- Business in a box starter package

- SaaS

- Available in 200 countries

- No upfront costs for basic package

- Premium package for additional monthly subscription

- Competitive rates for low volume businesses

- Customizable payment button

- Developer API tools

- 24/7 customer care

- Debit card linked to PayPal account

- Additional services such as business loans

Established in 1999 Paypal now has 254 million active consumer accounts, and 17 million merchant accounts; the high brand awareness and consumer trust will be a huge asset to your business.

It’s easy to set up, with accounts active and ready to take payments in minutes, and your customer doesn’t need to have a PayPal account to use your service. However, the fees are higher than some other providers, making this a great option for micro-businesses or those who only process credit cards occasionally, but expensive for businesses operating with volume.

If you're a small vendor then Square payment processing is also well worth considering, but if you're a larger vendor looking to process more than $10,000 a month then you could find that Helcim or Stripe payments cost you less in the long term.

For other options, check out our Best credit card payment processing services buying guide.

Looking for pricing information on credit card processing services? Answer the questions below, and our vendor partners will contact you with a free quote:

PayPal Business review: Features

- Transparent pricing with no early termination fees

- High level of integrations

- PayPal Here mPOS app

PayPal’s mobile POS, PayPal Here, is a useful addition for businesses that are based online but may run pop-up shops, go to trade fairs or just want a POS terminal without having to invest in expensive hardware. The app is free but you will need to buy the card reader ($24.99 in the US).

PayPal’s major competitor in this space is Square, which comes in at a slightly more favorable price for small businesses with higher volume (especially those with lower ticket values), but if you’re a Saturday antiques dealer, itinerant classic car salesperson or niche arts and crafts producer, then PayPal might be a good choice.

PayPal operates in over 200 countries worldwide, and the pricing is local so make sure you check out your home site. In the US, PayPal charges a flat 2.7% for in-person transactions, 3.5%+15c for keyed-in transactions and 2.9%+30c for online transactions.

In the UK the cost is tiered according to your volume, starting at 3.4%+20p for monthly sales up to £1500, reducing to 1.9%+20p for £15,000 to £55,000. PayPal also has a micropayment rate as well, and no monthly subscription or hidden fees.

The company also claims it can help drive customers through your checkout, with shoppers using PayPal completing checkout 88% of the time. Payments arrive in your PayPal account almost instantly, giving you maximum control over your money.

A business account with PayPal also offers a high level of integrations. PayPal itself is easy to integrate into your existing ecommerce platform, but if you’re just starting out or looking to expand the range of tools available to you, PayPal offers integrations with all the major ecommerce and related service providers, like Shopify, Xero, Vend and MailChimp.

This flexibility is really useful; however, some of the services it offers, like virtual terminal and invoicing, come at an additional cost whereas their competitors in the subscription-free space, like Square, provide them as standard.

PayPal Business review: Usability

- Easy to open an account, developer support needed to go live

- Three different payment options

- Account stability issues

Like many other services that offer their platform with no upfront fee, PayPal is not suitable for high-risk businesses, like gambling sites or adult entertainment providers. If you do have a business dealing in any of the above we recommend you check out iPayTotal.

There have been issues with other businesses having their accounts frozen for several months while compliance reviews take place, limiting merchant access to their funds.

Seeing as PayPal is often dealing with very small businesses (think Etsy retailers and solo entrepreneurs) this can be catastrophic for merchants – and the standard response is that issues can take up to 45 days to rectify. PayPal’s web-based customer care still leaves a lot to be desired, according to many users.

PayPal boasts that its merchant account is easy to open and can be accepting payments within minutes. This was not our experience. Although it is true that the account is very easy to open, once in the back room we found PayPal’s web portal to not be as intuitive or as easy to use as most of its competitors.

Once you have found the products you are interested in from the merchant’s area there is an option to test them out, which is a great way to figure out if this will work for your business.

At this stage, you’ve made no commitment except to open the account, so if it isn’t right for you then you can walk away. To use a PayPal payments product requires you to copy an HTML code and put it in the right place on your eCommerce platform or website, so if you don’t feel confident doing that, you'll need a developer.

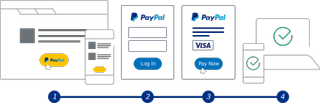

Checkout is a straightforward web integration that allows you to accept payments online, is fully PCI compliant, offers smart checkout buttons tailored to the consumer and offers PayPal Credit as an option where eligible.

PayPal offers three main options for online payments: PayPal Checkout, PayPal Payments Standard and PayPal Payments Pro. Checkout is a straightforward web integration that allows you to accept payments online, is fully PCI compliant, offers smart checkout buttons tailored to the consumer and offers PayPal Credit as an option where eligible. It also offers localized payment methods for customers across Europe. You may need the support of a web developer to integrate PayPal Checkout into your ecommerce platform.

PayPal Payments Standard is a similar offering with higher levels of customization. It also streamlines the checkout experience for mobile and tablet users. Instead of smart checkout buttons run by PayPal software, you can customize your payment buttons using inbuilt software. You don’t need a web developer for this; it’s just a cut and paste job, and the button builder allows you to change the look of your button and some aspects of the checkout process.

