- Web-based SaaS

- Hardware available

- Unlimited users

- Tele-support offered

- Online tutorials provided

- Fixed monthly fee

- Transparent pricing on transactions

- Visa, Mastercard and Amex processing

- In-person processing options

- No contract, monthly billing cycle

- Retail and online specific plans, and combi

- Full merchant services available

- Integrations available for accounting and shipping

- Mobile and tablet apps

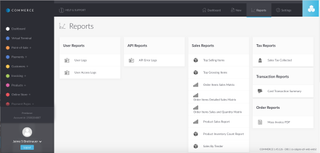

- CRM and reporting tools

- Subscription management

- Advanced security options

Helcim’s main offering is its integrity around pricing and excellent after-sales care. That means it is particularly good for small to medium-sized businesses that trade online and on the go. It also makes it one of the best credit card processing platforms around.

Helcim commerce is a one-stop, cloud-based merchant services provider known for its transparency around pricing and excellent customer support. Founded in Canada, it also services US customers, but is not available outside of North America yet.

For a monthly fee a Helcim account gives you access to a variety of software such as your gateway, shopping cart and of course payment processing, removing compatibility issues between different providers.

It publishes its interchange-plus pricing so the cost of using Helcim is predictable and clear from the outset – it prides itself on its no hidden costs approach to its services. It also offers a very competitive pricing offer, making it one of the most cost-effective solutions for SMBs.

However, if you are expecting to process less than US $2000 a month in payments, then Square payment processing or PayPal Business might be better options. Helcim will also not accept merchants in the ‘high risk’ category, for example gambling sites, adult entertainment businesses and vape shops. Try iPayTotal if you run any of the above.

Helcim offers packages for both bricks and mortar retailers and eCommerce businesses, and of course a combination of the two. Its payment processing software allows you to accept both credit and debit cards including American Express and China UnionPay, and it also offers physical terminals for a one-off fee including a mobile terminal compatible with its app.

Read also:

Helcim review: Features

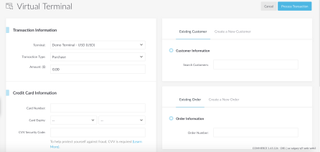

- Virtual terminal

- Fully customizable hosted payment pages

- Month-to-month pricing plan

Nothing inspires more confidence in a service user than having no contract. After all, if the company has faith in its product, and know you will be happy, why lock you in? While month-to-month account billing is becoming common in the payment processing industry, Helcim is unique in that it offers a full eCommerce setup, available via an online portal, with affordable rates that even lower volume merchants can take advantage of.

Helcim is one of the most user-friendly merchant services providers on the market, and its monthly billing schedule allows you to terminate the service swiftly if it’s not working for you. The 30-day free trial helps you get to grips with the functionality of the product up front too.

Plans are offered for a single, monthly fee ($15 for retail, $35 for online, $50 for both) that gives you access to all of the major features including (but not limited to) payment processing, the virtual terminal, reporting tools, POS mobile app, inventory management, invoicing tools, advanced security and fraud prevention, custom emails and a hosted online store.

The virtual terminal function, coupled with in-person payment processing via the swipe card reader and mobile app, makes this an ideal solution for businesses that sit comfortably in the eCommerce space but frequent trade shows, markets or other types of pop-up shop.

Meanwhile, the customizable hosted payment pages offer bricks and mortar businesses that are just stepping into the eCommerce space a customer friendly, branded solution to web sales without having to set up a full online store. Domain hosting, integrated shipping solutions and even discount codes make the crossover between physical and digital retail simple.

Security around mobile payment processing has been flagged by some users as a point of concern. The card reader offered for use with the mobile app is swipe only which could leave vendors vulnerable to counterfeit fraud liability.

On top of your monthly fee, Helcim has a transparent, interchange-plus pricing structure for payment processing charges. Unlike some other providers there are no hidden fees, and Helcim’s blog actively educates users in how to avoid those cheeky charges.

Pricing starts at 0.25% + 8c for up to $25,000 a month for retail and 0.45% + 25c for eCommerce, with the volume processing charges not dropping significantly until your monthly volume reaches a $100k minimum (see pricing chart).

So, while Helcim pricing is great for small to medium enterprises, very small businesses and start-ups may not feel the benefit. Helcim is quite upfront in acknowledging that, and honest about the costs related to the service. At least you will never receive an unexpected bill.

Helcim review: Usability

- Visually pleasing appearance

- Intuitive design

- Easy back-end navigation

Note that it is quite easy to log yourself out of your account accidentally while moving between your own product portal and the main site. If you leave your account to visit a tutorial, expect to have to log back in when you come back.

Modern in both appearance and structure, Helcim will be easy to use for anyone who has limited experience of a basic CMS like Wix or WordPress. Helcim holds your hand through the online registration process, and offers a variety of walk-throughs, tutorials and FAQ pages up front to get you started.

