MyPayrollHR was founded in 2006 and has grown quickly in several regions in the United States. The solution that it provides is essentially a tailored combination of cloud-hosted software applications and customer services. It combines on-demand access to all payroll functions from any web browser as well as HR functions, all working as a single system, while also handling mundane tasks such as making tax deposits as well as filing quarterly or annual reports. The support center offers live assistance to help with payroll or HR queries, and there’s a well-stocked library of common tax and HR forms, as well as templates for common job descriptions and much more. The custom report writer is especially noteworthy for the number of formats available and there’s an easily-navigated employee self-service portal that can save time across multiple departments for just one query.

After inputting all the necessary employee information, payroll is ready to run, and MyPayrollHR allows subscribers to print their own checks with automatic deduction of direct deposit amounts, any relevant tax payments and the subscription fee straight from the company’s bank account. Year-end tax forms such as W-2 and 1099 forms are processed (and included in the price, something which not all their competitors do) and individual employees can register onto the system and (at the company’s discretion) have access to they own pay and time off information. There is no mobile app, but the platform can be reached through any web browser, and the HR additions will be a welcome feature for companies that are stepping up their growth but aren’t yet ready for a full traditional HR department.

- Best Payroll Software

- Best Expense Management Software

- Best Personal Finance Software

- Best Accounting Software

Features

- Full service payroll with employee access plus tax forms submitted

- Supports scalability so excellent for growing businesses

- Excellent HR Resource Center with job descriptions

Payroll processing: payrolls are all processed online, with all information stored in the cloud

Payroll reports: 65 reports available giving a comprehensive report selection

Payment options: a choice of ways to pay employees, from direct deposits to paper checks to prepaid Visa debit cards.

Payroll tax: all payroll tax necessities are handled at every level, including completion and filing of essential forms with a guarantee to pay any fines incurred.

Operating Systems – iOS, Windows and Android

Hardware – not applicable as deployment is through the cloud

Free Trial – Offered to new customers, typically one month

Payment Options – As explained above, plans are constructed to be bespoke for each individual business, but the general entry level is $100 set up, around $100 per month subscription and $11.50 per employee per month

Support – 24/7

Unlike many of its competitors, MyPayrollHR doesn’t have a list of tiered pricing plans. The payroll solution offered to each business is a bespoke product that will differ slightly depending on the size of the business and its immediate payroll needs, though most core features will obviously be included in each package. Most price comparison sites show MyPayrollHR to be below average pricing compared to similar products in the marketplace. Pricing quotes to arrange set up are around the $100 mark (a one-off charge), then around $100 per month for the subscription with additional charges per person per month at around $11.50.

As we’ve noted, the online system is deployed via the cloud, so there’s no onsite software installation and this means the application can be accessed from anywhere via an internet connection and a browser. The payroll service feature is fairly versatile and can be set up to pay hourly and salaried staff as well as independent contractors. Automated timings are at the user’s discretion, with biweekly, weekly, semi-monthly and monthly all available, and of course it’s possible to run any additional payroll processes outside of the scheduled ones.

Limitless employee deductions and contributions are allowed, and employees can be paid via check, direct debit or onto a prepaid Visa debit card. All payroll taxes are foiled to the appropriate local, state and federal agencies and MyPayrollHR guarantees that they will paid correctly and on time, with a promise to pay any resulting fines if this is not the case.

One of the best features of MyPayrollHR is the number of payroll reports that are available – some 65, which is much more than some of its peers: as well as the aforementioned employee contributions and deductions, reports can include batch cash requirements and payroll allocations. The employee access is customizable, and saves the user time and money given that individuals can just look up their pay stubs, year-to-date pay and time off allocations under their own steam instead of sending queries to another department.

Design and usability

- Cloud hosted so there’s easy access to information from any web browser

- HR dashboard with customizable set up

- Clear links to employee master records

The initial interface of MyPayrollHR comes across as utilitarian rather than flashy – function over form perhaps but that’s not necessarily a disadvantage. As with most applications of this kind, the most important step is probably the initial set up of employee records. Thankfully, the set up process will have been customized and after basic employee date has been entered, even non-payroll professionals will find it fairly simple to enter payment, deduction and contribution types as well as all the organizational data, rate tables and pay schedules. Time sheet entry is a one-click process and an unlimited amount of pay lines can be entered for each individual employee. One helpful feature is that navigation can be completely keyboard controlled, and no mouse or trackpad is required.

