OnPay started out as a small but growing concern in Atlanta in the early 2010s, but it grew quickly and with forward-thinking and sensible revamps of its product, it started to gain a better and better reputation and now it is an undeniable presence in a crowded payroll solutions market. OnPay has very recently upgraded its one-size-fits all plan, while still maintaining the same price point, which is a great development for payroll administrators, especially those of small and medium-sized businesses, but now even bigger companies with more sophisticated needs would be wise to take a look. The new OnPay payroll solution has more extensive employee records, a new set of dashboards for ongoing intra-company conversations about issues such as paid time off, a vault for important documents and an enhanced employee experience with on-boarding improvements.

There aren’t really any major payroll solutions on the market these days that aren’t cloud-deployed, and OnPay is certainly no exception, which means the usual attendant benefits of the application being open to being accessed from any device with a web browser. OnPay does not, in a slight difference to some of its main competitors, come with a dedicated mobile application, though, and so some of the advantages of being able to work remotely are a little reined in for any employee or any administrator that wants to work remotely from their cell phone. However, this may not be a huge concern for businesses and the newly-expanded employee records section and the ability run unlimited payrolls will surely appeal to any payroll solution administrator looking to tick those boxes. The application also now comes with an improved range of customizable reports templates and an in-built document vault is also a nice touch. The customer support is only available during office hours, but that again seems like an easy work-around.

- Best Payroll Software

- Best Expense Management Software

- Best Personal Finance Software

- Best Accounting Software

Features

- A one-size fits all solution, deployed via the cloud

- Offers unlimited payroll runs

- All city, state and federal tax filing is taken care of

Payroll processing: The payroll processing is cloud-hosted, and unlimited payroll runs are available, with a two-day turnaround

Payroll reports: 40 report templates are available, and can be filtered by employee type, location or department

Payment options: a choice of three ways to pay employees: direct deposits, checks, or onto a prepaid debit card

Payroll tax: Payroll tax obligations can be handled at every level, including completion and filing of essential forms such as W-2 and 1099

Operating Systems – iOS, Windows and Android

Hardware – not applicable as deployment is through the cloud

Free Trial – Offered to new customers, typically one month

Payment Options – The OnPay payroll solution comes at a flat fee of $36 per month, plus $4 per employee per month and no hidden extras

Support – 9am to 8pm Pacific Standard Time, Monday-Friday

OnPay has made impressive strides in the payroll solutions world since launching, and has adapted to customer requirements perhaps faster than many of its competitors. It now offers a single, one-size-fits-all product and while that may raise suspicions that it is less flexible than the companies that offer multi-tired payroll solutions, its versatility is actually very good, and small, medium and even bigger businesses will find much to like in this one package.

The price point is attractive, too – OnPay has a flat fee of $36 per month, plus $4 per employee per month, and unlike some competitors that have additional charges for some basic services, OnPay includes almost everything in that fee (there are a couple of exceptions, namely: users can self-print and distribute W-2 and 1099 forms for free, but they charge a small fee to print and mail them for the user, and the user pays for any health, retirement, or workers’ comp policies they choose to add on).

The plan, then, includes a good-looking set of features. Users can run payroll as often as they like, or even choose multiple payroll schedules for different individual or sets of employees. OnPay holds all city, state and federal taxes and makes all the end of year tax payments. The application can handle both regular W-2 employees and 1099 contractors for the same price, and those employees can be paid by check, direct deposit or onto a prepaid debit card (payroll is usually subject to a two-day turnaround). Garnishments are taken care of with just a couple of clicks and there are 40 report templates that can be filtered by employee type, location or department, and exported in a number of file formats.

The application can be integrated with a long list of established accounting and other financial software packages including QuickBooks and Xero and there are no extra integration fees. Although the solution does not come with a dedicated mobile application, the desktop version is also optimized for mobile, so it’s still fairly simple to run payroll from anywhere. The employee self-service portal is as good as any other solution on the market and the self-on-boarding feature really saves a lot of time for payroll administrators. Employees can be granted lifetime accounts, and so even when they have moved on, they can recover their own financial information without having to contact anyone. The phone support from OnPay is good, but is only available from 9am-8pm Pacific Standard Time, something to be aware of at least.

