Allstate Auto Insurance: What you need to know

Allstate Auto Insurance isn't the most affordable car insurance out there, but that is because it offers lots of features and services aimed at making your cover better. This means you can save money over time through good driving but also that you can expect superb cover should anything go wrong during your cover period.

Allstate has an AM Best agency rating of A+ Superior for financial strength so this is at the scale where you can relax knowing your claim should be paid quickly. With complaints less than average the way this company works appears to be to the liking of its customers.

The inclusion of a mobile app is a big deal for Allstate as it uses the phone's camera to allow you to upload lots of important information so the claims process can begin right there and then immediately after an accident has happened.

Allstate also offers lots of incentives to encourage you to drive well and safely, including money off your policy when you go for certain periods without any accidents or claims.

Thanks to a guarantee process from the company, if you're not happy at any point after a claim has been handled then you are eligible to get credit back for the inconvenience caused.

If you opt to use the tracking app it's possible to save even more money off your policy for driving responsibly. So while pricing may start at the higher end it's possible to bring that down over time if you're a good driver.

Policies: How much does Allstate Auto Insurance cost?

- Low-cost car coverage: $566

- High-cost car coverage: $702

- 20/65/20 coverage: $329

Car replacement service: If the car is under two years old you're eligible for a new car replacement

Emergency roadside assistance: Three options: pay as you use, add-on to auto policy, or from Allstate Motor Club

Accident forgiveness: Rates won't increase if you make a claim, even if it's your fault

Policy options vary widely for everyone due to the car, age of the driver or location in the US. Also the car type will affect the quote, as will your history. We tested quotes with the industry recommended level of cover, 100/300/100.

We got quotes for a car that's the most expensive to insure and one from the least pricey – but other factors beyond value to play a part so take that as a rough guide. Compared to that average the Allstate quotes were a little on the higher side.

For the low-cost car, coverage was around $566, which was a little above the average at $533.

For an expensive car the policy was also above average at $702 versus the average $688.

Multi-car policies did offer savings pushing the prices down to a few hundred dollars under the national average cost.

Adding a teenager can increase prices by up to 80% with some insurers but for Allstate we got a quite of $900, which is about $500 less than the average.

For the general state minimum cover, 20/65/20, the price was $50 less than the average at $329.

Allstate Auto Insurance: Accident forgiveness, safe driving bonus and deductible rewards

- Accident forgiveness policy protects your premiums

- Accident-free driving rewarded with refunds

Allstate understands that accidents happen and it also understands that if it penalises its customers for mistakes it will lose them. That's why it operates an accident forgiveness policy which means you can have an accident, and claim without it affecting your premiums – even if it was your fault.

If you do stay accident free you're rewarded. Allstate will send you a check for every six months you drive without an accident.

However, for every year that you receive no driving violations you can earn $100 off your collision deductible, up to $500 off with the first $100 taken off when you sign-up.

Allstate Auto Insurance: Roadside assistance and new car replacement

- Three roadside assistance options

- Allstate may replace it for a new model if totaled

The Allstate roadside assistance comes in three options: either as a per-use charge, as an add-on to auto policies or directly from the Allstate Motor Club. The latter is a subscription service similar to the AA.

If that accident means you car is totaled, then Allstate may replace it for a new model. This is presuming your car is less than two years old and it is written off as too damaged to repair.

Allstate Auto Insurance: Satisfaction guarantee

- Good complaints response process

- 6 months of credit if your not happy how your claim was handled

If you're not happy then Allstate wants to make sure you're given what's owed to you. That's why it operates a claim satisfaction guarantee.

The company will issue up to six months of credit to your insurance premium if you're not happy with how your claim was handled. This comes free with all standard policies in any state that it is available so be sure to check you get it where you are.

Allstate Auto Insurance: Ridesharing insurance

- Covered in 47 states

- You're always covered

Allstate does offer ridesharing cover for drivers of taxi services that use apps like Uber or Lyft. This applies in 47 states and Washington DC.

Since some of these companies only give cover when the driver is active on a job there is risk when in between pickups. This policy from Allstate aims to fill in those gaps so you're always covered.

Allstate Auto Insurance: Mobile app

- Log claims directly on the Allstate Mobile app

- Submit photos via the app

The Allstate Mobile app is one of the best out there when it comes to claims. This is thanks to a system which allows you to log a claim via the phone and have the process begin right away.

Using the app and your smartphone's camera you can submit photos – using the QuickFoto feature – of the accident damage, the VIN number, odometer reading and the car as a whole. This is then sent through to Allstate and is enough information to get the claims process underway, meaning you can begin claiming right after the accident has happened.

Another app available to customers is the Drivewise app. This is used to detect driving habits and will make users eligible for rewards if they drive safely. Points are deducted for things like driving over 80mph, hard braking and late night driving. Points can be used to redeem gift cards, local offers and sweepstakes.

