Best home gyms 2026: Top-rated machines from Bowflex, Marcy and TRX for your home

All of the best home gyms for challenging yourself at home, with multi-gyms that integrate weights, benches, and more.

With the best home gyms, you’ll be able to fit in a workout regardless of the time of day and be able to leave your after-work commute to the gym in the past. Rather than waiting around to finish your set, these machines enable you to progress on your fitness journey at home and offer as much resistance as you need in order to be challenged. More private than the gym and much more hygienic, once you install a multi-gym in your home, you’ll be feeling more motivated than ever.

If you’ve already kitted out your home gym with one of the best exercises bikes or the best elliptical machines, then you’ve got cardio covered already. What you need next is a space to work on your strength, and these machines can offer just that, with multi-gym designs allowing you to complete a full-body workout from home.

If you’re a little more pushed for space, then you could opt for a folding weight bench, and get to work with various free weights, and benefit from reclaiming your home space at the end of your workout too. This round-up includes picks from major fitness retailers, including Total Gym, Bowflex, Marcy, and TRX, so that you can make your purchase with peace of mind. With so much choice, make sure to factor in the space you’re working with, and to make a note of the features that really matter to you.

The best home gyms to consider now

1. Total Gym FIT: Best home gym for full body workouts

Why you can trust Top Ten Reviews

Total Gym FIT Home Multi-Gym

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

The Total Gym FIT is a bit different from a lot of the machines featured in our best home gyms guide. How? It uses a glideboard, which means it's able to create resistance through using your bodyweight.

This is a good thing as it means the system is much more compact, plus it's light enough to easily fold away and store when not in use, minus weight plates, of course. The Total Gym FIT weighs just 66lbs, and unfolded it measures 93(L) x 18.5(W) x 44.5(H)". The maximum user weight is great too at 450lbs, which is around 150lbs more than most other home multi-gyms.

Being a glideboard design means it can also be used for a host of exercises - over 85, in fact, so you'll get a very comprehensive, full body workout with the Total Gym FIT home gym.

While all the home gyms we've included here can help tone and strengthen your muscles, the FIT also provides unique cross-training exercises designed to improve your cardiovascular health.

The Total Gym FIT is one of the more expensive home gym systems around, but it comes with a lifetime frame warranty and two-year guarantee on parts.

- Read our Total Gym FIT review

2. Bowflex Xtreme 2 SE: Best home gym for expandable resistance

Bowflex Xtreme 2 SE Home Multi-Gym

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

The Bowflex Xtreme 2 SE Home Gym is a relatively compact and lightweight home gym that does away with weights in favor of torsion based resistance up to 210lbs. You can expand this resistance (at an additional cost) to 410lbs.

The Xtreme 2 SE uses power rods that work like a bow under torsion to offer 210lbs of weight broken down into increments. This makes it easy to swap between exercises, with over 70 different upper body, lower body and core exercises available.

The Bowflex Xtreme 2 SE Home Gym weighs 185lbs, which is heavy enough to keep it safely grounded during more intense weights-based workouts, but not so heavy that you and a buddy can't move it around at home if needs be. While the maximum user weight isn't as high as the Total Gym offering, the Xtreme 2 SE supports up to 300lbs and is designed for one person to exercise at a time.

Again, this is one of the most expensive models in our best home gyms guide, especially with the expanded resistance, preacher curl and ab attachments. That said, it's also one of the top home multi-gyms that will grow with you. How come? You can expand the resistance from 210lbs to a whopping 410lbs, making this a good investment for long-term weight training at home.

- Read our Bowflex Xtreme 2 SE review

3. Marcy MWM-988: Best home gym for beginners

Marcy MWM-988 Multi-function Home Multi-Gym

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

The Marcy MWM-988 Multifunction Home Gym is an affordable way to get a full multi-station weight based training system in your home. Because of the price and the instructional materials you get with this home multi-gym, we'd also recommend it to beginners who need more hand-holding when starting out.

The MWM-988 is a sturdy, 14-gauge steel gym designed to offer 36 different exercises. These focus on key areas including lower and upper body, core and more. In terms of design, for the lower price it's surprisingly sturdy, durable and well put together. It's a shame that the padded seat can't be adjusted for height, but the maximum user weight is on par with the Bowflex home gym at 300lbs.

The weights use a protective stack shielding for safety, and that also means the machine is a little quieter in use. You get up to 150lbs of weight with the Marcy home gym, which can be used with the high pulley, low pulley, curl pad, pec fly, chest press and leg attachment. All in all, this is excellent for a full body weights workout.

The Marcy MWM-988 Multifunction Home Gym also has a separate dual function arm press, so you can perform vertical butterfly and chest presses. In the case of the vertical butterfly, each arm swings separately to provide more balance based work to make sure you avoid pesky muscular imbalances. This is ideal if one side is stronger than the other, as you can set about evening them up.

4. Total Gym XLS: Best compact home gym

Total Gym XLS Home Gym

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

The Total Gym XLS is arguably the best home gym for anyone who wants a static multi-gym but is short on space at home. Why? Because it can be quickly folded away when not in use. It's also suitable for heavier users, as it can support a maximum user weight of up to 400lbs.

Despite the compact size, the Total Gym XLS multi-gym supports over 80 exercises and comes with a Total Gym TC Basic account for viewing guided workouts online. So you can train along with a variety of body strength, weights and other workouts.

The squat stand works well, with lots of grip for a more stable connection, and the pulley system is smooth for even resistance when using bodyweight. Not great when it comes to building home exercise equipment? Us neither, which is why we love how the Total Gym XLS comes fully assembled, making it one of the top home gyms for exercising right out of the box. Just position it, unfold and go.

Ok so you'll need to learn a few moves first, and decided which ones to include in your full body workout or individual workouts dedicated to upper and lower body. But once that is done, the XLS is one of the easiest home gyms to use.