Design and usability

- Cloud-hosted deployment means accessibility any time, anywhere

- Clean and thoughtfully-designed dashboard

- An intuitive and easy to use feel

Nobody could fairly accuse OnPay of not looking again and again at the payroll solution application, examining its weaknesses and responding to changing consumer needs. Since launching, there have been constant improvements and revamped areas of the application. The result is a very balanced, flexible package and that isn’t a compliment that can be leveled at every one-size-fits-all payroll solution.

The overall user experience with OnPay’s interface is a very positive one, having undergone some substantial improvements over the last couple of years. It is efficient, and designed in a way that comprises all of the features that you might need even going up to medium and larger businesses while retaining an organized, fluid feel. Some lists and sections can feel that they rely on scrolling a little too heavily, but it’s a minor complaint.

The dashboard is modular, and presents the administrator with all the essential statistics up front. The boxes include Recent Pay Runs, Upcoming Pay Runs, Important Dates, Payroll Amounts and Quick Links to the most useful sections.

The graphic design is subtle with color used sparingly but effectively and the aesthetic really works. Navigation is icon-driven, with quick links to employee details, year-end adjustments, new hires and timesheets.

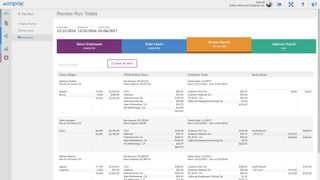

A new feature is a separate screen for contractors, so that they can be dealt with in their own space. The payroll run itself is subject to four discrete stages, and the user is guided through them with colored tabs for reference. Three of them apply to the payroll process and the fourth one is concerned with the array of report templates that are included. The final tab is where the HR tools reside, including any essential documents (which can be stored within the application for easy retrieval). This section also now includes the ability to open a conversation window between the administrator and individual employees where any discussions or updates about paid time off can take place and be referred back to.

An easy-to-follow, four-step wizard takes the user through the payroll process itself, with the usual prompts and reminders that come as reassurance when such an essential function is being used. The desktop version, as noted, is optimized for mobile use, so remote users can log in and work away from the office. This works perfectly well for some sections of the application, though the amount of reports is limited and on pages with a lot of data, records can be hard to read without enlarging. Enhanced security is a much-welcome addition to the application, and OnPay now offers administrators the opportunity to set six levels of access, so that everyone in the company can see what is relevant to them, and only that information.

Performance

- Unlimited payroll runs and payroll processing takes just minutes

- 40 inbuilt report templates

- Excellent options for integration with most major brands

The next stage – after an impressively quick analysis and calculation by OnPay’s software – is to review the payroll. City, state and federal taxes are all taken care of by OnPay and it also files 941 and 940 forms at the end of the year. It’s very clear on the final stage just how much money will be taken out of the company bank account, and from there it’s a simple click on Approve Payroll. As noted, the range of reports – numbering around 40 – means that most payroll administrators will have plenty of options.

The four-stage wizard system employed by OnPay is as fast and efficient as any on the market. Sadly, same-day payroll processing is not an option as there’s a two-day turnaround, but that can easily be worked into any schedule. As with all online payroll solutions, it’s the set-up process that takes up the most amount of time, but OnPay actually offers a free service where one of the payroll specialists will take on the data entry for free. Administrators can also get individual employees to on-board themselves through the employee portal. If the user chooses to do this themselves, a new five-step set up wizard is there to assist, also a new feature.

All the employee and HR-related information can be entered by clicking on well-organized tabs. When you run payroll, the first step will be to choose the employees being paid in the first step produced by the wizard. After this, the number of hours can be entered, including paid time off, and it’s also possible – in a feature that many comparable payroll solutions don’t offer – to customize the pay types.

Verdict

For a one-size-fits-all payroll solution, OnPay is surprisingly versatile and has a depth of functionality that many sizes of business will like. OnPay has balanced this with an appeal to small businesses, who won’t feel that they’re paying for a lot of unnecessary features. OnPay has come a long way in a short time, and it’s by repeatedly looking at its own product and making improvements where necessary. What OnPay offer now in terms of payroll solutions is a robust, likeable product that has a surprising amount of features but has maintained an attractive price point.