PayPal Payments Pro is the company’s premium subscription offering, $30 a month in the US. It is definitely web developer territory. A major offering is a hosted, customized checkout page that allows you to keep your customer on your website for the entire shopping process.

Unlike Helcim though, which uses clever software to skip out your web server so your customer is dealing directly with their payment processing platform, the PayPal version will require you to engage in some level of PCI compliance.

Pro also opens up a virtual terminal option so you can receive payments over the phone – although this is offered as standard by some other payment processing platforms like Square with no fees, so do your homework. Virtual terminal fees are 3.1%+30c for a domestic transaction going up to 4.6% for international transactions.

Again, recurring billing is offered by a third-party provider at an additional cost, but comes as part of a standard package with some other providers like Stripe and Fattmerchant.

PayPal Business review: Performance

- Good integrations and mobile app

- Instantly available funds and mass payouts

- Useful business features, like Working Capital

Perhaps realizing that other payment processing services have most areas of the direct market cornered, such as Stripe with its developer tools, and Helcim with its all-in-one ecommerce platform, PayPal is expanding its business-related services out into the leftfield.

Working Capital is one example of a really useful financial add-on that you wouldn’t normally expect payment processing software to provide. Paypal Working Capital is a fast cash advance paid back via a small amount deducted from each day’s transactions. It also offers PayPal Loan Builder, a short-term loan service for merchants with a good credit score.

You don’t actually need to be using PayPal as your processor to take advantage of this. It is also in the process of acquiring mPOS iZettle, which is well established in Europe.

PayPal will integrate with almost any software out there, so it gives you a really good level of flexibility compared with some other providers like Helcim, whose integrations are comparatively limited.

Shopify, Xero, QuickBooks, MailChimp, Wix, WooCommerce, Vend, Revel, and Magento are all well-known names on the long list of third-party integrations available, and there are also some more specialized products. If you are switching to PayPal from another payment processor, you shouldn’t have to worry about whether it will work with software you are already using quite happily.

If you are opening a new business, it might be worth checking out PayPal’s Business in a Box, which brings together all the services you need to start and run your business with a guarantee they will all work together well, and at a good price.

For businesses that would benefit from a mobile POS, PayPal Here offers a basic but robust app and card reader combination that can even be part of a countertop setup for those who want a register. The app is free although you will need to buy the card reader ($24.99 in the US, although the company sometimes offers deals).

Another great feature when comparing PayPal’s performance to other market players is the fact that your money becomes instantly available in your PayPal account as soon as a transaction is made.

For smaller businesses with cash flow concerns, this is an offering not to be sniffed at. While some other providers offer this service, there is usually an additional charge.

If you want to spend your money somewhere that doesn’t accept PayPal, and you don’t want to wait one to two business days for a bank transfer, then a PayPal debit card linked to your account might be a good solution. Alternatively, for 1% (capped at $10) you can transfer funds to your personal bank account instantly.

On top of instantly available funds is the ability to make mass payouts. If you are a business that employs or contracts regular staff and suppliers, you can load a mass payout (either using a spreadsheet or get your developer on to it via the API tools) and pay everyone at the same time. This saves you time, and also works out cheaper than doing individual payments.

PayPal Business review: should you buy?

PayPal was revolutionary 20 years ago, but is now coasting on its name somewhat. It is still well worth considering for small volume businesses outside the US who want to be able to trade internationally, but there are also other options that should be explored.

PayPal offers a recognizable, global payment processing solution that will fill your customers with confidence. Some local currency payments are available and this will expand.

Transparent pricing is useful, but the high fees make this option suited mostly to low volume businesses and micro-businesses. If you are US-based, there are more competitive options, like Square.

Customizable payment buttons are a nice touch but the developer APIs are limited. It’s also a bit of a shame their back end is complex enough to warrant the involvement of a developer even to implement the basic package.

The high level of third-party integrations means you can confidently use PayPal as a payment processor and know it will work with your existing setup. The mPOS option, PayPal here, allows you to set up an in-person payments terminal for very minimal outlay. This is counteracted somewhat by having to pay $30 a month for a virtual terminal.

Immediately available funds coupled with the PayPal debit card make this a great option for small businesses worried about their cash flow. The addition of loans available to merchants, and the ability for customers to pay later on some transactions, also make this an enticing option.

However, account stability complaints and poor customer service history should be a worry to some merchants, particularly solo operators who rely on their business as a main source of income.

What other credit card processing services should you consider?

PayPal Business is one of the best credit card processing services around but it may not be the right one for your business. Naturally, there are plenty of other services to choose from. These are the ones we think are worth consideration and what purpose they are most suitable for; click through for the full review.

Helcim is a great all-round option; Flagship Merchant Services offers great personal service; Fattmerchant is good for large volume; Dharma Merchant Services is an ethical business option; Square is best for SMBs; Stripe Payments offers users great customisation options; and iPayTotal is the best for high risk merchants.

To see all these compared in once place, read our Best credit card processing service buying guide.

Looking for pricing information on credit card processing services? Answer the questions below, and our vendor partners will contact you with a free quote: