 forms. If our company is one with an unchanging roster of salaried employees, then Gusto Payroll Solutions doesn’t need any further information at the point of payroll processing and it can just go ahead and complete this task automatically to our timetable. Once payroll is complete, reports can be viewed and exported in a choice of formats.

The choice of report templates is acceptable and probably perfectly fine for any entry-level user. It’s perhaps worth noting, though, that other payroll solutions, such as ADP Payroll Solutions do offer much more choice in this area, though it may not be a priority requirement for most users. All of these processes can be completed from any web browser, and there’s no discrete app to download to a mobile device. There’s very little difference between the iOS and Android versions, so users shouldn’t experience anything too jarring as they access Gusto Payroll Solutions across various platforms and devices.

Verdict

Payroll solutions is, as we’ve noted, a crowded field and an industry that is only getting more crowded, but there are a few reasons that Gusto Payroll Solutions has seen such impressive growth since the 2011 debut. The company’s own estimation is that some 60,000 business use their services across the United States, which is a noteworthy achievement, backed up by the fact that the company is regularly opening more and more offices across the country.

One of the stand-out features is the striking aesthetics, and Gusto Payroll Solutions has a notably clean, trendy look that modern small businesses will really take to.

For small business owners – the market that Gusto Payroll Solutions is particularly focused on – the features are on a par with any entry-level product on the market, plus there’s the added draw of Gusto Payroll Solutions having a very competitive pricing structure.

The user experience is as good, if not better, than its peers. The simple set up process comes with as much assistance as necessary, whether through the online prompts, help files and demonstrations, or over the phone with the company’s Customer Service team.

All the essential elements of the payroll process are handled efficiently and there’s even a welcoming, almost friendly aspect to using Gusto Payroll Solutions. Both business owners and payroll professionals will welcome the time saving aspects of Gusto Payroll Solutions, particularly the employee self on-boarding and the ability for employees to essentially address their own queries with access to whatever information is made available to them. This definitely helps free up time for perhaps more pressing business matters.

As a relatively young company, Gusto is particularly predisposed to the challenges of small start-up firms, and though the limited hours of customer service access might put some people off, as long as this is something a business is aware of, it seems like an easy workaround.