Top Ten Reviews Verdict

FAFSA is the number one choice for students looking to apply for a loan to help pay for school.

Pros

- +

Loan forgiveness program

- +

No need for a credit check or a cosigner

- +

Interest rate usually fixed and lower than most private lenders'

- +

Income-based repayment plan

- +

Payments don't start until after graduation.

Cons

- -

Loan cap at $12,500 per year for undergraduate students; $20,500 for graduate students

- -

Loan programs are subject to change with the law

- -

Application not quick or easy

Why you can trust Top Ten Reviews

Federal Student Loans: What you need to know

Students looking to borrow money have many options in terms of lenders, but one of the most popular lenders happens to be the federal government. The government issues about $120 billion in loans to millions of students all over the country, regardless of the level of education they're working toward.

Federal Student Loans: Common questions

Loan type: Direct subsidized loans, Direct unsubsidized loans, Direct PLUS loans, Direct Consolidation loans

Rate type: Fixed

Loan term: 10 - 30 years, depending on the loan type

Loan amount: $5,500 to $12,500 per year for undergrads, up to $20,500 each year for graduate and professional students

Application and origination fees: Origination fee

Discounts: 0.25% interest rate reduction for auto-payments,

Repayment options: Standard Repayment Plan, Graduated Repayment Plan, Extended Repayment Plan, REPAYE, PAYE, IBR, ICR, Income-Sensitive Repayment Plan

Deferment or forbearance hardship options: Yes

Co-signer release: Parents cannot co-sign student federal loans and are not obligated to pay the borrower's loans

Grace period: Direct Subsidized Loans, Direct Unsubsidized Loans, Subsidized Federal Stafford Loans, and Unsubsidized Federal Stafford Loans have a 6 month grace period; PLUS loans have no grace period; schools determine the grace period for the Federal Perkins Loan; all grace periods are subject to change depending on student's circumstances (ie. active military duty, returning to school, loan consolidation)

Perks: None

What is FAFSA?

