GoDaddy is best known for its domain name service, website building tool, and small business email. From that core of services came the idea of a simple bookkeeping package for the freelancers and contractors who make up the lion’s share of Godaddy’s customer base.

GoDaddy Bookkeeping was originally designed as a tool to help these sole proprietor businesses estimate quarterly tax, and it has been refined and developed over a number of years since then. Today, it is a good solution for freelancers in need of basic bookkeeping, but not sophisticated enough for larger businesses. GoDaddy does what it does well, but doesn’t do anything beyond the basics.

Features

- Solid invoicing and expenses

- A range of payment gateways

- Basic features and little else

Deployment: Cloud

Apps: Android and iOS

Training: Documentation, guided tour

Support: Phone, live chat, FAQs

There is no double-entry and payroll, which means GoDaddy is unsuitable for larger businesses in need of a complete accounting solution.

GoDaddy’s features are simple, straightforward and user-friendly. As such, the package is a decent option for freelancers who want a basic tool for helping them keep their bookkeeping in order. GoDaddy uses simple language and step-by-step processes to put basic financial management within reach of those who would otherwise run in terror from terms like ‘profit and loss’ and ‘accounts receivable’.

GoDaddy is not a comprehensive accounting package and a rather thin feature list reflects that fact. But freelancers and basic business owners would be unlikely to use most advanced features anyway. What they want, and what GoDaddy gives them, is a simple way to invoice clients and track expenses. GoDaddy’s invoice tool in particular is very good, with a selection of clean, modern templates to choose from alongside the ability to set up payment gateways and automatic reminders.

Talking of payments, GoDaddy lets you accept payments via PayPal, Stripe and Dwolla, which is more gateways than some rivals allow.

We liked the ability to track an invoice throughout its life, from creation to payment. This could be useful for a freelancer waiting for a much-needed cash injection. You can be notified automatically when an invoice becomes overdue, when it is viewed by a client and when it is paid online. You can send automatic thank you notes to customers when payment is received.

None of this is unique or groundbreaking, but it is useful, and not all of its rivals offer such a comprehensive invoice service. It’s even possible to schedule recurring invoices, though this is only available at the most expensive of GoDaddy’s three price plans. GoDaddy does a similarly thorough job with estimates. Freelancers will be extremely happy to know when their estimates have been viewed and, more importantly, accepted.

GoDaddy also offers good expense tracking tools. This is by no means a comprehensive accounts payable solution, but it does a good job of helping one-person businesses organise simple expenses. We particularly liked the ability to categorize business and personal expenses, a useful feature for freelancers who use one account for both and individuals who run small ecommerce businesses on the side.

GoDaddy also has a time tracking feature, and though it is not particularly sophisticated some rivals - like Wave Accounting - don’t offer one at all. You can enter billable and non-billable time and easily convert hours worked into an invoice. There is no project management feature, however, and a package like FreshBooks is a better option if you value both these features.

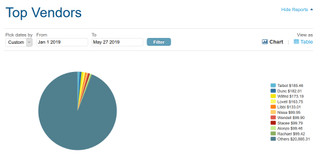

GoDaddy also offers reports, most of which are aimed at freelancers and small ecommerce sellers who want to keep an eye on sales and expenses. A profit and loss report is also included, as are reports on sales by state, income, top customer, top vendor and spending. Unlike many rivals, GoDaddy will also estimate quarterly tax, if you assign income and expense categories to each transaction. GoDaddy supports Schedule Cs and 1040.

Interface and usability

- Very easy to set up and use

- Clear, easy to understand dashboard

Again, the dashboard language gives a clue as to who GoDaddy thinks its customers are. ‘Money I have’ and ‘Money I owe’ are not sentences usually uttered by financial professionals. But they are exactly what cash-strapped freelancers want to know. Talking of which, the ‘new events’ and ‘invoice activity’ links (under the overview tab) give useful up-to-the-minute information.

Compared to some accounting packages GoDaddy is a simple solution that looks to solve simple problems. As such, it is extremely easy to set up, and requires no specialist or technical knowledge. Link a bank account or credit card to the software, and let GoDaddy pull in your recent transactions. Then you can start work, whether that means categorizing expenses or sending an invoice.

You won’t have any trouble doing either. GoDaddy is very easy to use, and its design, layout and language is well pitched for its freelancer and sole proprietor audience. The dashboard gives details on profit and loss, current expenses, your current timesheet and open invoices. It’s immediately obvious if you have tasks to perform, like sending a payment reminder (if this is not automated).

Performance

- A simple bookkeeping solution that performs well

- Good integrations for ecommerce sellers - but little else

GoDaddy has a reputation for decent customer support. You can contact the company 24/7 by phone, and it also offers live chat and a contact form. There is also a help center with a range of how-to articles and answers to frequently asked questions. The GoDaddy blog and social media feeds are not specific to its Bookkeeping software, so there is a lot of information about web building that you might have to wade through to get to what you need. But they are good small business resources generally. Finally, the GoDaddy community forum is a good place to share information with other users.

GoDaddy is a simple bookkeeping tool for freelancers and small time ecommerce businesses and as such it performs well. Tasks can be achieved quickly and outputs are generally clean and professional. The software’s own templates will be perfectly good for most freelancers and contractors.

As with most accounting software, GoDaddy has an associated mobile app, available for Android and iOS. This is good, and in fact is only a slightly scaled down version of the main site. You can view profit and loss, income and expenses charts, and check the status of your invoices (and create new ones if needs be) on the go. You can also access customer records and payment features. Again, these are perfectly good apps if you run a very small business, allowing you to keep on top of basic finances wherever you are.

One excellent performance-enhancing feature is GoDaddy’s seamless connectivity with Amazon, Etsy, PayPal and eBay. This selection gives away who GoDaddy sees as its core customer base. If you do sell through these ecommerce platforms, and use PayPal to process payments, it is an extremely useful feature and unique to GoDaddy. Link your sales from ecommerce marketplaces to GoDaddy and easily stay on top of income, taxes and business performance.

On the flipside, there are hardly any other integrations to speak of. Aside from banks and payment gateways, receipt scanning and tracking app Shoeboxed is the only other integrated app of note.

Verdict

Still, GoDaddy is well priced and understands its audience, so that makes it a good choice for freelancers and small online merchants who need a basic bookkeeping solution.

The fairest thing to say about GoDaddy Bookkeeping is that it knows its audience and serves it well. A series of useful integrations with major online marketplaces nail the software’s colors firmly to the online merchant mast. This is a good, basic solution for eBay sellers, freelancers and other sole proprietors who want to organize their finances more efficiently and, most importantly, get paid on time.

For its limited ambitions, GoDaddy works well. Alongside ecommerce integrations, invoicing is a standout feature, and one of the best in its class. The package also features easy setup, decent design and a nice mobile app.

On the flipside, there is little depth here. Time tracking is present, but limited. Project management is lacking, along with payroll, bill-pay, inventory management and other features larger businesses would quickly miss. To be fair, GoDaddy is not competing against QuickBooks or Xero, but it also feels a little underpowered against more direct competitors like FreshBooks.