Allstate Auto Insurance: What the users say

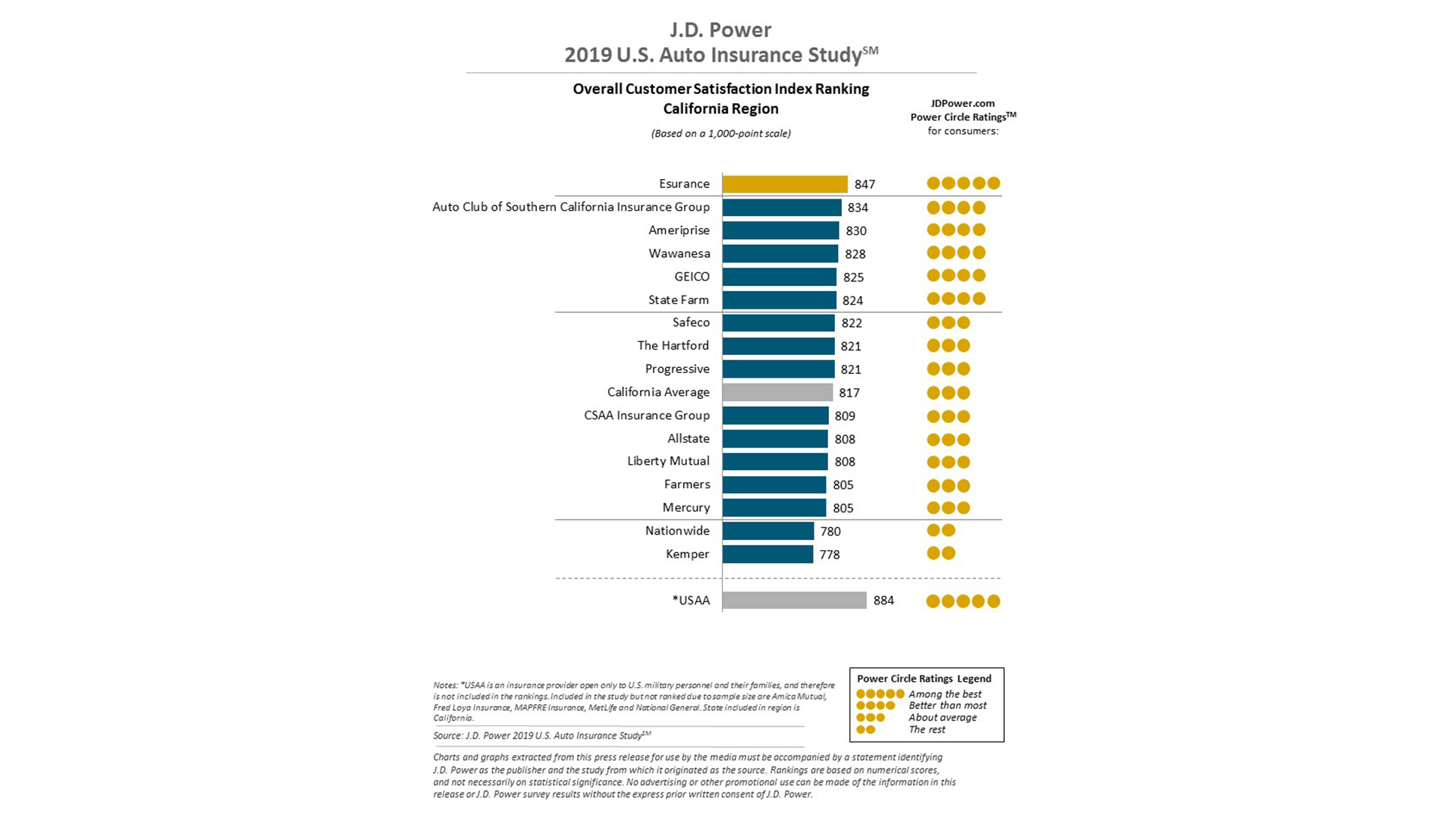

- 3 star rating overall from J.D. Power

- 4 star rating from ConsumerAffairs

Allstate Auto is not the cheapest but it is a well-reviewed provider that guarantees satisfaction for peace of mind.

According to the 2018 J.D. Power study, the overall customer satisfaction score was three out of five with threes across the board for things like estimation process, repair processing, rental experience and claims.

ConsumerAffairs gives near a four-star rating for average customer reviews with positive for claims, discounts and rewards but negatives for premium increases for some customers.

Allstate Auto Insurance: Verdict

Allstate Auto is the third-leading car insurer in the US, serving all 50 states and offering over 3,500 repair shops.

Allstate Auto Insurance is not the cheapest you'll find out there, but does offer one of the best apps meaning an excellent claims process. This is backed by guarantees to ensure you are happy with the claims process and if you're not then you get rewarded.

Roadside assistance options are varied to suit everyone while benefits can help make savings for those drivers that are safe and responsible on the roads.