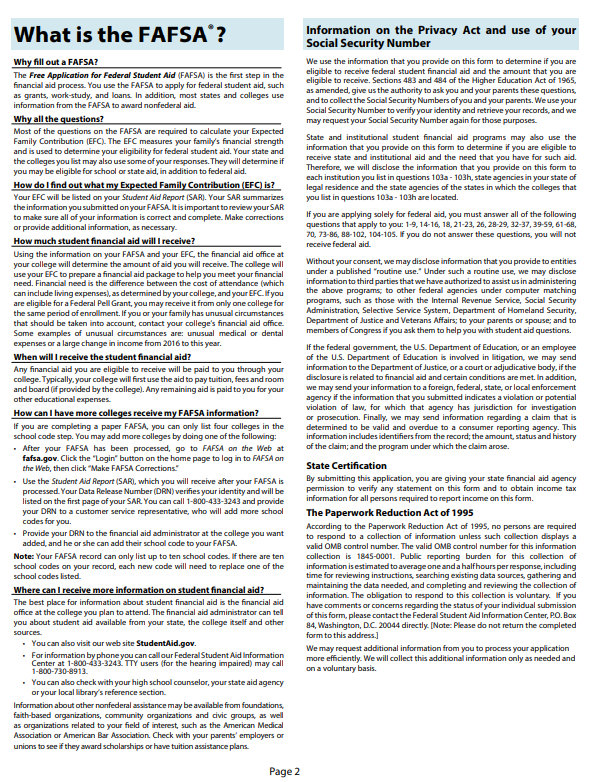

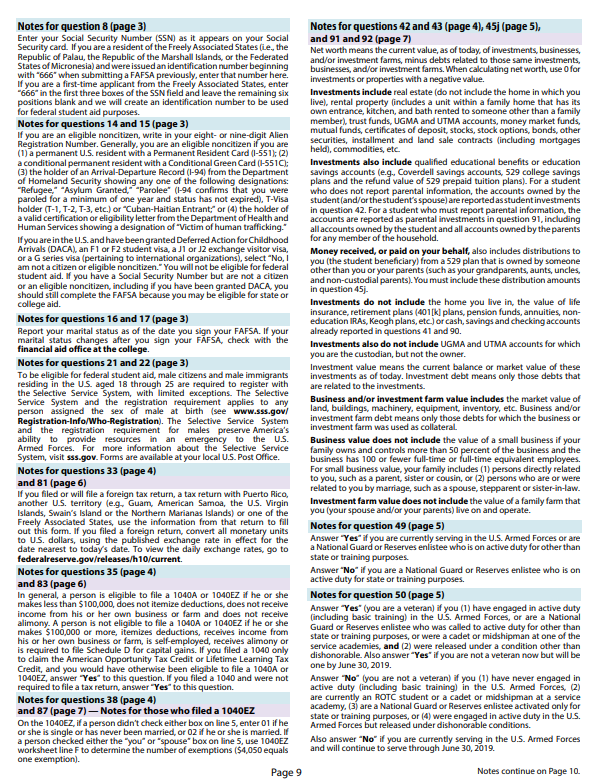

FAFSA stands for Free Application for Federal Student Aid. As the name suggests, students can apply for financial aid from the U.S. government for free. Students fill out this form, then the government determines whether or not they are eligible to receive federal financial aid based on criteria such as citizenship and high school completion.

Federal student loans forgiveness

Federal student loans are eligible to be forgiven under certain circumstances, which is largely what sets federal student loans apart from private lenders. Such circumstances include: the entirety of the loan hasn't been repaid in a pre-determined amount of time; working for the government for a certain amount of time; and working for a non-profit for a certain amount of time.

Can federal student loans be consolidated?

Federal student loans can be consolidated, but whether or not you are able to depends on individual circumstances. While it seems like a good idea for anyone with multiple student loans issued by the government, you may lose some benefits if you choose to do so.

Sign up to receive the latest news, reviews, buying guides and deals direct to your inbox

Do federal student loans affect your credit score?

Taking out any student loan, whether it's from a private lender or the government, affects your credit score. While you don't need good credit to apply for federal aid, and a hard credit check isn't performed when you apply, not making payments on time can negatively affect your credit score.

Federal Student Loans: Advantages

If you're thinking about taking out a loan to help pay for your or your child's education, federal student loans are your best bet. The advantages of taking out federal student loans greatly outweigh the disadvantages, and also generally outweigh the advantages of taking out loans with a private lender. If you need to take out a student loan, we highly recommend you file with FAFSA. Private lenders' loans should supplement whatever additional funds you need to complete your education. The advantages of federal student loans are:

Eligibility

It's fairly easy to qualify for a federal student loan. A student must meet some basic requirements, though the student must be seeking higher education (the loan cannot be for a private K-12 institution).

Contrary to popular belief, non-American citizens may be eligible for federal financial aid, but the student must meet other criteria to be considered an "eligible non-citizen." DACA or undocumented students are not eligible for aid, but may still qualify for private aid, such as through private lenders like Sallie Mae, and grants and scholarships.

Having "good" credit is not necessary to be considered eligible for federal student aid (with one exceptions - the direct PLUS loan).

Co-signers are not required for federal financial aid because credit checks are not required.

Types of loans

If you are looking into federal financial aid for the first time, there are 3 main options for. Direct Subsidized Loans are based on financial need, and Direct Unsubsidized Loans and Direct PLUS Loans are not. Students are not limited to one type of loan, and may receive all three.

Regardless of the type of loan you receive, they generally have lower rates and fees than loans issued by any loan issued by a private lender. Rates for federal students loans are also fixed, meaning that they will remain the same over the course of the life of the loan.

Other Aid

Loans aren't the only financial aid that the government offers. Work-study programs allow students to work part time to help pay for their education. The program is open to students who demonstrate financial need and is administered by the school. The jobs offered may be on or off-campus, and there are generally many on-campus jobs that are reserved for students who are a part of the program.

Students can also apply for grants and scholarships, which can be offered by the federal government, the state government, the school itself, a private company, or a non-profit. This is considered "free money" as the funds that are issued to the student do not need to be repaid. The federal government offers 4 types of grants: eligibility depends on academic performance and demonstrated financial need.

Repayment

Repaying your federal student loans is generally less of a hassle than repaying loans issued by private lenders. Many repayment plans allow you to make lower payments if you need to, and many plans are income-driven, meaning that you will only pay a certain percentage of your paycheck, regardless how much money you make. If you don't have an income, you will pay $0 until you do. There are many repayment plans to choose from, and you can reapply to change your repayment plan.

If you are experiencing economic hardship, you can apply for federal loan deferment, which can last for up to 3 years - exponentially longer than most deferment periods offered by private lenders, which commonly offer 12 months in 3-month increments.

