QuickBooks is a huge global name in the financial and accounting software market, having been around since the early 1980s as the go-to accounting software for home computer users as well as commercial clients. Intuit QuickBooks Payroll was launched in 2018 as a cloud-based, online payroll solution that would replace its former offering, Intuit Enhanced Payroll. Its immediate appeal stems from both the goodwill and loyalty that many customers have to the QuickBooks brand, and the fact that the two tiers of Intuit QuickBooks Payroll let customers choose either a basic, stripped down (but relatively manual) version or an elevated version with enhanced functionality and much more automation.

Both versions can also be integrated with many other products from the QuickBook range. The entry-level pricing will be attractive, though there are some add-on costs for certain services. The app is straightforward and customers will appreciate the fact that the application and monthly subscription supports unlimited payroll runs, a feature that not all Intuit QuickBooks Payroll’s competitors do.

The cloud-based deployment for Intuit QuickBooks Payroll doesn’t come as any great surprise as almost all solutions are now used this way, but the benefits, especially for smaller businesses, are still undeniable – no installation, no maintenance, 24-hour access and from any device with an internet connection. Intuit QuickBooks Payroll does offer a free mobile application to complement the desktop package, but there are some minor gripes with that, more on which later.

Support falls short of the gold standard of 24-hours, seven days a week, though the hours – 6am-6pm Pacific Standard Time – should be workable for most businesses in the United States. There’s extra assistance offered by Intuit QuickBooks Payroll during the all-important set-up process, and the application has very direct prompts put in layman’s terms to keep things simple. For anyone familiar with online payroll solutions, the lack of customization in some fields may be a drawback, and some of the tax functionality has extra charges, but it’s a straightforward application and very easy to use.

- Best Payroll Software

- Best Expense Management Software

- Best Personal Finance Software

- Best Accounting Software

Features

- Two tiers of solution available

- Offers unlimited paychecks and unlimited payroll runs

- Tax information submitted and free W-2’s filed

Payroll processing: The payroll processing is cloud-hosted, and unlimited payroll runs are all processed in real time online

Payroll reports: 16 report templates are available, though they are not particularly customizable apart from date ranges

Payment options: a choice of two ways to pay employees : direct deposits or checks

Payroll tax: all payroll tax necessities can be handled at every level, including completion and filing of essential forms such as W-2 and 1099 (may incur extra charges)

Operating Systems – iOS, Windows and Android

Hardware – not applicable as deployment is through the cloud

Free Trial – Offered to new customers, typically one month

Payment Options – Intuit QuickBooks Payroll Self Service Payroll is $35 per month plus $4 per employee per month. Intuit QuickBooks Payroll Full Service Payroll is $80 per month plus $4 per employee per month

Support – 6am to 6pm Pacific Standard Time, Monday-Friday

Two tiers of solution available to fit small companies with limited needs to larger and growing companies that require more functionality

Offers unlimited paychecks and unlimited payroll runs

Tax information submitted and free W-2’s filed, with a guarantee to pay any fines incurred should they arise (with the Full Service Payroll option)

QuickBooks replaced the previous payroll solution, Enhanced Payroll (still supported but no longer sold), in 2018, and now has two tiers of payroll solution for new customers. Both are deployed in the cloud, and offer QuickBook customers the opportunity to integrate with any QuickBook accounting and financial products that they may already have. Both come with discounts for new customers who want to buy other QuickBook products at the same time that they purchase Intuit QuickBooks Payroll.

The two plans on offer from Intuit QuickBooks Payroll are as follows:

The most basic, stripped-down, entry-level solution is Intuit QuickBooks Payroll Self Service Payroll. The features of this package include such basic payroll functionalities as the calculation of employee pay checks, 24-hour direct deposits, the calculation of year-end tax forms and unlimited payroll runs, which is a definite boon, especially at this level of pricing. It’s important to note, though, that the guarantee to pay any fines that arise from errors in tax return information is not a feature of this product.

Intuit QuickBooks Payroll Self Service Payroll also comes without any extra on-boarding help, the luxury of automated payroll tax payments, and same-day direct deposit. The standard price for this (though special offers are to be found regularly on the company’s website) is $35 per month plus $4 per employee per month. This is one of the better value prices in the market and will suit small businesses who just have basic payroll requirements.

The elevated package is Intuit QuickBooks Payroll Full Service Payroll. The application comes with all the features of Intuit QuickBooks Payroll Self Service Payroll but with a host of additions for larger companies. Payroll tax obligations are automatically taken care of (and come with the aforementioned guarantee of paying fines for any errors that arise), W-2 forms are filed and sent, same day direct deposits and an enhanced level of remote payroll assistance. The regular price for this package is $80 per month, plus $4 per employee per month. Again, this represents relatively good value.

