Top Ten Reviews Verdict

Progressive is a large-scale insurer that uses its size to offer low prices for its policies. Despite offering some of the lowest prices, there are excellent coverage options with features like roadside assistance, gap insurance, rental reimbursements and plenty more on offer. There are no brick-and-mortar stores, but on the whole Progressive is a very competitive insurer for your vehicle.

Pros

- +

Super affordable

- +

Discount programs

- +

Good for those who have history of accidents

Cons

- -

No brick-and-mortar stores

Why you can trust Top Ten Reviews

Progressive Auto Insurance: What you need to know

Progressive Auto Insurance is one of the most affordable ways to insure your vehicle thanks to its cheap policies and strong financial backing from this huge US insurance firm.

The company is well known for its fast claims process, which is impressive when you look at how widely its policies cover customers. There are a lot of discounts available too, thanks to these many features. For example, rewards for good driving or even for students doing well, are just some of the incentives Progressive offers.

This is a modern system though, so don't expect to find brick-and-mortar stores anywhere. In fact, don't expect to find coverage in all states either, so be sure to look into yours before you go any further.

Progressive uses a direct model in order to keep its rates as low as possible to undercut the competition. But be warned, this does mean a lot of the features we're going to talk about below could be optional add-ons to your policy. As such always be sure to check you're covered for anything specific you require before you sign-up. In the case of Progressive, if you need it, you can likely add that feature onto your policy anyway.

Policy extras like pet cover and car mod payouts are just some of the offerings you can enjoy.

Policies: How much does Progressive Auto Insurance cost?

- Minimum cover: $924

- Comprehensive cover: $2393

Gap insurance: Get up to 25% above the value of your car if it's totaled

Roadside assistance: This pays for help if you run out of gas, get a flat tire, have a breakdown and more

Snapshot: Be tracked to save money for being a safe driver

Pricing will vary based on plenty of factors that include age, driver history, credit rating, location, car type and more. So, these numbers give you an idea of pricing compared to the competition out there. These prices below use the average for all numbers to give you a broad idea.

Progressive offers a minimum cover policy for an average $924 compared to State Farm's $712, Geico's $812 and Allstate's $1390.

Sign up to receive the latest news, reviews, buying guides and deals direct to your inbox

Go for full comprehensive cover and you'll be looking at an average charge of $2393 from Progressive compared to $3545 from Allstate, $1737 from State Farm and $2158 from Geico.

Progressive Auto Insurance: Snapshot

- Offers benefits to those drivers who drive more carefully

- For discounts, requires you to be tracked

Progressive wants to make the roads safer and so it offers benefits to those drivers who drive more carefully. In order to assess if you qualify as a safe driver, and can then get a discount, you need to be tracked. This is done with a free opt-in program which uses a device that plugs into your car. This collects driving data like speed, how much and when you drive and more.

Progressive uses this data to adjust your premium rate down or up next time you renew. Yup, it can go up too, so if you're a heavy footed driver you might want to avoid this. That said, you do get an automatic discount just for signing up.

Benefits also work for a deductible savings bank. If you have comprehensive and collision coverage then you can opt into this program to reduce your deductible every six months you don't make a claim, by $50. This carries on until your deductible reaches zero.

Progressive Auto Insurance: Pet injury protection

- Will cover your pets in the car too

- All vets bills paid for if you pet is in the car at the time of an accident

In a rather unique offering, Progressive will cover your pets in the car too. This is covered if you opt for collision coverage.

That means that if you're in an accident and your pet is in the car at the time and gets hurt, all your vet bills will be paid for. This is a great option for anyone who has animals in the car on a regular basis.

Progressive Auto Insurance: Gap insurance

- Will help you pay back your car loan

- Pays up to 25% above the value

Progressive will help you pay back your car if you still owe on it and end up in an accident that totals the vehicle.

The gap insurance policy will pay up to 25% above the value of your vehicle meaning it should be enough to cover the remainder of your loan or lease. This is a really nice option as paying that off when you can't use the car could be a very painful process.

Progressive Auto Insurance: Roadside assistance

- Will pay for help if you need it when you're stuck out on the roadside

- Covers lots of different situations from a flat tire to a breakdown

Progressive will pay for help if you need it when you're stuck out on the roadside. By paying for this you're able to use a service nearby for the quickest recovery then claim it back later, rather than being locked in.

This will cover lots of different situations from a flat tire or dead battery to a breakdown, running out of gas or if you've locked your keys in your car. You can simply call up, get saved, then worry about the claims later. But don't worry, as Progressive is good at claims payments.

Progressive Auto Insurance: Ridesharing insurance

- Covered by Progressive for 32 states and the District of Colombia

- Gives you full cover all the time

Ridesharing insurance is covered by Progressive for 32 states and the District of Colombia. This applies to taxi drivers who work using app-based services like Uber and Lyft. While these companies offer cover when on a job, that doesn't cover in between jobs.

Progressive ridesharing insurance gives you full cover all the time so even when you're going to a job or coming home, you're still protected on the roads.

Progressive Auto Insurance: Custom parts

- Offers cover for those who like to add extras to their vehicles

- Any custom parts added will also be covered

Progressive offers cover for those who like to add extras to their vehicles. That means any custom parts of equipment that's been added to your car, inside or out, will also be covered on top of the value of the vehicle.

This part of the policy will mean you can claim a pay out to fix a specific part of the car after it has been damaged.