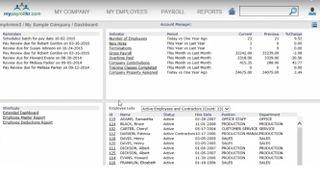

The dashboard looks fairly stark, but it gives immediate access to the most frequently-used components of the MyPayrollHR system. It is divided into four sections. The first is Reminders, which will alert upcoming events such as payrolls that are in the immediate horizon or employee reviews that may be due. The second section is titled Indicators, which is a snapshot of key HR stats such as number of employees, new hires or overtime paid. The third section is the Shortcuts section, which is open for you to add your most regularly-referred-to reports so that they can sit right there on the dashboard and give simple, one-click access.

The final section is the Employee section, where it’s easy to browse a list of employees that can be sorted in a variety of ways, from a simple alphabetical list to hire date or department. This is also a one-click process through to any employee’s file, which in the case of MyPayrollHR has the ability to contain much more HR information than many other comparable systems, though the only mandatory fields are those which house the details necessary to process payroll.

One particularly helpful field is the zip code field, because that triggers an automatic connection to the tax geo-code associated with that location, meaning that local and state taxes are automatically calculated. These employee profiles also list the individual employee’s tax information and let you set up the method of payment. On each employee page, there’s also a drop-down menu where you can select, for instance, Year to Date register, which will take you straight to a summary of that employee’s payroll history for whichever calendar year you need. It’s from this drop down menu that we can also enter employee deductions, contributions and garnishments.

Performance

- Payroll processing is intuitive and can be completed in minutes

- Seamless integration to accounting software such as QuickBooks

- Fully customizable reports or a choice from a wide range of templates

The payroll process is similarly intuitive and payroll can be run in minutes once the initial set up of data entry has been completed. The upcoming payroll batch will sit in the Reminder section of the dashboard screen. One click takes you through to the payroll screen, where time clock files can be uploaded or entered manually. Regular payroll runs will probably include all employees, though you can also choose payroll processing by department or work site.

MyPayrollHR will ask you to check that all time sheets have been entered for the batch before proceeding to the next stage. A batch processing prompt will show the various calculations done by the MyPayrollHR system. Looking or changing any individual employees’ check is as simple as clicking on their voucher number, which takes you into a detailed breakdown of thee check. It’s at this point that the various reports are also available for preview, more on that later.

There’s a handy preview mode that can be analyzed closely before any payroll process is approved, and of course the payroll can be edited and recalculated before the all-important approval is given. The Batch Posting is the final link that you’ll click, taking you into one final prompt screen that asks if the batch is finalized. Clicking ‘yes’ means that no further changes can be made and the payroll runs.

Multiple pay periods can be processed in a single batch, and employee pay can be spread across a theoretically unlimited number of bank accounts. There’s a useful general ledger tracking feature and ledgers can be allocated by department, work site, specific project, and so on. Added to this is MyPayrollHR’s comprehensive human resources functionality with Employee Masterfiles including information on employee history, employee review, employee events and employee paid time off.

Where MyPayrollHR shines is at the report stage. The application has several dozen templates available for ease of use – especially helpful to small business owners who may not necessarily be familiar with payroll software. MyPayrollHR also lets users create their own reports, and again, this is a fairly simple procedure and produces the same colorful charts and graphs. In short, while the interface is perhaps more stark than some of its competitors, the usability for new users is good, and the functionality is in place to suit any growing business.

Verdict

MyPayrollHR prides itself on supporting scalability, and the features and especially the HR support included in the application will suit that growing business that’s ready to step up but doesn’t quite have the resources yet to create an actual HR department. In terms of payroll, all the essential features are there, and navigation and data entry shouldn’t present any problems. The cloud-hosted delivery means access is convenient and the employee access is a time-saver. The feather in MyPayrollHR’s cap is really its range of report options, and the pricing is seemingly competitive when compared to its main rivals.