- SaaS

- Hardware available

- Third-party hardware and software integrations

- US only

- Monthly subscription, two levels

- Low per-transaction cost, 0% mark up

- No termination fee

- Omni web portal for business management

- Range basic of software

- Mobile payments

- Payment button without full shopping cart

- Virtual terminal

- 24/7 in-house customer care

Fattmerchant offers a good challenge to both Dharma Merchant Services, and Stripe’s proposition, offering API developer tools, a monthly contract and integrated mobile options at a lower overall price.

Florida-based Fattmerchant launched in 2014, developing a product that offers greater transparency over processing costs while also offering 0% markup, just the interchange fee – a rare model.

Although it aims its product at SMEs, the high subscription price means the cost efficiencies come into their own at volume. This makes Fattmerchant a great solution for medium to large businesses.

Fattmerchant has earned a high level of trust among its clientele, and customer service is known to be top notch. Coupled with the predictability of a flat monthly fee, no markup on processing costs, and great services included for free like PCI compliance, invoicing and inventory management tools, it’s an attractive option.

Read our Best credit card processing services buying guide.

Looking for pricing information on credit card processing services? Answer the questions below, and our vendor partners will contact you with a free quote:

Fattmerchant review: Features

- Low card processing rates with 0% mark up

- Two-tiered monthly subscription plan with no cancellation fee

- In-house, 24/7 customer care

Arguably the least complained about payment processing platform out there (although also the new kid on the block), one of the great selling points of Fattmerchant is that it provides its own, in-house customer care 24/7. It advertises all its contact details freely online, and doesn’t lean heavily on its online community to offer support. This gives it an advantage over competitors like Stripe and Square – and even Helcim, which provides excellent customer care but not 24/7. The sales team is all also in-house, which helps with transparency when deciding if Fattmerchant is the right solution for your business.

For a flat monthly fee, you can buy into a payment processing plan that suits your business, and offers no percentage pricing markup on transactions. It’s a bold offering, and one that is attractive to many businesses especially when coupled with no early termination fee. However, the monthly charges are higher than competitors, and of course when you have offerings on the table like Square – fast setup with no upfront costs – many SMEs, especially those in the micro-business category, may prefer to start with a payment processing solution that presents less up-front financial commitment.

Fatmerchant’s standard plan is $99 per month and that includes PCI compliance and no monthly minimum as well as free statements, analytics and 24/7 customer care. It gives you access to some pretty compelling rates, too. Mobile payments, for example, are charged at just 15c per transaction, with no percentage markup, while the virtual terminal is also 15c per transaction – vastly cheaper than most competitors. If you have a physical business, then countertop transactions are even more competitively priced at just 8c per transaction.

If your business processes more than US $1m in payments each year, Fattmerchant offers an enterprise plan for $199 a month. This gives you access to slightly lower rates (12c for mobile and 6c for countertop for example), and includes additional features like risk monitoring, an account manager, and chargeback assistance. Neither of these plans incur early termination fees. If you are processing enough volume to warrant the monthly spend, then Fattmerchant is the cheapest payment processing solution available in the US. Low volume businesses would be better off looking into solutions like PayPal Business or Square payment processing, which are more expensive per transaction but don’t have any other associated fees.

Fattmerchant review: Usability

- Complex sign-up process

- API developer tools available plus third-party integrations

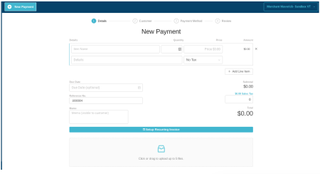

- Intuitive virtual terminal

Remote payments, for businesses that take payment over the phone, are also simple for the terminal operator and payments are processed in real time without a need to send an invoice.

The fee for this is highly competitive, at just 15c per transaction, compared to Stripe which charges 2.9%+30c. In addition, a hosted payments page allows you to send payment links to customers, or create an HTML solution to place a payment button directly on your website.

Third-party integrations allow you to sync with a payment terminal, mobile terminal and QuickBooks. All customer information is kept securely on file. The virtual terminal also syncs with inventory management to keep your stock levels at their optimum, and all this information is aggregated via their Omni reporting platform.

Fattmerchant may offer an excellent pricing structure, but the pay-off is the in-depth level of information needed to sign up. You almost need your blood type and approved business plan just to get an account, and the level of frustration we felt was quite high, especially after our lightning fast Square sign-up experience.

You are also funneled into choosing the products you want right at the start of the sign-up process. Although you can make changes later, having to think about this before you’ve even experienced the software might be off-putting for some businesses.

Once you’re in the club though, things get much smoother. The back end is modern, intuitive and visually pleasing. Although Fattmerchant doesn’t boast about its third-party integrations, a wide range of existing products can be used alongside the platform.

For example, although it has a relationship with VeriFone and will sell you hardware, it also claims that over 90% of existing PoS systems will integrate with Fattmerchant – and it offers those integration gateways free of charge (although the PoS dealers may charge an integration fee). Vend, Revel, Micros and ShopKeep are all commonly integrated with Fattmerchant.

Although Fattmerchant is not an all-in-one eCommerce platform like Helcim, integrations with solutions like Shopify and QuickBooks make it easy to look after every aspect of your business in one place via the Omni centralized reporting platform.

Although you can customize the look and feel of these solutions, some businesses may require more. Fattmerchant offers a selection of API developer tools so your business can personalize its payment gateway. SKDs are available for both iOS and Android platforms.

The flat pricing is exactly the same for those wishing to take advantage of developer tools as those using pre-built options, but of course you will have to pay for a developer to utilize it. This isn’t by any means a main draw for this product, and the API tools are quite limited in comparison to the offering by Stripe. But if you want a low level of software customization alongside the excellent rates, Fattmerchant is worth considering.

The Fattmerchant virtual terminal offers an in-depth range of features to make it adaptable to a wide variety of businesses. One-time and recurring invoices are easy to set up, and the virtual terminal will also send invoice auto-reminders to your clients so you don’t waste time chasing up. You can set up due date reminders for your clients in advance and auto-receipts are also an option.

Fattmerchant review: Performance

- Use any mobile device

- Excellent customer service and customer-centric approach

- Next-day funding payments

It’s good to point out here that Fattmerchant, like many small companies, uses a larger company as a back-end processor. It publishes the full terms and conditions on its site, which are actually from its back-end processor the National Processing Company.

Having read its ‘no contracts’ claim, you may be alarmed to see there is a three-year term and penalties for early termination written into these T&Cs. Don’t panic. Fattmerchant will provide you with a subsidiary document on sign-up with its own small print, which should include its month-to-month billing and 30-day notice period. Make sure you review it thoroughly before you sign.

In a bid to keep competitive, Fattmerchant is now compatible with both iOS and Android platforms. The virtual terminal is also available on any device that has an internet connection. These are aspects of a product that you may expect as standard, but don’t assume as it really isn’t the case.

Fattmerchant founder Suneera Madhani used to work in payment processing software sales. She has said, of her decision to found and launch Fattmerchant, “that’s where I first saw the major disconnect between payment processors and merchants. The small businesses just weren’t receiving the same level of customer experience, transparency and value they were sold on.”

Although it’s probably the price offering that will draw you in, the Fattmerchant model is in fact built on good customer service. That’s not just about having a 24/7 in house customer care team (although that helps).

The product itself is completely customer-centric in its design, with the subscription-based flat pricing model a first in this category, offering complete predictability and transparency over costs, and an affordable option whatever the individual ticket price.

Even the decision to have an in-house sales team has been designed with the customer in mind, because if you are buying a product like this, that will be so central to your business, you want someone who fully understands and believes in what they are selling you – not just someone thinking about their commission.

There are other payment processing solutions on the market, like Helcim, that offer the same high level of customer care, but no one else has linked their competitive price directly to positive customer outcomes in this way.

Carrying on the customer care theme, next-day fund payment service is a great asset, especially to smaller businesses who may need a high level of visibility over their cash flow. This is inclusive of the subscription, with no penalties or extra processing fees for the fast payout. In addition, you can choose their same day payout option for a small fee.

Fattmerchant review: should you buy?

Fattmerchant might not be the cheapest upfront payment processing solution but for medium volume businesses upward, it cannot be beaten on overall price. If you are a company that processes a small number of large tickets, then the Fattmerchant offering is a particularly good fit.

Built around good customer service, their 24/7 helpdesk and in-house sales and customer care team are huge selling points. It is considered one of the best Fintech companies to work for globally, and the team is passionate about positive user experience.

The customer-centric approach sees a high level of usability built into the platform. Although the account application process is cumbersome, the offering within – especially the good range of third-party integrations – is easy to use and customizable to the look of your business.

The API developer tools aren’t anywhere near as advanced as Stripe, but if you’re looking to build a payment gateway and are prepared to forfeit a higher level of customization to take advantage of the price offering, then this is a fit.

Although it is not a one-stop ecommerce shop, it’s easy to keep track of all your integrations through the Omni platform, making it very competitive when comparing with companies that offer more advanced ecommerce options, like Helcim.

Transparent, affordable, and with a good range of tools and integrations, Fattmerchant is one of the best card payment processors on the market for businesses with medium volume.

What other credit card processing companies should you consider?

Fattmerchant review is one of the best credit card processing services around but it may not be right for your type or size of business. As you might expect, there are plenty of other services for to choose from. These are the ones we think are worth consideration and what purpose they are most suitable for; click through for the full review.

Helcim is a great all-round option; Flagship Merchant Services offers great personal service; Stripe Payments offers great customisation options; Dharma Merchant Services is good for businesses who want to be more ethical; Square is best for SMBs; PayPal Business is great for micro-businesses; and iPayTotal is the best for high risk merchants.

To see all these services compared in once place, read our Best credit card processing service buying guide.

Looking for pricing information on credit card processing services? Answer the questions below, and our vendor partners will contact you with a free quote: