Sallie Mae Student Loans: What you need to know

Sallie Mae is a private student loan company that was founded in 1973. Initially, it was a government entity that issued federal education loans, but started the process of privatizing its operations in 1997, a process that was completed by the end of 2004. Sallie Mae is the biggest provider of federally insured private student loans, making it a popular choice for students and their families.

Sallie Mae Student Loans: Common questions

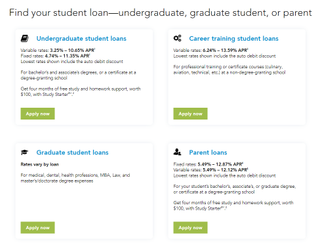

Loan type: Undergraduate, Graduate, MBA, Career training, Parent, Medical school, Medical residency, K-12, Law school, Bar study, Dental school, Dental residency, Health professions graduate

Rate type: Fixed or variable

Loan term: 5 - 20 years, depending on the degree earned

Loan amount: $1,000 - up to 100% of the school-certified cost of attendance

Application and origination fees: No application, origination, disbursement or prepayment fees. K-12 loans have a 3% disbursement fee.

Discounts: With the exception of K-12 loans, all loans are a eligible for a 0.25% interest rate discount if you sign up for automatic payments. Servicemembers may also benefit from additional debt management services.

Repayment options: Deferred interest, fixed payment, interest-only

Deferment or forbearance hardship options: Yes

Co-signer release: After 12 on-time principal and interest payments

Grace period: 6 months

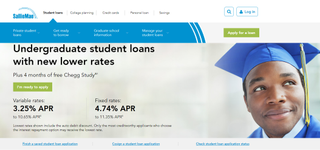

Perks: Quarterly FICO credit score update, free 4 month trial period of live online tutoring through Chegg Tutors

Does Sallie Mae offer student loan forgiveness?

Unfortunately for many student loan borrowers, Sallie Mae does not provide student loan forgiveness. Forgiveness is limited to federal education loans. Sallie Mae is a private lender, but it's still one of the best private student loan providers out there.

What is Sallie Mae's interest rate for student loans?

In short, the interest rate on your student loan depends on the type of loan you apply for. For undergraduate student loans, for example, variable rates range from 3.25% to 10.65% APR, and fixed rates can be anywhere from 4.74% to 11.35% APR.

Does Sallie Mae offer loan deferment and forbearance?

Sallie Mae offers loan deferment, meaning that you can stop making payments without paying late fees and hurting your credit score. Forbearance can be requested due to extenuating circumstances such as job loss or a medical emergency. Loan deferment applies to other situations, such as returning to school.

Do Sallie Mae student loans incur fees?

There is no application fee, and there is no loan disbursement fee. However, there are still two possible fees you can incur. The first is the late fee: if you're late on a payment, the lender charges 5% of the past due amount, but that amount is capped at $25. So, even if 5% of your monthly payment is more than $25, you will only pay $25. The second fee is charged in the event that your check is bounced: this will incur a $20, which is charged to your account is due with the next payment.

Sallie Mae Student Loans: Advantages

Getting a student loan from Sallie Mae offers many advantages, especially if you have a large amount to pay or require flexibility. Sallie Mae is so large that it can offer this kind of flexibility, especially in terms of repayment plans.

Application

Applying for a student loan is easy and generally takes about 15 minutes. There are no application or origination fees.

The loan

There is no preset loan limit, meaning that you can borrow up to 100% of the cost of your education.

Qualification

Sallie Mae is one of the few lenders who will lend to part-time students. Non-U.S. citizens, including DACA students, can apply with a co-signer.

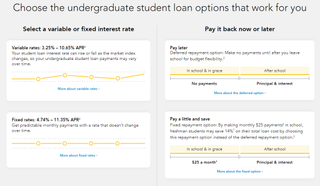

Repayment

While still in school, students can benefit from repayment plans that suit their needs. They generally have three choices that offer the maximum flexibility: defer repayment option, which defers the entire loan (principal and interest) until graduation; fixed repayment option, which lets a student pay $25 a month while in school to reduce the total interest accrued; and the interest repayment option, where the student pays the interest only while in school and through the 6 month grace period after graduation.

In the event of a life changing event that affects your ability to pay your loan, Sallie Mae will allow loan forbearance. If you continue your education, you can defer on your loan.

Sallie Mae loan applicants also qualify for discharge due to death or total disability, meaning that the totality of the debt is waived.

Co-signers can be released after the borrower makes 12 full - principal and interest - payments, which is a short period of time in relation to other lenders.

Sallie Mae Student Loans: Disadvantages

Sallie Mae does not disclose loan specifications before the time of application, and there is no pre-approval process. Sallie Mae requires a hard credit check before showing you lending rates, which may hurt your score (though only a little).

Sallie Mae also assigns loan terms instead of letting the borrower choose a repayment term. However, most of Sallie Mae's loans' repayment terms fall in the range of 5 to 15 years.

Finally, Sallie Mae does not offer any discounts beyond a 0.25% interest rate discount for automated payments.

Qualification highlights: How to qualify for a Sallie Mae student loan

Regardless of the level of education, all students must meet the same basic requirements in order to qualify for a Sallie Mae student loan, but may have additional requirements, depending on the type of student loan. The basic requirements are:

- A FICO credit score of at least 748 (although Sallie Mae does not disclose the minimum FICO score to qualify, 748 is the average minimum we've seen)

- Borrower's age is the age of majority in their state (18 in most states). Younger applicants must have a cosigner who meets additional credit and income requirements.