- Read our Total Gym XLS review

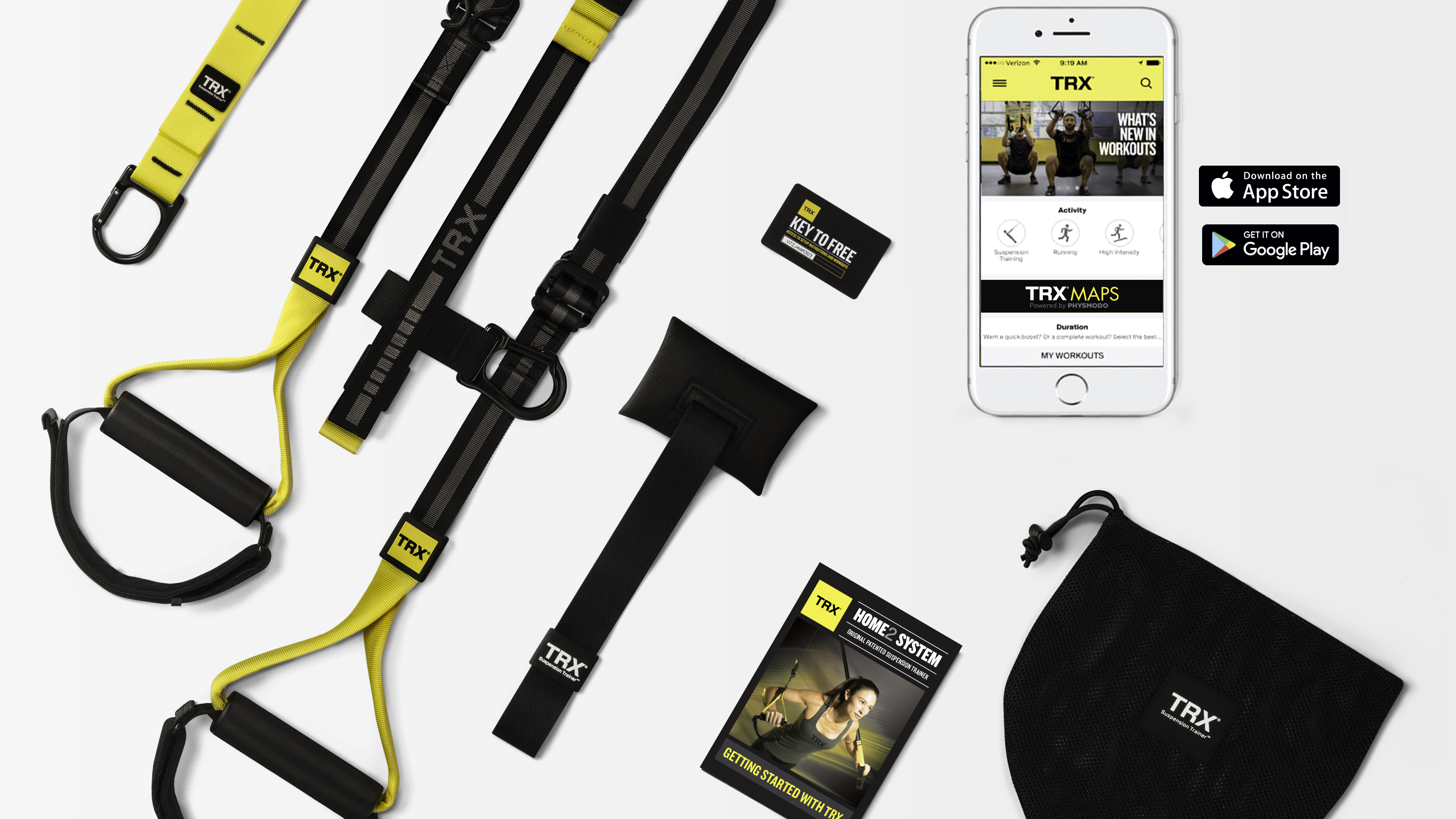

5. TRX Home2 System: Best home gym for body strength beginners

TRX Home2 System Suspension Trainer

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

Working out can feel hard enough at times, without you then having to wrangle a complex home gym system. The TRX systems make body strength training easy and (almost) fun, giving you the means to perform an endless array of core and strength training exercises from a very minimal piece of kit.

The TRX Home2 System is a suspension trainer, designed to be hooked over a sturdy door in your home, or attached to a sturdy pole or frame outdoors, such as a large tree branch or jungle gym bars. So it’s one of the more versatile home gyms you can find - and one that can easily be packed up and taken into the garden or your local park to get those added benefits of exercising outdoors.

When you first unpack it, the TRX Home2 System doesn’t look like much at all. It’s basically a series of straps and anchors, and a small black mesh bag to store them in. The TRX app is the second half of the package, as this is where you’ll find guided body strength training workouts led by TRX instructors. TRX Training, the brand’s online fitness program in app form, is also home to cycling, running and yoga workouts, among others. You’ll get a free year’s membership of the app when you purchase the Home2 System.

The TRX Home2 System is designed for building up your core strength, but there are specific ‘lean and toned’ workouts, as well as exercise programs created to boost your flexibility and mobility, and to support healthy and sustainable weight loss. You’ll get a free exercise poster with the suspension trainer, so if you don’t want to use the TRX app, you can refer to this for the most common TRX exercise moves and create your own routines for indoor and outdoor body strength training.

6. Bowflex PR3000: Best home gym for cardio

Bowflex PR3000 Home Multi-Gym

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

The Bowflex PR3000 home gym is a multifunction system that uses Power Rods to create resistance. You get 210lbs as standard, but this can be scaled up to 310lbs once you start to progress in your weight training.

The home gym is good for over 50 exercises and uses a no-change pulley system. This makes it easy to transition between sets, and is therefore also ideal for HIIT or cardio based workouts. The addition of a row station makes this an even more inviting option for cardio fans.

The seat is adjustable, unlike some others in our best home gyms guide, and is good for up to 300lbs of user weight. The Bowflex PR3000 is a great option if you live with others who also want to use the machine and will therefore need to change the settings easily to suit them.

While the Bowflex PR3000 home gym isn't the cheapest multi-gym, it's very well made and designed to last many a year. Speaking of years, Bowflex offers a seven-year power road warranty and one-year frame warranty on the PR3000.

