Square has made a name for itself globally, being the go-to brand for payment processing, The move into payroll solutions was, then, a logical progression for the company and it launched its first payroll processing application in 2015, making it a relative newcomer in the payroll solutions market.

Square Payroll has made some upgrades to the initial version of the application that came out then, though it still remains a relatively pared-down product, especially when compared to full service payroll solutions such as MyPayrollHR. Essentially it offers all the requisite elements to run a simple payroll, which will be perfectly sufficient for all manner of small businesses. However, growing and larger businesses with more sophisticated HR and integration needs will find that some of its limitations make it an unwise choice. Weighing up the budgetary advantages of Square Payroll against this lack of advanced functionality will be the main choice facing any potential customer. One further advantage in the favor of Square Payroll is that it at least integrates easily with the range of other products offered by Square.

Square Payroll conforms to the industry standard of being a cloud-deployed application, bringing with it all of the usual attendant advantages – the ease of access from any device with a web browser at any time and the nifty sidestepping of any costly and inconvenient installation processes. Square Payroll also comes with a free mobile application for use on smartphones (both Android and iPhone), and while it is as well designed as its Square payment processing counterparts, it does lack a few of the features of the desktop version (more on that later).

Square Payroll does have the further advantage of offering two discrete payroll solutions. The first and most basic of all is a Contractors Only payroll solution that is a real rarity in the payroll solutions market. Although this plan has a slightly limited functionality, it does include unlimited payroll runs. The Employees and Contractors plan comes with a host of extra features that will suit smaller businesses down to the ground, and both of the plans come with US-based phone support.

- Best Payroll Software

- Best Expense Management Software

- Best Personal Finance Software

- Best Accounting Software

Features

- Two tiers of solution available

- Offers unlimited payroll runs even on the most basic plan

- With the Employee and Contractors solution, tax filing is taken care of

Payroll processing: The payroll processing is cloud-hosted, and unlimited payroll runs are all processed in real time online

Payroll reports: Only custom reports are available, and the options only include Paycheck Details, Employee Totals, Paystubs, or Company Totals in CSV format

Payment options: a choice of two ways to pay employees : direct deposits or checks

Payroll tax: With the Employees and Contractors package, payroll tax necessities can be handled at every level, including completion and filing of essential forms such as W-2 and 1099 (only 1099 forms are included in the Contractors Only package)

Operating Systems – iOS, Windows and Android

Hardware – not applicable as deployment is through the cloud

Free Trial – Offered to new customers, typically one month

Payment Options – Square Payroll Contractors Only is $5 per contractor per month. Square Payroll Employees and Contractors is $29 per month plus $5 per person per paid month

Support – 6am to 6pm Pacific Standard Time, Monday-Friday

Square Payroll has made strides with the features added to its payroll solutions packages since it launched this in 2015. Square Payroll has two versions of its payroll solutions available. Both are deployed via the cloud and offer existing Square customers (those who use their payment processing, point-of-sale applications) the chance to integrate payroll runs and data with these services. Both Square Payroll solutions sit at the affordable end of the market.

The two plans on offer from Square Payroll are as follows:

Square Payroll Contractors Only is an entry-level payroll solution that stands out in the market both for its undeniable affordability and its rare nature, there being very few products of its kind available. This plan starts at just $5 per contractor per month, which is a very attractive proposition for small businesses that don’t need anything more. This subscription fee includes unlimited payroll runs, automatic payment of 1099 contractors including year-end 1099 forms, direct deposit and pay check payment options and US-based phone support, as well as integration with the Square range of products. It also integrates seamlessly with QuickBooks for online accounting and AP Intego for worker’s compensation. There’s an (albeit limited) amount of custom reporting available, and the option to create online accounts for individual employees, which can save valuable company time when it comes to specific payroll queries.

Square Payroll Employees and Contractors would still be considered an entry-level payroll package, even though it is the more sophisticated and expanded product offered by Square Payroll. As well as all the features included in the Square Payroll Contractors Only package, it comes with a host of extras that make up the essential elements that a business needs to run a full payroll. The ability to process W-2 tax forms is there, including submission at the end of the tax year, and this function stretches to include the submission of all city, state and federal taxes. New hire and salary garnishments are possible, including reimbursements, paid time off and benefit deductions. The phone support and integration with Square, QuickBooks and AP Intego is also obviously included. This plan costs $29 per month plus $5 per person per paid month

There isn’t quite as much depth to the features as you might find with a more expensive payroll solution, but for some small businesses, those features are not necessary and are just money wasted, and so Square will be a good fit in such instances.

Design and usability

- Cloud-hosted deployment for accessibility any time, anywhere

- Bright, colorfully-designed dashboard

- Very intuitive and easy to use for non-payroll professionals

Being a relatively new payroll solution and a fairly new company, especially compared to old, established names such as QuickBooks or ADP, Square Payroll can bring modern aesthetics to the product. The interface is colorful and simplistic, using bright primary colors in the dashboard modules. The dashboard itself presents general company information (Deposits, Gross Sales, Invoices, etc) instead of payroll-focused analyses.

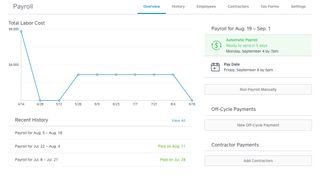

The modules incorporate other Square products, and users must click on the Payroll link on the left had toolbar, a minor inconvenience. This link takes you through to a more sparsely-designed Payroll page, which displays a graph showing recent payroll activity, some alerts and upcoming deadlines and buttons to run payroll, start off-cycle payments or add contractors.

Not much navigation is necessary, and it is way less involved than its more sophisticated competitors. At the top, there are tabs for payroll history, employee information, contractor information, tax forms and settings.

There’s a refreshing simplicity to the site, which does hint at the lack of depth, perhaps, but again, first time payroll users and small business owners who don’t need extensive functionality will be reassured by this. There are some prompts that pop up, mostly a continue button that checks on your intentions during the payroll run, and some basic work screens that are easily closed as normal windows are and we’re promptly returned to the dashboard or payroll home screen. There’s not any real danger of getting lost in the system and overall it feels less daunting than some of the more utilitarian payroll solution options on the market.

Performance

- Unlimited payroll runs and payroll processing takes just minutes

- Reports are all custom-built

- Excellent options for integration with other Square products

The payroll process itself on Square Payroll is as fast as any other similar product. As with all of these competitors, the real work is entering all the individual employee information that allows you to run payroll. Square allows the payroll administrator to save a lot of time by allowing employee accounts so that they can enter their own information. The administrator can then enter pay rates, whether the employee is hourly or salaried, etc.

If your company is offering benefits, Square payroll has partnerships with third party businesses for health insurance and retirement plans, and these again are easily integrated. One sticking point is that for paid time off, Square only allows this or sick leave – the administrator cannot choose both for one employee on an individual payroll run. Square does support wage garnishments and other deductions, etc, that are outside of tax.

On the issue of tax, there’s a manual step that some packages do automatically, and that is that we must enter the tax information for our state, although Square does provide up to date reference charts. Another slight hold up is that when we link Square to our company bank account, the process can take a couple of days as Square must verify the account. Once this is done, though, same-day payroll processing is available, which is a definite advantage. A payroll history may be necessary for companies that have already been paying employees, but Square’s support team are available to help with this.

To run payroll, we click on the Pay My Team button on the payroll tab, and that takes us to three options: run regular payroll, run off-cycle payroll and pay contractors. Choosing one of these takes us to the list of relevant employees and it’s a simple matter of entering any hours that need to be logged and anything ‘additional’, which covers tips, bonuses, etc. We go through time off and tax information screens and then we are asked to confirm the withdrawal, presented at as we are at the same time with totals that we’re about to approve. Once Confirm Withdrawal is clicked, the payroll is run, but there’s also a handy option to cancel as long as this is done before 7pm Pacific Standard time the day before payday.

There are no report templates in Square Payroll, and you can only export CSV formatted reports with paycheck details, employee totals, company totals and pay stubs –a relatively limited choice. Integration is possible with Square products and QuickBooks Online.

Verdict

Square Payroll is an easy-to-use but relatively simple payroll solution. It has many of the advantages of its more sophisticated competitors such as unlimited payrolls and automated tax payments and filings (for the Employees and Contractors version). However, it does lack depth and some of the more advanced functionalities that can be found with other solutions on the market. If a small company only employs contractors, then it’d be difficult to see past the very good value of its Contractor Only plan, and similarly, small businesses that just need the basic elements to run a payroll will be more than satisfied with its Employees and Contractor plan. Larger businesses with more complex HR requirements, however, should probably look elsewhere.