Progressive Auto Insurance: User Reviews

- 3 star rating overall from J.D. Power

- 4 star rating from ConsumerAffairs

Progressive is a huge insurer so has lots of feedback which generally is good but the issues are clear from the general consensus.

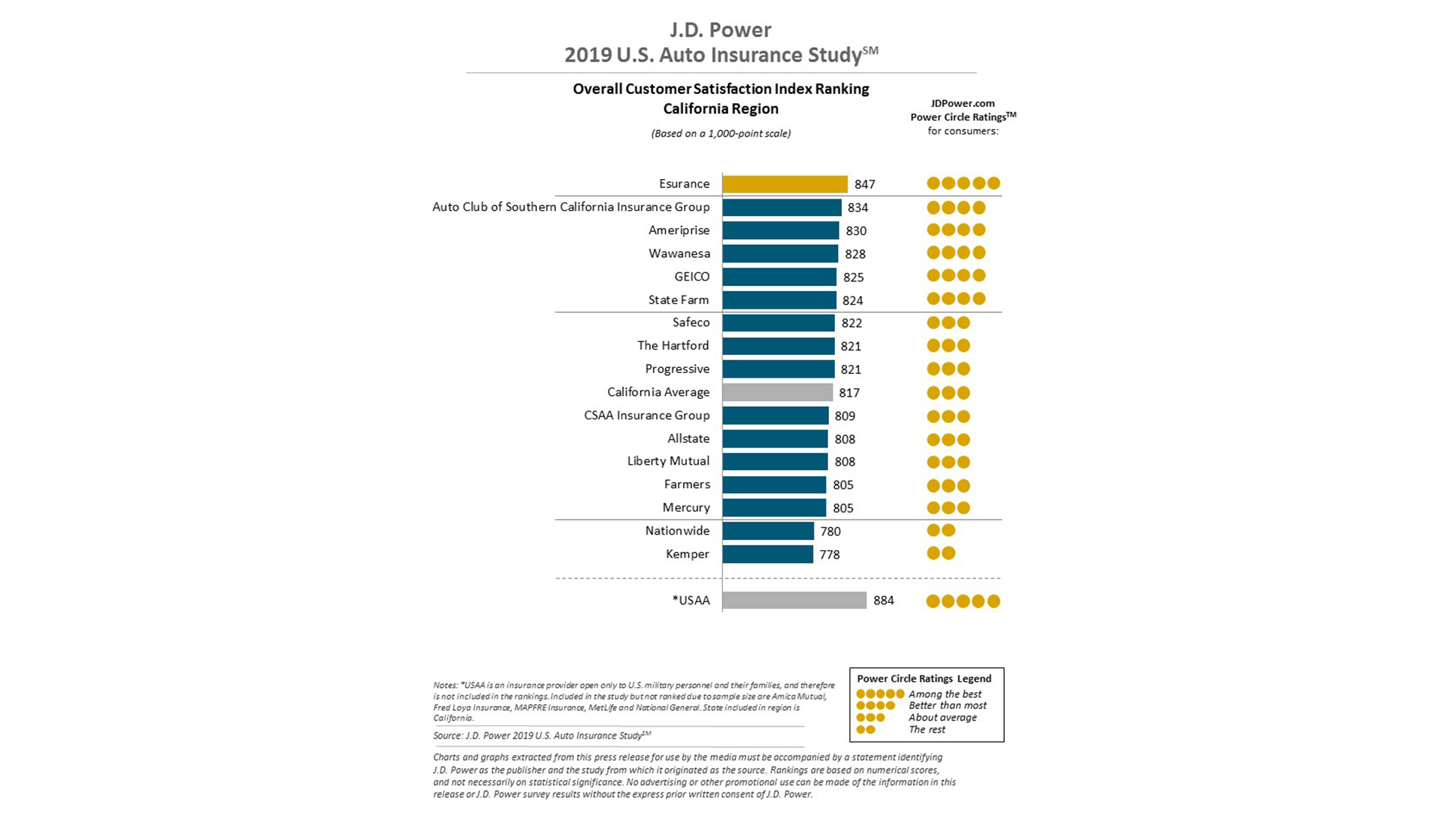

According to the 2018 J.D. Power study, Progressive earned a three-star rating for claims handling and shopping. It also got a three star rating for rental experience and repair process making it decidedly average according to these studies.

ConsumerAffairs typically gives lower ratings so it's impressive that Progressive has scored nearly four stars from 2,721 reviews. Positives include good discounts, fast claims and exceptional customer service while negatives were lack of discounts in all states and no brick-and-mortar stores.

Progressive Auto Insurance: Verdict

Progressive is one of the largest insurance firms out there, meaning you can get a huge selection of features for your policy at competitively low rates. It also means you can expect great customer service and a quick claims process.

While not every state is covered and there is a lack of brick-and-mortar shops, you can rely on a strong financial position that results in reliable cover. For those with pets in vehicles, those with car modifications or those who have claimed previously, Progressive is a great option as an affordable auto insurer.

Luke is a veteran tech journalist with decades of experience covering everything from TVs, power tools, science and health tech to VPNs, space, gaming and cars. You may recognize him from appearances on plenty of news channels or have read his words which have been published in most tech titles over the years. In his spare time (of which he has little as a father of two) Luke likes yoga, surfing, meditation, DIY and consuming all the books, comics and movies he can find.