Inside the product, the back end looks like any other website, with a list of sections down the left-hand side including payments, customers, invoicing, products and online store. Clicking on each section expands them to offer you a variety of customizable options presented as graphics.

Access to mobile apps and integrations like QuickBooks is also available here. Helcim is really designed to be a one-stop shop though, so although third-party integrations beyond what it offers are available, you will need to speak to the customer service team about how they will work with Helcim, and you may need to change platform. For example, Helcim does not currently support Xero as it has a relationship with QuickBooks – whereas Stripe offers Xero integration.

Helcim does have a developer API, so you can develop custom software integrations for your payment gateway. The functionality of this is nowhere near as in-depth as Stripe, which really has to be the first port of call for any larger business looking for customizable options – but it’s great to have some flexibility offered as part of a complete ecommerce solution.

Once you get into the nitty gritty of what the product offers, you find there are some really cool features that make your life easier and offer your customers peace of mind too.

For example, Helcim.js is a javascript plug-in that allows you to quickly and easily add payments to your website so you can accept credit cards online. The customer will not be redirected to a payment page, and will stay on your website which is better for the integrity of your business, and also less time-consuming at the checkout.

However, the payment takes place directly between Helcim and your customer, cutting out the middleman – your webserver – to offer greater security.

Helcim review: Performance

- A complete ecommerce solution on one platform

- Options like multi-currency make customer experience seamless

- Real-time processing and updates

Helcim bills itself as an all in one commerce platform, and that is exactly what it is. Easy to use for those with even limited exposure to SaaS tech, and offering an unlimited number of users, Helcim provides excellent training for new merchants and good customer care. Customer services are available 7am to 7pm MST five days a week, and 9am to 5pm at the weekend via email and phone. They are very responsive.

Under the fixed monthly fee merchants get access to a variety of services they can take or leave depending on the needs of their business. Customized PDF invoicing, accounting and tax assistance, setting up repeat customers, and product catalogues are all easy to use and offered as standard.

If you already have software you are happy with, such as a shopping cart, check with the customer services team before you commit to buying the product.

The limited integrations are worth being aware of, especially if you already have software you are happy to use. Check with the customer services team what works with the product and what doesn’t. Shopify and Magento, for example, happily integrate with Helcim.

The inventory management feature is particularly useful, allowing you to import (and also export) inventory data which is then tracked in real time. You can view reports related to your inventory and set Helcim to offer you a warning when a SKU is low.

Although security around the mobile swipe reader available to use with Helcim’s app has been flagged by users, the security solutions offered across the rest of the product are satisfyingly advanced.

Helcim includes Fraud Defender software, which uses seven different factors to rate transactions offering a final score. The merchant can set up an automatic decline of purchases that fall below a certain score.

Setting up payment options is easy, and Helcim accepts all major credit and debit cards, Apple and Android Pay and even China UnionPay, so if you are prepared to ship product overseas the world is your oyster.

There is also an easy to enable multi-currency service that allows your customers to purchase products in their own currency.

Helcim review: should you buy?

Affordable, transparent and supportive, this is a great option for most SMEs, except very low volume start-ups and micro-businesses. These businesses will be better off considering Square or PayPal. High-risk businesses will also need to find another solution. Helcim is particularly good for those companies sitting firmly in the eCommerce sector but also offering physical pop-ups.

Helcim is a great option for SMEs who want a complete merchant service that doesn’t require technical ability to use. The intuitive back end design and a range of tutorials make using the product easy, although you may need the input of a software developer for some aspects.

The main selling point is the transparency around pricing and the affordability of the product. A simple monthly fee for each plan of $15, $35 or $50 a month combined with full published prices for the cost of processing volume payments and any add-ons (like hardware) you wish to purchase makes budgeting simple. You should never receive an unexpected bill.

The Helcim customer services team are available every day with extended 12-hour office times Monday to Friday. Unlike some other services that rely on community support, Helcim’s professional team offer both phone and email contact options and are very responsive.

Software integrations for the Helcim commerce product are limited, so it’s best to check with the team if you already have a shopping cart or accounting software you like.

Customizable integrations are not available, but if you are prepared to change your platforms, the complete Helcim Commerce product offers extensive choice, great security features and some existing 3rd-party integrations that will work well for most businesses.

All this makes Helcim one of the best credit card processing services we reviewed.

What other credit card processing companies should you consider?

Helcim is our pick for the best overall credit card processing service, but it may not be quite right for your type or size of business. Of course, there are plenty of other services for you to choose from. Here are the ones we think are worth consideration and what purpose they are most suitable for; click through for the full review.

Stripe Payments offers great customisation options; Flagship Merchant Services is best option for personal service; Fattmerchant is good for large volume; Dharma Merchant Services is an ethical business option; Square is best for SMBs; PayPal Business is best for micro-businesses; and iPayTotal is the best for high risk merchants.

To see all these compared in once place, read our Best credit card processing service buying guide.

Looking for pricing information on credit card processing services? Answer the questions below, and our vendor partners will contact you with a free quote: