Top Ten Reviews Verdict

Founded in 1916 Michigan, Auto-Owners remains a middle-sized insurer that focuses on customer care. Prices are competitive and the mobile app is excellent but you won't be able to get online quotes.

Pros

- +

Affordable prices

- +

Excellent customer service

- +

Great mobile app

Cons

- -

No online quotes

Why you can trust Top Ten Reviews

Auto-Owners Insurance: What you need to know

As a Forbes 500 company for more than a decade, Auto-Owners Insurance is one of the best auto insurance companies in the US, yet remains a medium-sized company. As a result it offers the care you'd expect from a smaller company but while also managing to offer the financial security and affordable prices of a larger company.

The company, despite its name, also offers other types of insurance beyond auto cover. If you do go for more than one type of cover you can make savings in the benefit bundles.

Auto-Owners is available in 26 US states with a website available to check if you're eligible. That site will also allow you to track a claim's status but it won't let you get a quote as you'll need to speak to a local agent of this as the company wants to offer a personal touch.

Despite not offering an online quote the company is still high-tech as it does offer an app for your mobile which allows you to access you policy anywhere. You can pay bills and more using your iPhone or Android device.

While discounts are available they're pretty standard. It's the customer care which is a stand-out feature. But that's just one of the features worth mentioning, read on to find out everything you need to know about Auto-Owners Insurance.

Policies: How much does Auto-Owners Insurance cost?

- Minimum coverage: $649

- Comprehensive cover: £2112

Gap insurance: Paid difference between actual value and amount left on totalled car

Roadside assistance: This includes towing, battery jumps, locksmith and more with a 24/7 phone line to access it

Modified/classic cover: Coverage specifically for classic cars or modified vehicles

When you get your quote from Auto-Owners it will be tailored to your specifically. That means things like your age, location, car, driver history, credit history and more will be taken into account. As such it's difficult to give an exact price but to give you a rough idea here are some prices uses the national average and compared to the big name insurers.

Auto-Owners offers a minimum cover policy for an average $649 compared to State Farm's $712, Geico's $819 and Allstate's $1,390.

Sign up to receive the latest news, reviews, buying guides and deals direct to your inbox

Go for full comprehensive cover and you'll be looking at an average charge of $2,112 from Auto-Owners compared to $3,545 from Allstate, $1,737 from State Farm and $2,158 from Geico.

Auto-Owners Insurance: Personal Automobile Plus

- Has over 10 perks and coverages

- Includes things like identity theft coverage and cell phone insurance

Auto-Owners has a stand-out feature which is calls the Personal Automobile Plus package. This is all about personalising your insurance package to offer all the best features that you could need or want. This has over 10 perks and coverages.

These include things like identity theft coverage, cell phone insurance, replacing lost or stolen keys and plenty more. It's essentially a one-stop-shop for all the cover you should need when out on the road.

Auto-Owners Insurance: Diminished value

- Innovative diminished value policy

- You get back the difference in cost after the work has been carried out

If you've been in an accident, made a claim and had your car fixed that may be the last you think about it. Most insurers won't think beyond that point either. Auto-Owners makes the good point that after you've had work done your car may diminish in value.

So even though you're back on the road and your car is working fine you may have lost money through the damage taking place. This is what Auto-Owners wants to cover with its diminished value policy. That means you'll get back the difference in cost after the work has been carried out so, theoretically, you shouldn't lose a penny even from the value held in your car.

Auto-Owners Insurance: Gap insurance

- Avoid losing out if you're still paying off the vehicle

- You're not left to pay off a car that is no longer on the roads

For total loss accident damage you could end up losing out if you're still paying off that vehicle on a lease or loan basis.

A gap coverage policy means Auto-Owners will pay back the difference between the actual cash value of your car and the amount that's left to pay on your loan. The result should be you're not left to pay off a car that is no longer on the roads as it's been written off.

Auto-Owners Insurance: Roadside assistance

- Roadside assistance is included in the policy

- Applicable in all 50 states and Canada

Auto-Owners offers a car breakdown coverage system which covers you for lots of incidents when out on the road.

Primarily your coverage for a breakdown with a call-out towing service is included in your policy. But this extends to other situations like needs a battery jump, tire replacement, locksmith assistance if you've locked your keys in the car, oil and fuel delivery and more.

All that can be access 24/7 using a dedicated number (1-888-869-2642) which is available in all 50 states as well as in Canada.

Auto-Owners Insurance: Custom parts

- Customized parts coverage available

- Need to speak with agent to work out what needs cover

Auto-Owners caters for those that like to modify their cars or to anyone who owns a classic car. This specific coverage is aimed at offering cover for classic, exotic, sports and modified vehicles specifically.

Since all these types of vehicle are unique so too is the coverage that goes with them. So you'll need to have a chat with an agent to work out what needs cover so a quote can be given to make sure you're totally cared for.

Auto-Owners Insurance: User Reviews

- 4 star rating overall from J.D. Power

- 2.5 star rating from ConsumerAffairs

Auto-Owners has done very well in customer reviews with a lot of positive feedback online and through third-party analysis.

