Kashoo claims that it is “designed for business owners, not accountants”, which is another way of saying that it is a basic bookkeeping and accounting package for those with little knowledge of bookkeeping and accounting packages. Kashoo offers something of a halfway house between freelancer-focused solutions like Wave and more complete small business accounting packages like Zoho. Its features will cover the needs of many small businesses, and not only single person enterprises or two-person partnerships. At the same time, it is not sophisticated enough for the more demanding requirements of larger SMEs. Still, at $19.95 per month for unlimited users, it is a well-priced option and worth consideration.

Features

Deployment: Cloud

Apps: iOS only

Training: Documentation, webinars

Support: Email, phone, live chat

- Good invoicing and expenses

- Project management is basic but useful

- No estimates

While Kashoo covers most of the basics well, it is lacking in some departments. There is no inventory tracking, no budgeting and no time tracking tool. Nor is there a customer portal and payroll is achieved through paid-for third party integration.

Kashoo has a decent range of features, though you will have to pay more for a couple of them, including payroll (Kashoo partners with SurePayroll for this, and offers a discount). Many small businesses will be happy with the software’s native feature set, however.

Double-entry accounting is supported, and client and supplier records are as detailed as they need to be. A nice touch for businesses with customers or supply chains overseas is the ability to add a currency preference. Once you’ve populated the site with customers, you can start invoicing them. This is straightforward, with the option to add a sales tax to each transaction and make invoices recurring. There are several invoice templates to choose from and some limited customization is possible, though you can’t change colors or fonts or toggle fields on and off.

On the downside, Kashoo lacks an estimates feature or quoting tool. Even ostensibly simpler solutions like GoDaddy Bookkeeping offer an estimates tool, and some small businesses may miss the ability to create and track estimates and easily turn them into invoices.

Kashoo does have a decent project management feature, though. It’s fairly basic, but some small businesses will appreciate being able to create projects, add descriptions and attach them to invoices. You can’t attach expenses, which is a shame, but some of Kashoo’s rivals don’t offer any project management facility at all.

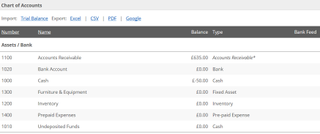

We liked the expenses feature in Kashoo, which lets you capture receipts from the mobile app (more on that later) and import bank statements in a host of formats, or by live bank feed (in fact, importing and exporting with Kashoo is generally excellent, with the software supporting a full range of formats). Adding an expense manually is easy enough. You can of course connect Kashoo to your credit card or bank account, and it simplifies the process of reconciliation by suggesting possible matches.

Kashoo’s reports are fine. There are eight in total, including general ledger, balance sheet, unpaid bills, unpaid invoices and an income statement. This will be enough for many small businesses, but consider that QuickBooks can run up to 80 reports and Kashoo feels a little light in this regard. You can filter reports by date, project and so on.

Performance

- Excellent customer service

- Great iPad app

- No Android support

Finally, Kashoo’s integrations are limited in the extreme. It connects with Stripe, Square, BluePay and FreshBooks Classic, and that’s it. That might be all many businesses need, but clearly the likes of FreshBooks Online don’t think so. FreshBooks boasts enough integrations to put itself at the heart of any small company’s financial ecosystem. Kashoo really doesn’t.

Kashoo’s performance will be more than enough for many very small businesses, who will also be reassured by the company’s excellent reputation for customer service. It offers live chat, phone and email support, and customer reviews often mention how knowledgeable and helpful its agents are. This is no small point, especially if you are a new business or one with very limited bookkeeping and accountancy know-how. Support is a clear mark in Kashoo’s favour.

Another plus point is its dedicated iPad app. Kashoo was the first to develop an app specifically for iPad and it works brilliantly, offering a great mobile bookkeeping experience. Being able to send invoices and track expenses while on a boring train journey is a performance-enhancing feature that Kashoo has clearly put plenty of thought into. The iPad app keeps working even when you lose internet connection, simply storing information locally until it can reconnect to the cloud.

Unfortunately, this mobile excellence is a double-edged sword. There is an app for iPhone too, but no apps for Android - phones or tablets - at all. This is a serious (and rather strange) omission. Android users are well supported by other software packages, so Kashoo is giving potential customers an easy excuse to walk away. A previous Kashoo Android app was deleted after repeated customer criticism, but that’s surely no reason to give up on the platform altogether. We can only hope the situation is temporary.

Verdict

It’s hard to know quite what to make of Kashoo. In its favor, you get the full package, and unlimited users, for a single, affordable pricing plan. If you’re an iOS user, you’ll love its mobility. And its customer support is second to none.

On the downside, there are no estimates and its Android app has vanished.

We understand that Kashoo is not a full-featured accountancy package and that, as its makers say, it is “designed for business owners, not accountants.” But that doesn’t explain the lack of Android support or the absence of one or two useful and not-that-advanced features.

Still, many small business users will be perfectly happy with Kashoo, especially if they’re also Apple fans. The Kashoo iPad experience is particularly well thought out, and makes bookkeeping on the go easy and productive. At the same time, the software deftly handles invoicing and expenses, and also features good reports, bank reconciliation and useful project management.

In summary, Kashoo is most accomplished in areas that make it best suited to smaller SMEs with basic requirements. Companies with more complex needs - perhaps they carry inventory or prepare a lot of pre-invoice documents (like estimates) - might be better off looking elsewhere.