Paychex was founded in 1971 and so has decades of experience to bring to their products. Paychex Flex is presented as a comprehensive, payroll and human resources solution including multi-tiered plans to appeal to all sizes of business – the flex stands for flexibility and the choices on offer certainly back up that part of the name. What Paychex Flex offers is a truly scalable set of solutions that also allow an entry level, payroll-only choice, in contrast with some of the competitors such as MyPayRollHR. The buy-in price may be too high for some – although each plan is created on a bespoke basis and pricing plans are not made public, online reports suggest that even a basic payroll-only plan starts at prices that put it well up the league table of most expensive solutions. It hasn’t put off too many customers, though, and according to the company’s own claim, one in twelve private sector workers are paid by Paychex Flex.

As with almost every plan in the modern payroll solutions field, Paychex Flex is deployed via the cloud, meaning that issues of accessibility are neatly sidestepped and administrators (and employees) can access real-time information whenever they need to from any web browser. The plans also come with a free mobile application, so that employees can access their own information and make updates and changes if necessary. The collateral of there being no onsite software installation or maintenance is also a huge plus for any business.

The 24-hour support, seven days per week is definitely not the industry standard, and Paychex Flex is one of the few companies that offers it. This is especially important during the set-up process, and even outside of the live support, Paychex Flex has a wealth of resources, with demos, tutorials and much more on offer to clients. As with all payroll solutions, the set up stage of the process is the most crucial, and Paychex Flex has an implementation specialist to assist with live support, one of the extra benefits of spending a little more up front.

- Best Payroll Software

- Best Expense Management Software

- Best Personal Finance Software

- Best Accounting Software

Features

- Excellent range of products

- Can help with your W-2 preparation

- More than 160 payroll-related reports are possible

Payroll processing: All payroll processing is cloud-hosted, and payroll runs are all processed in real time online

Payroll reports: 120 report templates are available, much more than many of Paychex Flex’s competitors

Payment options: a choice of ways to pay employees the basic plan offers the options of direct deposits or to prepaid debit cards, the second tier up and the higher tiers offer payment via check

Payroll tax: all payroll tax necessities are handled at every level, including completion and filing of essential forms such as W-2 and 1099

Operating Systems – iOS, Windows and Android

Hardware – not applicable as deployment is through the cloud

Free Trial – Offered to new customers, typically two months

Payment Options – As explained above, plans are constructed to be bespoke for each individual business and pricing information is not made public. Paychex Flex is reported to be among the more expensive options

Support – 24/7

Excellent range of products, from stripped-down payroll plans to full-service, fully-scalable payroll and HR management systems

Can help with your W-2 preparation and ensure your compliance with state and federal tax regulations, offering a guarantee of paying any fines incurred

More than 160 payroll-related reports are possible, many more than most of Paychex Flex’s competitors

In the payroll solutions industry, some companies offer bespoke plans, and some offer tiered pricing, but Paychex Flex, as you might expect, offers both. Despite Paychex Flex not allowing specific price quotes to be made public, the general analysis is that they are on the more expensive side of the industry, but that for many companies they present a worthwhile investment given the decades of experience, robust and scalable product and a 24/7 live support offering.

Paychex Flex offers four tiers of plan (again, customizable within these levels) with different levels of service and features for different sized businesses. All of the tiers offer 24-hour, seven days a week support. They are as follows:

Express Payroll: This is the most stripped-down, entry level payroll solution offered by Paychex Flex. The basic payroll processing and payroll tax features are all present and correct, as well as additional draws such as new-hire reporting, payments via direct deposits and onto prepaid debit cards and access to an employee financial wellness program.

Paychex Flex Select: The company reports that this is the most popular plan for smaller businesses. It offers all the features of Express Payroll, with the additions of a dedicated payroll specialist being on call, labor compliance kits and the option to pay employees via a printed check (that can be customized with the company logo).

Paychex Flex Pro: Designed to appeal to mid-sized businesses, this plan comprises all of the features in the previous two plans, plus onboarding tools so that new hires can complete much of the relevant payroll data entry themselves, freeing up the payroll administrator for other company business. There’s also the inclusion of pre-employment background screening.

Paychex Flex Enterprise: At the top end of the scale is the Paychex Flex option for larger businesses. This plan includes all of the above features, plus it brings to the table a large range of specialist analytical tools as well as a full suite of Human Resource management features.