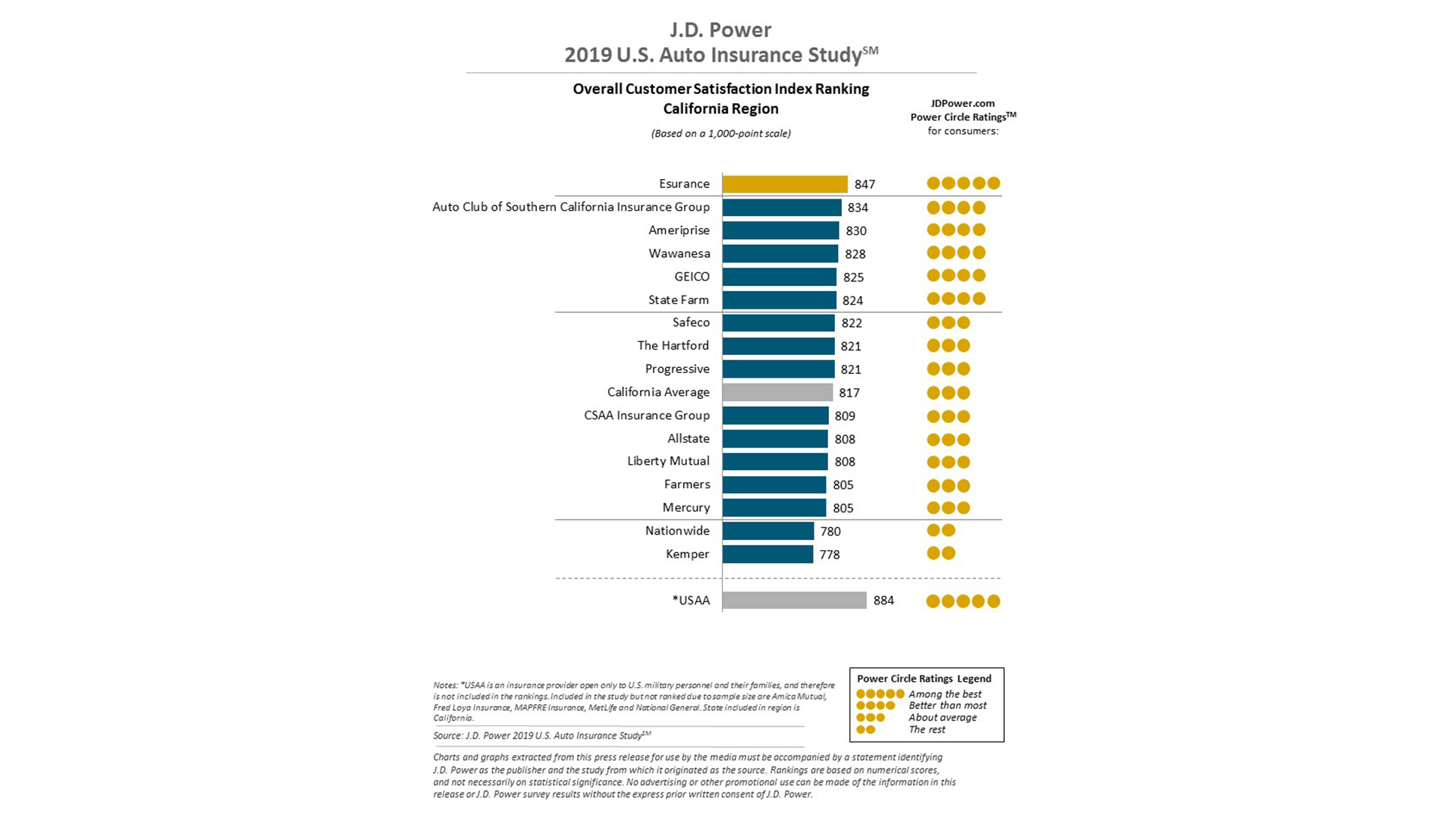

According to the 2018 J.D. Power study, Auto-Owners earned a four star rating for both claims handling and insurance shopping making it one of the best out there.

ConsumerAffairs typically gives lower ratings and Auto-Owners got a two and a half stars but based on just 97 ratings. Positives include being a Forbes 500 company, having local agents, offering different types of insurance and bundle options. Negatives include claims processing times varying and rates not being as competitive as other firms.

Auto-Owners Insurance: Verdict

Auto-Owners Insurance is one of the highest rated insurers based on customer reviews, largely thanks to excellent customer service and decent insurance coverage options.

Pricing is affordable and very competitive and the company's financial strength of great enough to offer security to customers. The lack of online quotes isn't ideal for everyone but this is balanced out by an excellent agent service which can be well personalized.

Auto-Owners is only available in 26 states but with the great offerings at excellent prices it's something you'll be lucky to have as an option where you are.

Luke is a veteran tech journalist with decades of experience covering everything from TVs, power tools, science and health tech to VPNs, space, gaming and cars. You may recognize him from appearances on plenty of news channels or have read his words which have been published in most tech titles over the years. In his spare time (of which he has little as a father of two) Luke likes yoga, surfing, meditation, DIY and consuming all the books, comics and movies he can find.