The packages are not customizable in terms of features, but they can be linked up with various combinations of the QuickBook product suite to create an integrated system to suit the needs of the customer.

Design and usability

- Cloud-hosted deployment brings all the benefits of accessibility

- Modular, colorfully-designed dashboard

- Good use of prompts for ease of use for all

The initial user interface for Intuit QuickBooks Payroll is aesthetically pleasing, and edges towards a more design-conscious overall look than just being completely utilitarian. The dashboard incorporates colors nicely without it being overwhelming, and important financial information is presented in easy-to-read graphs and pie charts. Business, past payroll and company banking information is easy to add.

The employee record is split into three sections: the most important being Pay, and with a couple of clicks you can add salaries, rates, etc. Intuit QuickBooks Payroll uses very simple language for its prompts, and will ask questions like, “How much do you pay Employee X?”. The other tabs, Profile and Employment, provide fields for more HR-related information.

One of the slight issues with Intuit QuickBooks Payroll that’s often mentioned is that this functionality is less robust than it might be, though it’s perfectly fine for running payroll. Adding tax information depends on which plan you have – with Intuit QuickBooks Payroll Payroll Self Service, this is more of a manual process (still straightforward, but more time consuming) whereas Intuit QuickBooks Payroll Full Service is more automated.

Intuit QuickBooks Payroll also provides free mobile applications so that administrators and employees can log on remotely, but the mobile apps have a more limited range of features, and Android and iPhone versions have slightly different functionalities. Nevertheless, both the desktop and mobile application versions are well-designed, easy to navigate and even beginners won’t find too many challenges to setting up and running their first payroll.

Performance

- Unlimited payroll runs and payroll processing takes just minutes

- Fairly limited range of report templates, with just 16 built in

- Excellent options for integration with other QuickBook products

As with all cloud-deployed payroll solutions, running payroll on Intuit QuickBooks Payroll should be a rapid process, dependant of course on how many employees are in the organization and how regular or otherwise their salaries and paid hours are. You can run payroll by clicking on Run Payroll, which is found on either the dashboard (Overview) screen or the Employees screen.

You then to make sure there’s a check mark next to all the employees that are to be included in the payroll run and enter the hours, etc, in the appropriate boxes. The Gear and Pencil icons on these screens are there if you want to, respectively, see a checklist of the types of earning available and making sure an individual employee’s withholding and garnishment details are correct. The latter will take you to a further screen that gives us a comprehensive analysis of that individual paycheck.

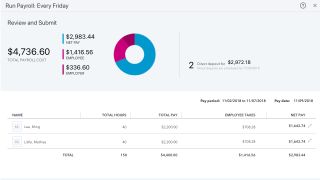

The next stage it to preview the payroll, and it’s possible to save it right there instead of sending it immediately. Either way, the payroll preview will present you with an easy-to-read summary, broken down in pie charts. After submitting payroll, you are taken back to the Overview.

Same-day payroll runs (submitted by 7am Pacific Standard Time) are possible through Intuit QuickBooks Payroll Full Service Payroll. The reports available for the administrator to run are somewhat focused, and all of them have very limited customization options compared to comparable solutions on the market – the parameters are really just confined to date ranges. In terms of tax information, Intuit QuickBooks Payroll Full Service Payroll will prepare and file your W-2 forms. It’s possible to also dispatch 1099 forms, though this incurs extra charges on a sliding scale depending on the number required. Many similar solutions include these features as standard.

Verdict

Intuit QuickBooks Payroll is a relatively new cloud-deployed payroll solution that definitely comes from a trusted name in the accounting and financial services world. The expansion into offering two tiers of service is an improvement, as is the fact that the solutions offered by both tiers can be integrated easily with the QuickBooks family of products.

The lower tier - Self Service - allows smaller companies to pay for a stripped-down, limited but perfectly workable payroll solution that requires a small amount of manual input. Full Service, the higher tier, is fully automated and would suit growing and larger businesses, especially ones that already use other QuickBook products. Design and usability are good, and payroll execution is very simple thanks to the plain language used.

Limitations include a slight lack of depth on the employee information field and a limited set of reports that are also limited in their scope for customization. Some tax procedures are handled automatically on the higher tier, but some functions that are included in most comparable plans do incur further costs with Intuit QuickBooks Payroll. The budgetary advantages are undeniable though, and small companies especially should find the basic package an attractive one.