If you qualify for federal subsidized loans, which are based on financial needs, you will ultimately end up paying less interest than you would normally on other loans, including loans from private lenders. While you are still responsible for paying off the principal of the loan, the federal government will take care of the accrued interest while you're in school, during your grace period after graduation, and during any deferment period. This does not apply to federal unsubsidized loans.

Unlike private lenders, the federal government is a little more forgiving of late payments because it has the power to recover its money than private lenders do. If you miss a payment, you don't need to scramble to pay what you owe: for federal loans, your payments aren't considered "delinquent" until after 3 months of missed payments (as opposed to one missed payment for private lenders).

Your federal student loans go into default after 9 months of missed payments, at which point the government reserves the right to recover the money you owe by withholding money from your paycheck or tax return. This is a longer period of time than most private lenders.

If you're struggling to make multiple federal student payments a month, you can consolidate those loans. And unlike for private lenders' loans, you don't need good credit to consolidate. There are pros and cons to consolidating your federal student loans: while this may qualify you for additional student loan forgiveness options, but it won't save you money on interest in the long run. Be sure to consolidate through the federal government: if you use a private lender, you will lose the benefits of have federal student loans.

Tax benefits

There's a plethora of tax benefits if you take out federal student loans, which is a big reason why they should be considered first over private lenders' student loans. You can earn tax credits to help pay for costs associated with your education by reducing the amount of income tax you pay. You can also claim the interest paid on student loans and receive a tax deduction. The federal government also offers additional programs and savings accounts that help you save money in the long run. You can read more about the tax benefits you can get by taking out federal student loans by checking out the FAFSA website.

Debt forgiveness and cancellation

The federal government offers several debt forgiveness options that may apply to you. Among several scenarios, you may be eligible for debt forgiveness if you work for the government for a certain period of time, if you work for a non-profit for a certain period of time, or if you opt for certain repayment plans.

If you die, there is guaranteed debt cancellation, so your loved ones will not have to bear the burden of repaying your federal student loans. If you become disabled, you may be discharged from repaying certain types of federal student loans.

Federal Student Loans: Disadvantages

Compared to private student loans, federal student loans do not have any significant drawbacks - but it's important to know about them even if we think federal student loans are the best choice for any student with financial need.

