Buxfer stands out among the best personal finance software for the ease with which you can upload your bank accounts, set up a budget, and track your income and expenses. Providing all of the connectivity options expected of home finance software, Buxfer allows you to sync directly to your financial institutions, including credit card, checking, savings, cash, loan and investment accounts. You can also link to your PayPal account. When you sync your accounts, all of your balances and transactions update in the system and are automatically categorized. You can also edit any information uploaded by changing the item name, tag name, category and keywords it should attach to.

Buxfer review: Accessibility

Buxfer's personal accounting software offers mobile apps for both Apple and Android products, while you can also access the website from your mobile browser. With the good-looking and easy to use apps, you can manage and adjust your budget, and monitor, add, and edit transactions.

While some similar services require you to have a cloud storage service, such as Dropbox, Buxfer allows you to sync information between your devices without the need for any additional software or applications. If you do happen to use Dropbox, however, it is possible to have your daily automatic backups saved there.

Buxfer review: Budgeting

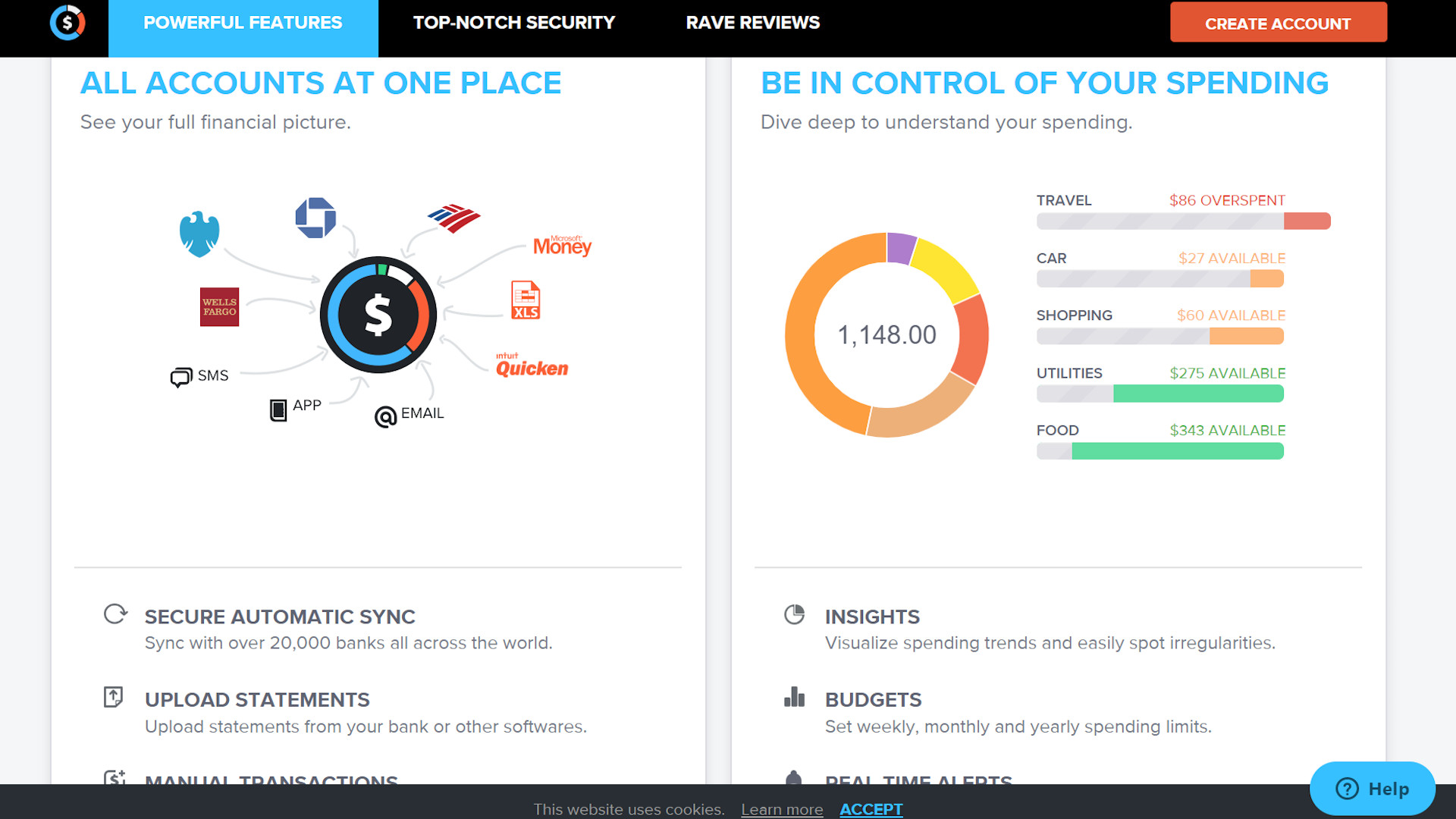

Budgeting is simple with the Buxfer software, which allows you to set an overall spending limit per week, month or year, and adjust the budget for each individual tag. Simply type the tag, the amount and time period, and you can choose to have the budget roll over to the next month or period.

The budget screen provides an overview of your balance and limits, as well as the total and average dollar amount of your outgoings. Each individual budget is displayed and color-coded with the amount spent and the amount left over - when you're well below budget, it appears green, before turning to orange as you approach your limit. If you exceed your budget, the red will let you know you've gone over.

Another helpful feature of note is shared expense tracking. This allows you to send money to family and friends to settle informal bills, and can prove useful if you share expenses, such as rent or utilities, with others.

Buxfer review: Reporting

Buxfer may have fewer reporting options than many other personal software packages on offer, but its reports are easy to generate and read nonetheless. The expense and income reports are simple pie charts with a color-coded key that explains the total and the percent of the total expenses for each tag, while there is the option to view a line chart showing income versus expenses as well. A net worth report is available, providing a forecast of your expenses, but could perhaps be improved with the addition of goal-setting and tracking tools.

The option to export the reports is also lacking. However, you can still save a backup of your transactions, choosing the account, tags and date range, and then save into either a PDF, CSV, HTML, OFX, or QIF format. And as mentioned already, there is the option to sync to your Dropbox account, where the reports can be automatically saved as backups each day.

Buxfer review: Investments

The Buxfer software provides for the addition and tracking of investment accounts, but doesn't offer many advanced investment tools. What can be seen is a portfolio overview, which displays your balance, income, expenses and transfers, while you can upload transactions or sync to certain institutions. It is also possible to manually add trades to keep your portfolio up to date as well.

However, disappointingly, the investment options don't link directly to the market, meaning you cannot compare your portfolio to the market or research stocks and other investments. If this is a feature that you need, Quicken or Banktree might be better options.

Should you use Buxfer personal finance software?

Buxfer's online platform is extremely easy to use, and the intuitive layout allows you to quickly set up your account, create a budget and begin managing your finances. While its reports and investment options might be lacking compared to other similar services, its budgeting and management features are impressive enough to make it one of the best personal finance software options available.