- Read our Bowflex PR3000 Home Gym review

7. TRX GO: Best home gym for small spaces

TRX GO Suspension Training Kit Home Gym

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

The TRX Go Suspension Training System is very different to any other machine featured in our guide to the best home gyms. Once glance at the system will tell you that, as it has no solid structure like the other home multi-gyms and instead uses straps with grips for hands and feet to create bodyweight resistance.

Not only does this make it the best home gym for portable use, it's also the top choice for those of you who prefer to weight train using your own body weight and no 'artificial' resistance.

While the TRX Go may look basic, it's actually the most versatile home gym in this entire round-up. That's mainly because it can be used to carry out a mammoth amount of exercise variations - over 1,000, actually.

It can be fastened to a huge variety of objects too, from door frames and garage doors to tree branches and park benches. That means you can get your body strength training sessions indoors or in a green space, depending on your mood. The included anchoring options give you a great variety of options to choose from, so you can pitch up pretty much anywhere and train.

When we used the TRX Go Suspension Training System, we discovered seven basic moves that, when strung together in sequence, provide an effective full body workout. These moves are push, pull, plank, rotate, hinge, lunge and squat. Those are brilliant for enhancing general flexibility and mobility, not to mention toning. However, if you are dealing with an injury you must get sign-off from your doctor before starting this or any type of fitness training.

Best of all, the TRX Go comes with a free six-month membership to the TRX app (iOS, Android), so you can follow along with custom body strength and HIIT workouts on your smartphone.

The cheapest prices on the best home gyms

Home gym equipment FAQ

How we chose the best home gyms

We've been reviewing the best home gyms for several years, so we know what to look for when seeking out the top multi-gyms for home use. Buying a home gym is a significant investment, especially if you're considering one of the pro-level multi-stations designed for multiple people to use at once. It’s therefore important to keep in mind that home gyms provide value both in terms of money and time.

If you invest in a quality home gym, you could save money in the long-term as you won't have to spend money year after year on an expensive gym membership. That, and you won't have to deal with lengthy queues at your local fitness centre either.

To help you pick from among the best home gyms, we also interviewed industry experts such as Tom Holland, a nationally-recognized exercise physiologist, Nautilus, Inc. fitness advisor and author of Beat the Gym. Holland helped us understand why strength training is so important, and why purchasing a home gym can be advantageous...

“Strength training is truly the fountain of youth, not only adding years to your life but also adding life to your years,” Holland said. “If you have a home, then you have a home gym. Everyone needs to exercise and you can now do so in the privacy of your own home. In the amount of time it takes you to travel to the gym, you can be finished with your workout.”

The best home gyms vs commercial gyms

Unsure whether to invest in one of the best home gyms or to stump up for another annual gym membership? It all depends on how often you hit the gym and whether you can get more out of paying for a monthly subscription than you could with owning your own multi-gym.

Here we look at the pros and cons of each, so you can determine what works for your budget and lifestyle.

Home gyms

The primary benefit of a home gym is that you get to choose what equipment and accessories are there, and you can set them up exactly how you want. You’ll never have wait for other people to get off the equipment you need to use either, or have to clean up someone else’s sweat.

A home gym is also open whenever you want it to be, and it doesn’t require a commute. You also don’t have to deal with sudden changes in hours of operation or busy peak periods where the gym is crowded.

Plus, working out on your own has advantages: no random distractions, and no worrying about others waiting to use the machine you're on. It's just you and your workout. You can also listen to or watch whatever you want, wear whatever you want, and puff and grunt all you want if your workout is intense.

Although buying one of the best home gyms requires an upfront cost, it could be more cost-efficient over time. After only a few years, the cost of those annual gym memberships will outstrip the cost of the home gym.

Commercial gyms Undoubtedly, the best part of having a commercial gym membership is that you have access to all kinds of equipment, accessories, amenities and exercise classes beyond the weight training room. For a monthly fee you can get in a variety of different workouts to hone your body and achieve your specific health and fitness goals, and all without having to maintain the equipment yourself.