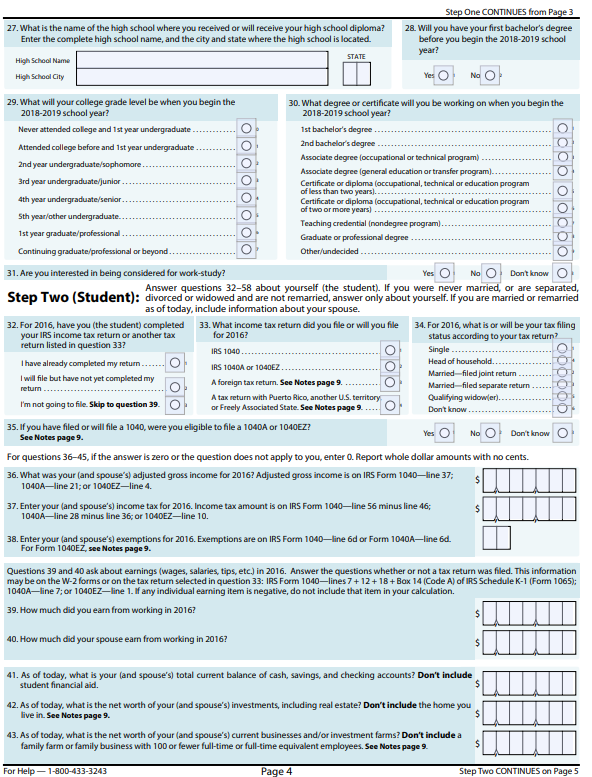

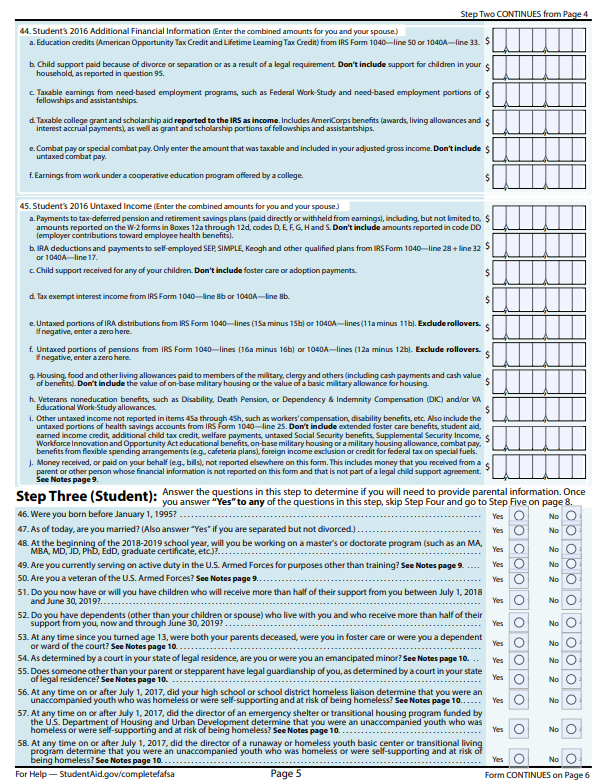

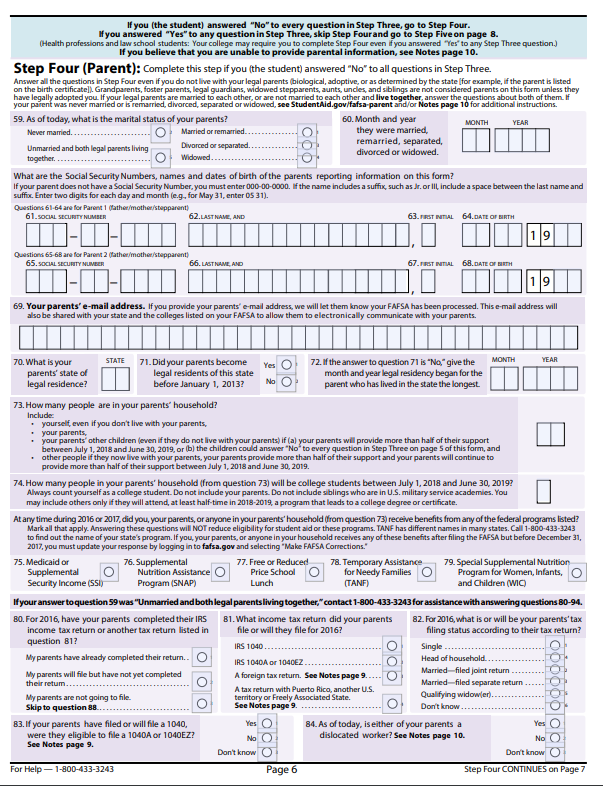

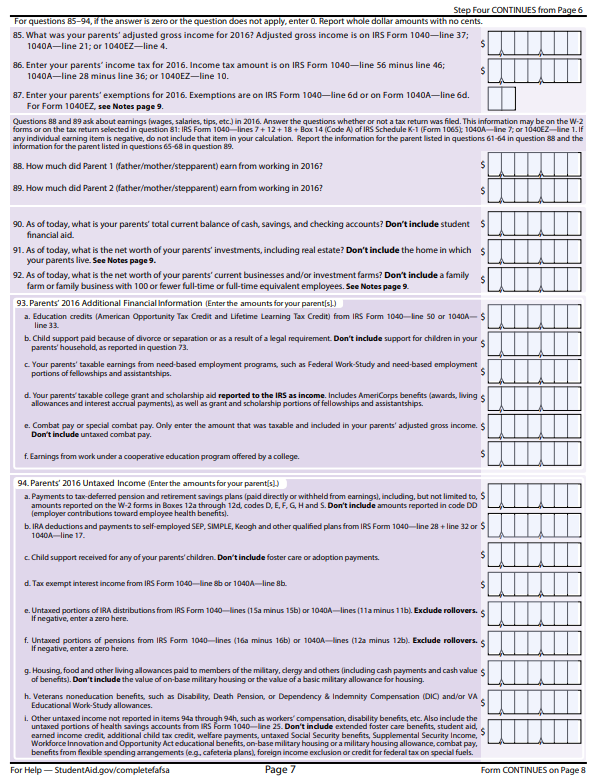

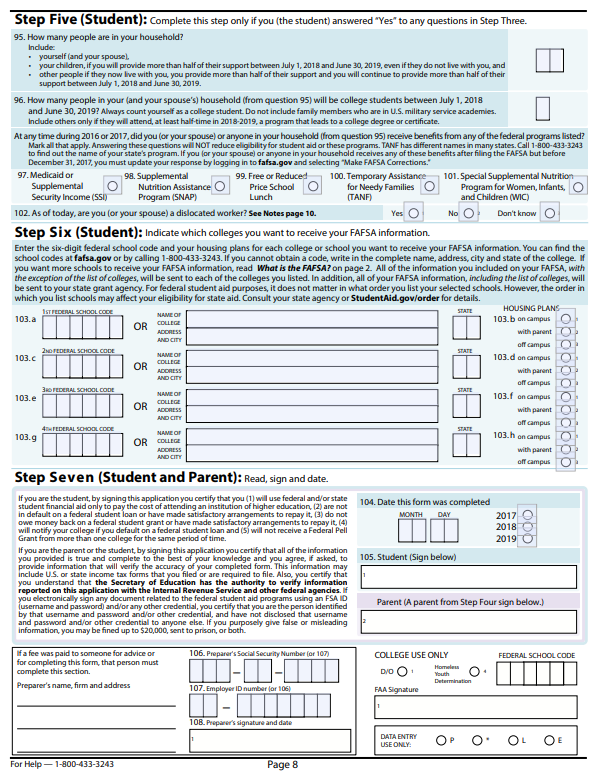

The application

The FAFSA is not famous for its simplicity. The FAFSA is quite long and tedious to fill out, and may be seen as a deterrent for many borrowers who may not know where or how to find some of the information needed on the form. However, this is necessary in part because the borrower's loans (not the Parent loans) are not credit-based. Although this is a rather unwelcome feature of Federal Student Aid, going through this process will ultimately be more rewarding than you may expect.

The loan

Federal student loans are subject to change and borrowers are essentially at the mercy of members of Congress and the President, who control the loans terms, forgiveness and repayment plans, and the interest rates.

Repayment

If you can't pay your monthly dues, the government reserves the right to withhold part of your income as payment for your federal student loan.