Once again, pricing is customized, and quotes will take into account how many employees the company has, what the company’s specific payroll schedule is and of course if the company is interested in pairing the plan with any other services offered by Paychex Flex.

Design and usability

- Cloud-hosted deployment brings all the benefits of panoramic accessibility and real-time information

- Comprehensive dashboard with important information

- Dedicated implementation manager to assist with the set-up process

The user interface for payroll solutions should ideally occupy that middle ground between straightforward functionality without being completely devoid of interesting visual quality, but not straying too much into the kind of cute aesthetic associated with social media start-ups and the like. Paychex Flex lands somewhere in the center ground, with probably a slight lean towards the utilitarian side without being lifeless.

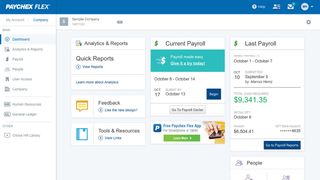

The dashboard has module boxes with information such as the current and last payroll summaries, including total cash outlays. The current payroll box has a countdown line just underneath the title so it’s clear when the next obligation to run payroll actually is. It’s clean, with lots of white space and a toolbar along the left hand side with links to whichever other features the plan comes with.

Like most other payroll solutions, Paychex Flex has a navigation system that relies on a combination of buttons, drop down lists and blank fields to be filled in with the relevant data. One minor issue reported by some users is that many features that run in the background on other applications tend to appear visually in Paychex Flex. That means screens can become fussier than is perhaps strictly necessary, though many would point out that this is just a vigorous attention to detail.

Whatever the plan chosen, the dashboard will also display a link to start the payroll process itself, any check dates on the immediate horizon, the cash total required for the next payroll, and a link to the payroll reports section of the system. As we’ve established, set-up is assisted by an implementation specialist from Paychex Flex, and they will walk the administrator through the necessary steps. Running payroll is a straightforward process assuming all the set-up information is present and correct, and for companies that enjoy a level of stability, payroll can be set to occur automatically as opposed to manually. Individual employee information is easy to access, and on the highest-rate plans, this feature enjoys a full Human Resources service that integrates with the payroll process.

Performance

- Payroll processing can take place in minutes

- Reports can be chosen from a range of 120 templates

- Federal, state, and local payroll taxes will be calculated, paid, and filed automatically

Most cloud-based payroll processes work in a similar way, but Paychex Flex has a couple of extra nuggets that are evidently worth the money to many companies. The dashboard presents the payroll administrator with a reminder that a payroll is due. Using whatever the latest employee information the application has, it presents a list of employees in a grid, with blank fields that can take in information such as hours worked, any additions such as bonuses or overtime, plus deductions such as unpaid leave.

Paychex Flex has the capability of adding unlimited custom fields for this part of the process, which is an edge over some of its main rivals. There’s also some extra flexibility that Paychex Flex has that others do not. It’s possible to enter information well ahead of time, so if an individual employee is awarded a bonus but the payroll run is still a little time in the future, you can enter that information at any time so it’s already on the system and no manual or physical reminders have to be made.

Once the payroll is approved and sent, there’s also a 15-minute hold period where any last minute alterations or accidentally excluded information can be added, again a feature that not many payroll plans offer. In line with other applications, Paychex Flex handles all the necessary tax obligations for each employee automatically, calculating and filing and guaranteeing accuracy.

Not every solution provider backs up their promise of accuracy with a guarantee to pay any incurred fines should they arise, but Paychex Flex is one of them. All the plans also process end-of-year forms such as W-2 and 1099 forms. Employees can use the free mobile app to check on any of their payroll and tax information at any time.

Verdict

Paychex Flex certainly lives up to its name with four versatile plans aimed at businesses of all sizes. The biggest plus points are that small companies can choose a stripped-down payroll solution without paying for unnecessary HR functionality. Growing, medium and larger businesses will look at the opportunities to scale up their operations within the application and the promise of a dedicated payroll specialist on call.

All of the plans enjoy the industry-leading 24-hour, seven days a week customer service. Although pricing is done on a bespoke basis and exact information is not made public, it is certainly one of the pricier solutions on the market. However, most companies will at least be interested in appraising the attractiveness of the scalability and the robust nature of the application, along with its extra performance features that are included even with the lower level plans.