- The borrower's school must qualify for a Sallie Mae loan

Applying for a Sallie Mae student loan

It is relatively easy to apply for a Sallie Mae student loan, and not very time-consuming. However, applicants may not have a good idea if they will be approved or not due to Sallie Mae's lack of transparency on their site and lack of information about qualification. The good news is that there are the basic requirements are fairly easy for any typical borrower to meet.

The application will ask for the borrower's basic information, such as name, address, date of birth, and the student and school information (degree working toward, academic period, anticipated graduation date, name of school, and more).

The application will also ask for information on the loan and how you determined the amount needed for the academic period. It's important to remember that Sallie Mae can offer a borrower less than what was requested.

Other information needed includes employment, financial information, and personal contacts. Cosigners will also need to provide some personal information in order to be approved as cosigners. About 90% of Sallie Mae borrowers applied for a student loan with a co-signer.

More often than not, Sallie Mae will approve applicants based on credit and application information. After approval, borrowers can choose the type of interest rate and repayment plan before accepting the loan. It can take as little as 15 minutes to get approved, and it can take anywhere from 2 weeks to 30 days for the loan amount to be disbursed to the school.

Sallie Mae Student Loans: User experience and customer service

Once you create a Sallie Mae online account, it's fairly easy to both schedule payments and make one-time payments. You can also check loan details and the progress you've made in repaying your student loans.

Customer service by phone is not available 24/7, but you can also contact Sallie Mae by mail. It's important to remember that customer service phone numbers vary by service, so the contact number for existing student loans is not the same for new student loans or existing personal loans.

Sallie Mae Student Loans: What happens if I can't pay my student loan?

When you miss your student loan payment's due date, your loan is considered 'delinquent'. In this case, you may be asked to pay a late fee due at the same time as your next payment. This may also entail additional loss of benefits. Sallie Mae is not clear on how many days past the payment due date the loan is considered delinquent.

When you don't pay your student loan payments for 270 days, your loan is considered to be in default. Several things happen at this point: your credit score can be negatively affected and the loan default can stay on your credit report for up to 7 years, and if you have a cosigner, their credit may also be in danger.

Sallie Mae Student Loans: What borrowers and cosigners have to say

Many potential borrowers are unhappy with Sallie Mae's reluctance to disclose minimum requirements to qualify for a student loan, such as the maximum debt-to-income ratio for borrowers, and feel uneasy about Sallie Mae's hard credit check potentially negatively affecting their credit scores. Many also express displeasure with Sallie Mae's customer service, which isn't 24/7, and which isn't particularly helpful when trying to change loan details.

It is also very difficult to find any basic information about the nitty gritty on borrowing, such as how many days past the due date you loan is considered delinquent, perhaps to discourage late payment. Worst case scenario, some hard lessons may be learned through trial and error.

However, Sallie Mae has a ton of supporting online content to help borrowers and their families make the best choices for them and to exhaust all other financial options before resorting to taking out a loan - an unusual move for a lender.

Despite user complaints, Sallie Mae, as a lender, is too big to ignore. Many borrowers opt for Sallie Mae because of the wide range of student loans the lender offers and because of flexible repayment options. For some students, Sallie Mae may be one of the only options as a lender.

Sallie Mae Student Loans: Other things to consider

While Sallie Mae seems particularly generous with its repayment options and terms, it can be easy for borrowers to get too comfortable with relatively low monthly payments. With interest, the amount you end up paying, compared to the amount you borrowed, can grow astronomically. If you can make an extra payment, or pay more than what's due, it's generally encouraged that you do.

What type of borrower is a Sallie Mae student loan best for?

Sallie Mae student loans can be a great fit for any student - but as with all loans, one must practice caution and financial responsibility before agreeing to a loan term and interest rate.

That being said, Sallie Mae offers a wide variety of repayment options to fit the needs of students at any level of their education, along with a generous grace period. This makes it ideal for students with hefty school costs, such as those entering the medical field, looking to practice law, or starting graduate school. Sallie Mae student loans are also ideal for undergrads who can't bear the burden of undergrad tuition without a loan.

Because cosigners can be released after 12 full principal and interest payments, Sallie Mae is a great choice for borrowers who want to promptly release their cosigners.

Part-time students don't have as many options as full-time students, so Sallie Mae isn't the best option for them. Finally, Sallie Mae is a great option for non-citizen and DACA students, provided that they have cosigners.

Sallie Mae student loans versus federal student loans

Sallie Mae is a private company, and the benefits of getting a student loan through Sallie Mae generally do not outweigh the benefits of taking out federal student loans. You should look into taking out federal student loans before looking into private companies. The interest rate on federal student loans tends to be fixed and lower than private loans', among many other benefits. Read more about the benefits federal student loans have to offer.

Sallie Mae Student Loans: Verdict

For many people, the thought of taking out a student loan raises a lot of questions about the future and the ability to repay large amounts over a relatively short period of time. 5 to 15 years may seem like a lot, but when taking out a loan, you need to consider the possibility of job loss, medical emergencies, family emergencies, and unplanned financial hardship. All of these occurrences can affect your ability to make your monthly payment.

The best way to approach student loans is to start practicing financial responsibility early and knowing who you can turn to in times when money is tight. Luckily, Sallie Mae offers a wide variety of repayment and loan term options, and you're bound to find a combination that makes you comfortable. While Sallie Mae student loans aren't a better deal than federal student loans, we think that Sallie Mae is one of the best lenders for student loans.