Because funds are limited and the amount of borrowers in the U.S. is only increasing, there is a loan cap at $12,500 per year for undergraduate students and $20,500 for graduate students for each year in school. This is often insufficient for many students who need help paying for close to 100% of school-certified costs who must then turn to other forms of aid, like grants, scholarships, and private lenders.

Customer service

Getting help with your loans and being alerted to loan changes may also be difficult, as the government outsources loan servicing to other companies who offer their services for cheap. This means that customer service may not be stellar, which can be difficult for people who do not understand the changes made to their loan terms, or why their payments were not properly processed.

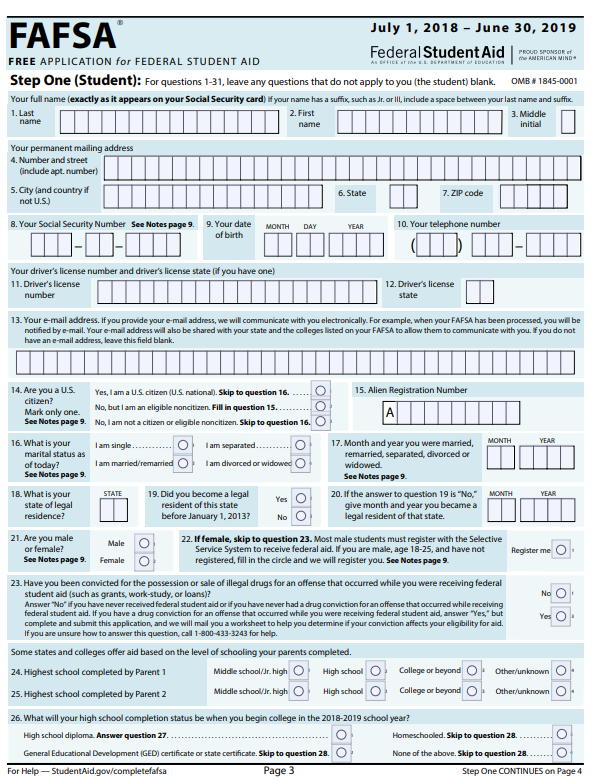

Applying for federal student loans: FAFSA

FAFSA is the Free Application for Federal Student Aid. It's fairly straightforward, but several steps are required, such as creating a FSA ID before actually filling out the form - in short, it's not a quick or easy process, and students and their parents should cut out a couple of hours at the very least to complete it in an accurate and satisfactory way. Parental or guardian information may be more difficult to complete.

The form, which you can preview online for the applicable school year, explains the process well. It's important to note that when they form says "you" or "your," it's addressing the student, not the parent.

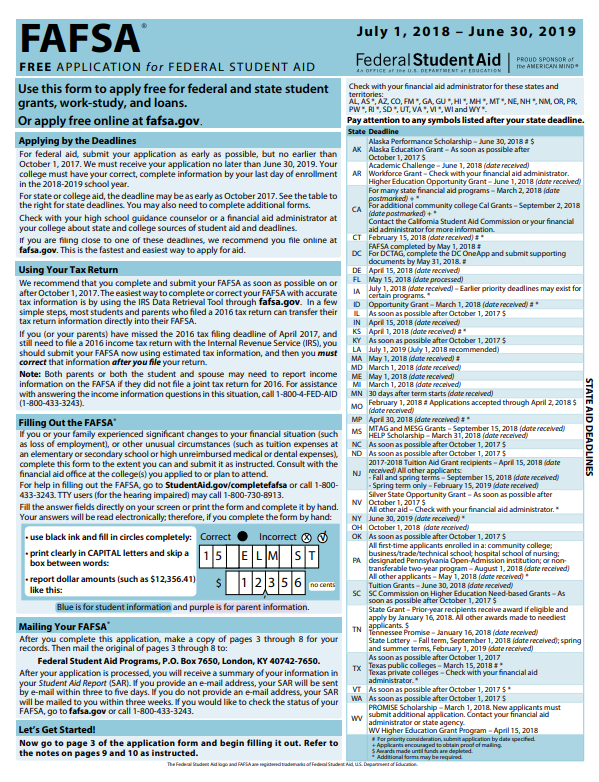

It's encouraged for students to fill out the FAFSA form during their senior year of high school. On the form, you can indicate which schools you applied to. Depending on the institution, you may need to complete the FAFSA every year you're in school. Tax return information is necessary to have on hand, but a handy IRS Data Retrieval Tool tool can locate that information for you.

In short, you may not want to procrastinate: apply for federal student loans as soon as you are able to after they are released the October before the next school year - remember, funds are limited.

Federal Student Loans: User experience and customer service

For those who don't have access to a desktop or laptop computer, the FAFSA is now newly available through the myStudentAid mobile app.

You can contact the Support Center, but keep in mind that there are different numbers for different needs, such as for changing your form information or getting loan counseling. The different departments may also have different hours, so check online before attempting to reach out. Users may find the different array of contact numbers a little frustrating, but the website offers a support center email option on their site as well.

Many users also report seeing multiple error messages when attempting to e-sign the form, making for a relatively poor and frustrating user experience. There are multiple reasons why this may be happening, such as using the wrong FSA ID (the student and the parent have different ones). We suggest you try signing through the new app if signing on a desktop or laptop doesn't work. We also suggest that you make sure that all information on the form is correct - even the most seemingly insignificant typo can prevent your form from being submitted.

While the FAFSA form may not be the most pleasant part of getting federal student loans, the website has a handful of helpful tools to get you better acquainted with the process. There are also several resources that help explain what kind of federal student loans are available, where you can find grants and scholarships, and how to manage your finances once you get a loan.

Although the user experience with federal student loans and the FAFSA isn't all that pleasant, it's well worth the effort to get the funds. The form, its language, and the process have greatly improved in the past few years, so we can imagine that the experience will only get better.

Federal Student Loans: Negotiating your offer

Getting federal student loans isn't easy, and receiving those funds for your education feels like an accomplishment in itself. But what if federal student aid is too low?

Because financial aid packages are determined by the school you or your child will be attending, you should contact the college to negotiate the financial aid package received. You can appeal for a greater loan award based on merit or based on need - the school will let you know what next steps are necessary in either case.

If the school cannot award additional funds to your federal student loan offer, then you can turn to private lenders like Sallie Mae to fill the gap between your needs and the cost of your education.

Federal Student Loans: Verdict

If you are an eligible candidate, federal student loans are your best bet. They're the best student loans out there, and every student who has graduated high school and looking to pursue a higher education should look into federal student loans if they are considering taking out loans at all.

Sophie is a born and bred New Yorker who, paradoxically, loves being in the great outdoors. Her favorite pastimes include running, baking, and writing. She also spends her time volunteering and leading volunteer projects with the Good+ Foundation and Achilles International when not providing information on the best deals, products, and services on the internet to TopTenReviews readers.