At a gym, you may even have access to a personal trainer, should you need a few private sessions (many of these charge extra on top of your membership fee). You may be able to find people to spot you when lifting heavier weights, and you'll become part of a larger fitness community. The energetic environment, bustle and motivation from fellow gym-goers is also a bonus for some people.

Commercial gyms are also climate controlled, so you'll feel more comfortable working out in a gym than you would at home if you don't have a central air conditioner.

What to look for in the best home gyms

Buying a home gym is a weighty decision, but we’re here to make it easier.

“It used to be that you had two main options when buying a home gym,” says fitness trainer and home gym expert Tom Holland. “Order it from a late-night TV infomercial or go to multiple stores in person. Now you can watch videos, read reviews and truly do your homework before you purchase.”

On that note, here are the four main things experts recommend you consider in order to choose the best home gym for you...

Space

Home gyms are big, heavy machines. Because space is such an important consideration, we outlined the dimensions and weights of each model. Along with accounting for your machine’s footprint, keep in mind that you’ll need additional space for range of movement as you extend your arms and legs during your exercise routine.

If you choose a multi-station home gym system, you’ll also need room to get around the machine as you move from one station to another. You’ll also want to allow enough space away from walls and doors to make your workout as comfortable and convenient as possible, and to ensure you can get in and out of the room.

Resistance technology

Free weights (think dumbbells and barbells) are used for independent weight lifting that doesn’t require a machine. By contrast, most home gyms use either weight stacks or weight plates to create strength-building resistance. Some, like the TRX GO, uses your own body weight to create resistance.

Weight stack machines let you choose your resistance level by adjusting a weight stack built into your equipment’s frame. A cable and pulley system provides the mechanism for you to lift and release the weight. Weight plates are weights you manually fasten to your home gym’s workout components and exchange for heavier weights as you build strength.

We also reviewed home gyms that use power rods to create resistance. Power rods, like those found on Bowflex home gyms, provide resistance much like the resistance on a bow. The resistance increases as the tension becomes tauter and eases as the rods straighten.

The best home gyms for beginners

Holland says that weight training newcomers often choose home gyms with weight stacks. These are also called sectorized or selectorized machines because they enable you to build strength more safely than when using free weights. Also, they offer convenience.

Plate-loaded pieces are good for someone who already has a set of weights to use on them, but they are a hassle to change when compared to a selectorized machine. It’s important to determine which style of resistance you would prefer. Also, consider buying a home gym that lets you add more weight or upgrade its resistance as you get stronger and your goals become more ambitious.

As you consider your budget, you’ll also want to think about your current fitness level and long-term fitness goals. It might be worth it, in the long run, to spend a little more money upfront rather than needing to invest in new equipment as you get stronger.

How much do the best home gyms cost?

We found a wide range in the pricing of home multi-gyms. Systems on the low end start from under $150, while the most expensive can reach up to $10,000 when you factor in all the accessories.

Based on our research, it’s best to budget an average of $1,300 for on of the best home gyms, as then you can hit that sweet spot between price and a great range of features, plus durability and ease of use.

Keep in mind that the price of a home gym depends on the machine's size and capability, what it's made of, and the technology it uses. Luckily, there are plenty of home exercise equipment sales throughout the year, so you may pick up a bargain.

Setting up a home gym

Where to set up your home gym

Considering where you’re going to set up your home gym should be one of your main considerations as you make your purchase. In the best-case scenario, you’ll want to set up your home gym on a concrete floor, to support all of that heavy equipment, including free weights. You’ll want your flooring to be able to withstand accidental drops and to be able to work out without disrupting your neighbors or family members too.

Ideally, if you have a garage or basement, then these spaces can double as a home gym pretty nicely, and offer good temperature control. Those who need to double up their office or spare bedroom as their gym instead should look for features that allow you to reclaim your space when you need to, including castors for portability and foldable designs.

You can also get inventive, and use closets, shelving and containers to keep your weights stacked up. These small organizational units will keep things from overflowing, and make your home gym an uncluttered space of calm, which is just what you need to get into the right headspace before a workout.

Easy home gym design ideas: What to consider for all types of spaces

If you have a dedicated space where you can set up different types of home gym equipment, it’s very easy to get excited planning the space and how you can best utilize it.

But before you begin, get clear on the machines and other types of exercise equipment you plan on putting in there. Why? If you have a large multi-gym, for example, you will need a lot more free space around it then if you are using a static weights station that can be pushed nearer to a wall.

There are several other key questions you should ask yourself before committing to a home gym design:

- Is the space to function solely as a home gym or does it need to double as an office, living room or bedroom too?

- How much home gym equipment can the space realistically hold without it being too cluttered for you to exercise properly?

- Is there enough natural light or do you need to install extra lighting?

- Does the floor need to be protected by mats or is it fine to have home gym machines placed directly on top of it?

- What type of exercise will you be performing in your home gym, and what equipment will you need to achieve that?

- Have all health and safety needs been addressed?

The space and location, as well as the home gym equipment you own or plan on buying, are the two biggest factors when considering different home gym design ideas. In an ideal world it will be as spacious as possible so that you can easily access your equipment, and perform a range of different exercises.

However, space is a premium in many homes, especially with so many people working from home as well as working out at home. So you may have to make do with transforming a corner of your bedroom or home office into a gym. If this is the case, you’ll need to pick compact or folding home gym accessories, such as folding exercise bikes, resistance bands, and a yoga mat for online workouts.

Along with proper home gym flooring and the exercise equipment itself, we would highly recommend investing in a proper home gym mirror so that you can keep an eye on your form. This is especially important when you’re lifting weights. You can even buy smart fitness mirrors now that display your workouts and give you real-time feedback on your performance and form. NordicTrack makes a superb home gym mirror system, the Vault, with Tempo Studio and The Mirror being the other well-known fitness mirror brands.

Do you need special home gym flooring or exercise mats?

Unless you’re using a suspension trainer kit such as the TRX models featured higher up in this guide, it’s more than likely that the home gym system you choose will be heavy. And unless you set yours up in a garage where the floor can be scuffed without consequence, you’ll need to think about how you’re going to protect your floor from your weights.

Furniture pads (they look like drinks coasters) are one option, sure, but if you move your home gym equipment around a lot, these small protective pads will quickly annoy you. Therefore the best type of home gym flooring is a series of thick rubber mats that either connect together like a giant puzzle, or will sit next to one another without moving.

You can find home gym flooring at plenty of major retailers, including Amazon, Target, Home Depot, and plenty more. The biggest home gym flooring brands include TrafficMaster, Gorilla Matts, ProsourceFit, and LifeProof.

The cost of home gym flooring such as this ranges from around $2 per tile, up to around $200 for extra large protective rubber exercise mats. Obviously these are a different kind of exercise mat to something you’d perform yoga or body weight training on. Here are some of our favorite home gym flooring options and where to find them:

Budget buy: ProsourceFit Puzzle Exercise Mat at Amazon

Spread these 0.5-inch thick foam tiles out underneath your home gym equipment and in any space where you might want to perform free weights training or plyometric exercises.

For large home gym machines: Gorilla Mats Extra Large Mat at Amazon

Super-popular home gym mats with over xx user reviews on Amazon. Gorilla Mats are non-slip, so you can get those burpees in without fear of your mat flying away from underneath your feet with each jump.

For stylish home gyms: OptiWood Engineered Hardwood Flooring at Home Depot

If you don’t want to cover your home gym floor with a sea of black rubber mats, choose this engineered hardwood floor instead. It’s waterproof and can be installed directly over your existing flooring.

Sign up to receive the latest news, reviews, buying guides and deals direct to your inbox

Luke is a veteran tech journalist with decades of experience covering everything from TVs, power tools, science and health tech to VPNs, space, gaming and cars. You may recognize him from appearances on plenty of news channels or have read his words which have been published in most tech titles over the years. In his spare time (of which he has little as a father of two) Luke likes yoga, surfing, meditation, DIY and consuming all the books, comics and movies he can find.